Bosch reports increased sales of €73 billion. Wins massive new sensor contract from Apple

Bosch – one of the world’s largest industrial companies, producing a wide variety of engineered products, from automotive components to home appliances – has reported increased sales for the year 2016.

In a press conference last week to launch the German giant’s annual report, Bosch CEO Volkmar Denner listed the key figures:

- sales rose from €70.6 billion in 2015 to €73.1 billion last year; and

- earnings before tax in 2016 reached a total of €4.3 billion.

Sales in all business segments and geographical regions had increased, added Denner.

As positive as the figures may seem, Denner said the company was nonetheless undergoing “profound transformation”, partly brought about by a range of new technologies which are changing the global industrial landscape, and because diesel engines may be phased out.

“The pace and depth of the transformation are particularly evident in mobility,” said Denner, “but also in technological development in general.

“The main catalyst of change is networking, both in our branches as well as in our own company. It changes business models, products and not least the working world.

“Merely defending our market-leading position is too short-term,” he continued.

“The transformation is profound. We have to become the driver of these technologies, place ourselves wherever possible at their peak – and make the most of the opportunities the new world brings.”

Essentially, Denner is faced with the prospect of having to make thousands of people redundant if he can’t find them alternative sources of income to replace what might be lost if diesel continues to decline.

Diesel engines actually power around half of all vehicles in Europe, and a similar proportion in India – both markets in which Bosch is strong.

But there is a growing perception that they are more polluting than unleaded petrol cars, and they are falling out of favour with politicians and they have banned diesel in some cities around the world. The bans will come into effect in a few years, and since 50,000 jobs at Bosch depend on diesel systems, Denner has a serious challenge to deal with.

Denner has consistently defended diesel, claiming it to be a clean technology. In comments reported in the German media, he said: “The diesel is a clean drive, not only in the laboratory, but also on the road, with existing technologies.”

He argues the German government is ignoring the facts about diesel and will be unable to meet its environmental targets without diesel.

And besides, Denner adds, “What is the use of clean air when people have no more jobs?”

But perhaps luckily and just in time, the artificially intelligent autonomous electric car is here, and a lot of its components are made by Bosch. But will it be big enough to carry everyone?

All aboard the driverless bandwagon

Bosch is a huge company, employing almost 400,000 people globally. The 130-year-old, privately-owned firm is one of the world’s leading suppliers of automotive parts, and its business in this segment has grown rapidly in recent times because of increasing demand for new technologies, including:

- advanced driver assistance systems;

- electric engines; and

- fully autonomous vehicles.

Ten years ago, driverless vehicles were thought of as either a fanciful notion that will never become reality or as being many decades away from becoming a reality on public roads.

However, in the last couple of years, the mood has changed and all the leading car brands are pouring billions into developing and testing totally driverless cars.

In the most recent development, Bosch has signed a deal with Daimler to develop autonomous vehicles which the two companies claim they can launch by 2020 – less than three years from now.

Some standards, or agreements, relating to driverless vehicles – such as the SAE’s 0 to 5 stages of autonomousness – have only recently been clarified, though they are by no means universally agreed. The SAE is discussing the issue with other bodies such as the International Standards Organisation and the American National Standards Institute, and there will inevitably be more news coming from those talks.

But while SAE may have 128,000 engineers and related technical experts on its membership lists, and ISO and ANSI many more, politicians have yet to formulate laws governing full autonomy and, therefore, there are no globally agreed regulations for the new technology.

Among the problems driverless vehicles present is the issue of responsibility – who is responsible if the vehicle is involved in an accident? Would it be the driver, who is more or less a passenger, or the manufacturers?

The insurance industry, too, is necessarily discussing and formulating approaches in readiness for the day when driverless vehicles take to the roads en masse, and not just as part of tests.

But for now, vehicles with what could be described as “partial autonomy” are already growing in number on the roads.

Advanced driver assistance systems, or ADAS, is the label given to a range of functions that most new cars have already integrated into their driving or operation.

These ADAS systems already enable cars to manoeuvre autonomously in a wide range of situations, such as parking, cruise control, emergency braking, and so on.

And, in addition to its deal with Daimler, Bosch has previously reached agreements with Nvidia and, more recently, numerous Chinese companies in the area of mapping technologies, which is likely to enhance its ADAS offerings.

As Denner said at the press conference: “We will continue to implement an essential prerequisite for automated driving in this decade: a highly accurate digital map, which also includes the signals from our radar sensors.

“We work with TomTom as well as with the Chinese suppliers AutoNavi, Baidu and NavInfo. Via the radar signature, self-propelled cars can be precisely located. All in all, nearly 3,000 developers are on the road to automated driving, 500 more than a year earlier.

“In 2016, we have surpassed the €1 billion mark for the first time – and a contract volume of €3.5 billion. In 2017 the market for advanced driver assistance systems is growing by 30 per cent, Bosch even faster.”

From TMI to AI

Not only has Bosch made a billion in the ADAS market, it has also made another billion in the industrial internet of things market. But a billion here and a billion there is all well and good, but where’s the serious money going to come from?

Big data and artificial intelligence is certainly a growth area, and it’s one Bosch probably needs to be heavily involved in because it will form the foundation of cars of the near-future – as it does to a great extent already. The company is steadily increasing its software-oriented materials as part of its informational output, but acknowledges being at the start of a very long journey.

Bosch has been involved in so many businesses over the decades – and still retains huge stakes in so many – that it’s quite impossible to explain everything in one article. The company’s own annual report for 2016 is more than 150 pages – and that’s just the main document, not including the supplemental material, which amounts to another 150 pages or so.

And even that doesn’t really cover it. I was invited to the company’s €310 million research and development facility, located in Renningen, Germany, as well as its separate building, specifically set aside for startups, and much of the business activity in those places is either under wraps or Bosch just didn’t have enough time or space to detail them in its annual report presentation and material.

But Bosch is such a massive company, where do you even begin? And how do you summarise everything?

The company has around 250 factories of its own dotted around the globe, as well as thousands of industrial clients, most of whom have factories of their own.

And that’s before we get to talking about the consumer side of the business.

Moreover, it has 390,000 employees – or “associates”, as Bosch likes to call them. That’s about a hundred thousand more than the number of people employed at Apple, Google, Facebook and Microsoft put together.

Among the “tech giants” of today, only IBM has a comparable-size workforce, with Big Blue employing a similar number to Bosch.

It may be just a coincidence, but both Bosch and IBM have histories going back more than 100 years: IBM was established in 1911, while Bosch was established in 1886.

The others – Apple, Google et al – were mostly products of the late-20th century. Facebook was actually founded in 2004.

It’s not a like-for-like comparison of course, as Bosch is primarily a manufacturing company, an original equipment manufacturer, or OEM, as the industry jargon goes.

The others – Apple, Google, et al – are mainly software companies. Apple may make most of its money from selling hardware, but it sub-contracts out the manufacturing to other companies.

In fact, Apple is now a major customer for Bosch, since the US company has chosen Bosch for the supply of sensors to support its augmented reality and other totally newfangled products it plans to launch, according to Bloomberg.

And, like all other industrial giants, Bosch is itself gradually becoming a software company, and a partnership with IBM will help Bosch to accelerate its development in Industry 4.0 applications. But since Bosch has already made more than €1 billion from industrial internet of things products and services, it’s not an absolute beginner.

As I alluded to earlier, it’s difficult to be succinct about such a massive company and its operations. Even if I were to try, it would be impossible to do in one single article.

Nevertheless, below are one or two of the more relevant areas for this website.

Connected, automated and on the verge of getting over-excited

As mentioned earlier, and widely known, Bosch is big in the automotive market, and its current area of intense interest is connected and autonomous cars.

Bosch refers to autonomous cars, perhaps cautiously, as “automated” cars. Strictly speaking, they are correct, since ADAS may be seen by some as the modern equivalent of the electric window. And besides, today’s artificial intelligence is tomorrow’s standard technology.

“The connectivity of cars with their surroundings and with the internet is a key challenge for future mobility,” says Dr Dirk Hoheisel, the Bosch board member whose responsibilities include automotive systems and mobility solutions.

“Automated and connected functions in cars not only make each journey safer and more comfortable, they also turn the car into a truly personal assistant.

“In this way, we are making connectivity a personal experience and giving people more time for actual living, while driving their car.”

Like many scientists and engineers at Bosch, Hoheisel has been with the company a long time and seems on the verge of becoming over-enthusiastic about every technology he talks about, perhaps because he knows that Bosch has the necessary resources to make any of his ideas a reality, no matter how far-fetched they may seem.

In an interview with Robotics and Automation News, Hoheisel said the company was working with partner organisations to create a completely automated car parking facility, and he explained how cars will be packed almost one on top of the other, as though they were servers in a data centre rack.

And that wouldn’t be a totally inappropriate comparison since cars are becoming increasingly computerised.

Robotics, automation and the master monster cloud

Bosch has numerous robots in development and already present in commercial settings. From humanoid robots to industrial robotic arms, the company seems interested in everything.

But perhaps because Bosch boss Denner is apparently convinced that networking is the key driver for much of the technological innovation – and financial income – of today, the company is prioritising such things as industrial IoT.

In this segment, the relevant Bosch board member is Stefan Hartung, whose responsibilities include industrial technology, energy and building technology and manufacturing co-ordination.

In an interview with Robotics and Automation News, it seemed Hartung was even more hyper than Hoheisel, speaking so fast it was difficult to transcribe what he said on tape – or digital voice recorder as it’s known these days.

Hartung was a bundle of boundless energy as he forcefully expounded on the strength of Bosch in the industrial market and then launched into a detailed description of how the industrial internet works, with sensors located at the lowest level attached to the machine, with microcontrollers and microprocessors above that, and then went on about open standards and the proprietary encryption technology the company uses to transfer vast amounts of data to a client company’s in-house servers, or 100,000 servers in the cloud, or if they want even more processing power because they’ve got “monstrous amounts of data” then they could go off and go to the “master cloud”, or maybe he said “monster cloud”… and then he himself went off into a world of his own before being stopped by his minder, clearly a person from the public relations department.

The full interview with Hartung will be published at some point on this website as soon as we’ve found a way to understand what he’s talking about.

Speak English

While we try and figure out what Hartung said, hoping to find a big story in there somewhere, it would be worth teleporting back to Bosch’s Renningen R&D facility again, since it is currently developing a number of interesting technologies.

Renningen is currently the base for some 1,700 “creative minds”, as Bosch refers to them – 1,200 scientists and engineers, along with 500 PhD students. Bosch regards it as the Stanford University of Germany.

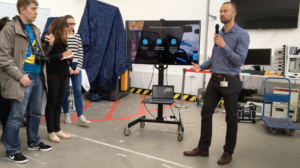

Robotics and Automation News was invited, along with other media, to visit Renningen to attend presentations by a number of the Bosch business units at various stages of their development, as well as the company’s own data science boffins.

The small companies included Deepfield Robotics, which has developed numerous technologies for the agricultural industry, from a robot that literally roams the fields tending to the crops, to artificially intelligent beehives for honey production – no word of a lie.

On the software side, one business is preparing for the car-sharing economy, and has developed an app to make it all possible. Bosch’s hugely sophisticated and powerful data mining systems were also on show.

Then there’s the team that has developed a small smart box – if I can call it that – which, when installed inside a forklift truck, can make the vehicle autonomous – potentially a huge market, given that only about 1 per cent of forklifts are autonomous.

And last but not least, the robotics department, which is developing a wide range of robots, from humanoids to industrial arms. The main picture is of Dr Kai Arras, who is demonstrating one of the company’s robots, this one designed to assist people at airports. More about this business unit in a later article.

As I’ve acknowledge earlier, it’s impossible to cover Bosch in one article. And I didn’t even begin to talk about home appliances, power tools or any of the multitude of things the company produces for the consumer market.

But if you still want a summarised overview of Bosch, here’s how the company is structured, in four segments:

- Mobility solutions

- Industrial technology

- Consumer goods

- Energy and building technology

But even before we take a deep dive into any of those sectors, it’s worth pointing out that at least four other business units are not included in the above four. They are in the areas of healthcare, software, startups, and venture capital.

(Main picture: Bosch’s robotics expert, Kai Arras, with one of the company’s robots in development.)