The Vital Role of Mechanics in Auto Repairs

February 14, 2024

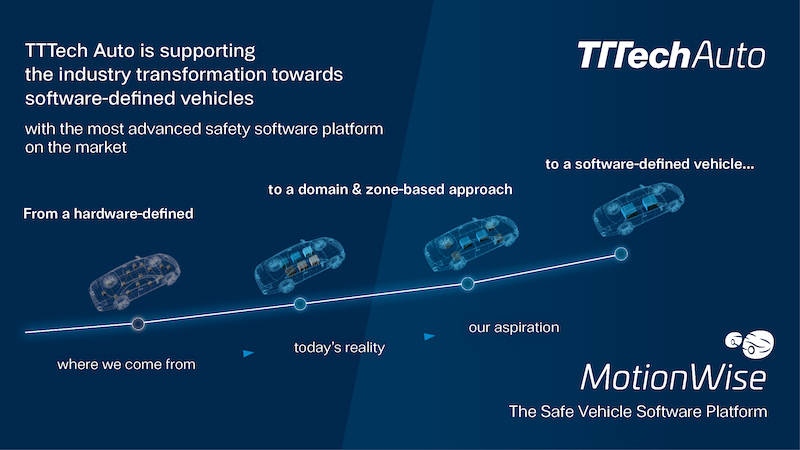

How Automotive Robotics is Transforming the Auto Industry

January 23, 2024

Select Auto Protect: A Comprehensive Review

January 7, 2023

How to Inspect a Car Before You Buy it

December 23, 2022

How to Buy Salvage Cars Online

November 27, 2022

How to Handle Failing Car Parts

February 22, 2022