The autonomous trucking sector is entering one of its most dynamic phases yet. After a decade of scattered pilots, cautious investment, and shifting timelines, the industry is now edging closer to real commercial deployment.

Several factors are converging at once: persistent driver shortages across the freight industry, rising pressure to improve efficiency on long-haul routes, and increasingly mature technology stacks capable of handling high-speed, highway-level autonomy.

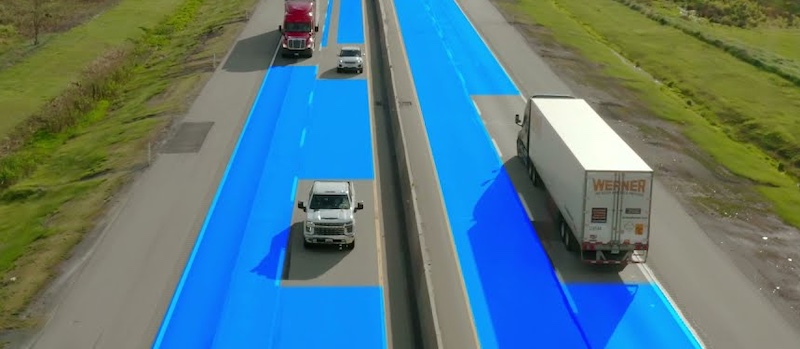

Unlike robotaxis – which must navigate dense urban environments filled with unpredictable human behaviour – autonomous trucks benefit from a more structured operational domain.

Highways offer clearer lanes, more consistent traffic patterns, and predictable routes. That simplicity is one of the reasons several technology providers, including Kodiak Robotics, Aurora, and Torc, have recently accelerated testing programmes and announced partnerships with major truck OEMs.

A number of US states have also begun clarifying rules for autonomous trucking operations, creating more certainty for developers preparing for commercial launches.

Yet achieving meaningful autonomy at 70–80 mph is far from trivial. At those speeds, a fully-loaded truck demands significantly longer stopping distances than a passenger car, meaning the perception system must detect obstacles hundreds of metres ahead – in all weather, at all hours, and in real-world conditions that cannot be cleanly simulated.

This is where sensing technology becomes a defining factor in which companies ultimately succeed.

Arbe Robotics, a developer of high-resolution 4D imaging radar, has positioned itself at the centre of this shift. The company argues that long-range radar with high spatial resolution will be essential for unlocking “eyes-off” capability at highway speeds – whether in advanced Level 3 systems or the more autonomous Level 4 freight operations many in the industry still see as the end goal.

To understand the state of the sector, the technical hurdles, and where autonomy is headed next, we spoke with Arbe CEO Kobi Marenko.

Interview with Kobi Marenko

Robotics & Automation News: Arbe built its reputation on high-resolution 4D imaging radar. What specific challenges in autonomous trucking does radar solve that cameras and LiDAR alone cannot – particularly at highway speeds of 70-80 mph?

Kobi Marenko: Accurate long-range detection and object separation are imperative features for autonomous trucks to drive safely at highway speeds.

When a car is driving at 130 km/h, it will need to safely detect vehicles or objects at a distance of over 200m to either change lanes or brake gradually and prevent a collision.

Now imagine a truck that takes a longer time to stop – it would need to detect objects at quite a distance for it to drive safely on the road.

Arbe can detect objects at over a 350 meter distance and can do so in low visibility scenarios (for example, going in and out of a tunnel), and even without a line of sight.

Additionally, Arbe’s sensors have ultra-high resolution in challenging environmental conditions such as snow, rain, darkness, and sun glare, enabling sensing every day of the year and every hour.

Radar inherently measures Doppler and thus can directly capture speed and motion of objects, a big plus for autonomous driving. And when aiming for cost-effective mass adoption, radar tech is much more affordable than the cost of LiDAR technology.

R&AN: We’re seeing renewed momentum in driverless trucking, with several companies announcing deployments or tests in the last few weeks. How does Arbe view the current state of the autonomous trucking market, and what has changed in the last 12-18 months to accelerate progress?

KM: The autonomous trucking business is indeed picking up momentum, even faster than robotaxis, due to several key factors:

We are seeing platform maturity by several technology providers including Kodiak, Aurora, and Torc, who are supporting announcements with trucking OEMs.

There is regulation that enables autonomous trucking routes in several key states such as Texas, Arizona, and California, which is also to be expected.

Operating on the highway, on pre-set routes, is much simpler than random urban driving and has a clear ROI over the robotaxi business.

In order to really take autonomous scaling to the next level, there is a need to expand autonomous trucking to more complex freight hauling corridors that have traffic congestion and not just main clear highways.

There will also need to be faster hauling speeds, and autonomous trucks will need to operate in all weather conditions. Arbe’s technology provides the perception needs at the right pricing to accelerate autonomous trucking beyond just highway driving.

R&AN: The industry has discussed Level 4 trucking for years, is Level 3 a more realistic commercial stepping stone for trucking – and if so, why?

KM: While L3 offers clear value for passenger vehicles, the true benefit for trucking lies in L4, where fleets can reduce driver dependence and operate for longer hours.

Because achieving L4 requires handling greater complexity and meeting strict safety demands, progress may be gradual, with L3 appearing as a transitional stage rather than a long-term objective.

L3 provides autonomy within a defined ODD but still requires driver intervention, which limits its value for trucks. To make L3 meaningful in this sector, its ODD would need to expand across more road types, higher speeds, and varied weather conditions.

L4, which enables operation within the ODD without driver involvement, remains the real target for autonomous freight. Arbe’s technology is designed to support both advanced L3 capabilities and the eventual transition to full L4 autonomy.

R&AN: Can you share any recent commercial milestones – OEM partnerships, production programs, pilots, revenue guidance, or geographic growth – that demonstrate Arbe’s current traction in the trucking and commercial vehicle segment?

KM: Last year, Arbe announced a collaboration with a prominent European truck manufacturer to integrate Arbe’s automotive-grade imaging radar technology into the manufacturer’s next-generation sensor suite, as part of the manufacturer’s transition to an advanced implementation stage.

R&AN: Highway autonomy at high speeds requires long-range perception. What range and resolution benchmarks does your radar currently achieve, and what is the minimum viable perception performance you believe trucks will need for safe Level 3 operation?

KM: For both L3 and L4 autonomous driving, trucks will need a perception radar with enriched perception algorithms for advanced capabilities, including: free space mapping, object tracking, and SLAM.

Perception Radar that differentiates true threats from false alarms is the only way to ensure a safe road for drivers, pedestrians, and other vulnerable road users.

Dynamic range is critical so that the radar can distinguish between small objects and large objects that are near each other – like a child near a large truck.

Trucks will need long-range detection at a minimum of 350 meters; however, Arbe can extend that range to 500 meters to support the longer braking distance of trucks. Arbe is actively testing this with Truck OEMs, as the leading benchmark.

R&AN: Several major players, including Tier-1 suppliers and truck OEMs, are building in-house radar capabilities. How does Arbe differentiate in a market where cost, performance, and integration all matter?

KM: Arbe’s radar has the highest channel count on the market today, which includes an array of 48 transmitting and 48 receiving channels.

Our radar solution is ultra-high-resolution and enables long-range detection in both azimuth and elevation and provides unmatched precision in environmental perception, including harsh weather and low-visibility conditions with minimal false alarms.

There is currently no other radar on the market that can provide the level of safety and reliability that our solution provides to navigate L3 or L4 driving.

R&AN: The autonomous-trucking sector has seen some consolidation and strategic pivots. Do you expect more mergers, acquisitions, or partnerships? And in your view, which technologies or business models are most likely to survive long-term?

KM: Every industry is facing major commercial shifts and experiencing expansion as well as consolidation – the trucking industry is no different. Regulation and legislation will play a major role in the automotive industry.

I do expect more announcements for eyes-off capabilities in the foreseeable future, and am very optimistic that eyes-off driving will reach broad adoption with high-performance perception radars playing an instrumental role in the technology stack.