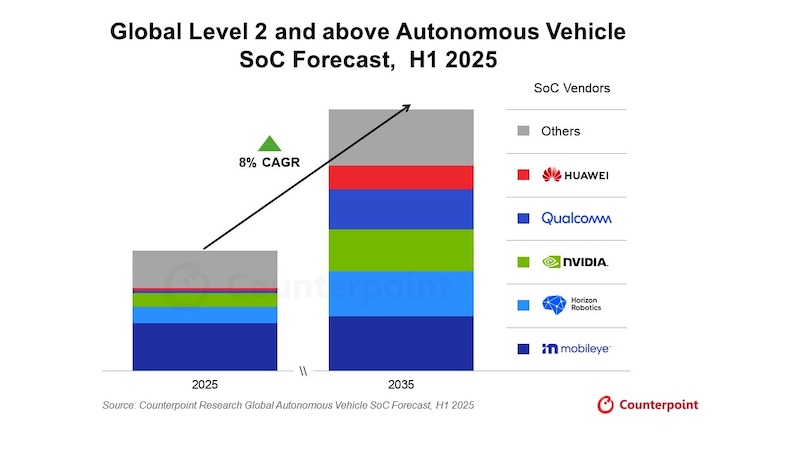

Global innovation in advanced driver assistance systems (ADAS) as well as autonomous vehicles are reshaping the competitive landscape for the suppliers of system-on-chips (SoCs).

The market is entering a fast-growth phase that will change supplier market shares among global suppliers, according to a new report by Counterpoint Research.

Mobileye, Nvidia, Qualcomm, Horizon Robotics and Huawei will emerge as the top five SoC suppliers for ADAS and autonomous vehicles with a combined share of over 78 percent by 2035, up from 69 percent in 2025, according to Counterpoint Research’s Global Autonomous Vehicle SoCs Forecast, H1 2025.

Higher levels of autonomy require high-performance SoCs capable of handling AI perception and sensor fusion, and redundancy requirements. In the next decade, with the expansion in the SoC market, a rebalancing between high-performance compute vendors and traditional automotive SoC vendors is expected.

Mohit Sharma, senior analyst at Counterpoint, says: “Level 2+ is the inflection point for automotive compute moving from simple camera ECUs to more centralized, AI-heavy SoCs.”

Chinese SoC players Horizon Robotics and Huawei are expected to dominate with over 50 percent overall domestic market share by 2035 through rapid scaling of cost-effective L2+ and above SoCs.

They are partnering with domestic automakers as a result of global geopolitical factors which has led to a more strategic initiative of self-reliance by automakers, who have taken to adopting locally sourced SoCs from domestic vendors and are even developing SoCs in-house.

Mobileye and its cost-competitive products are expected to see an increase in adoption in emerging markets such as India, Southeast Asia, Latin America and the Middle East, enabling Mobileye to maintain its leadership in L2 ADAS.

Crucially for Mobileye, its surround ADAS solution for L2+ autonomy is expected to see further traction among Western OEMs aiming to provide functionality in mass market vehicles.

The requirement of high-performance SoCs is expected to increase as OEMs offer higher levels of autonomy and move to a more centralized electrical architecture.

The higher levels of autonomy (L3 and L4) will be more demanding on AI perception, sensor fusion and redundancy requirements, while the centralized architecture will demand more powerful SoCs to handle both cockpit and autonomy functions.

Nvidia, Qualcomm and Huawei, which have higher performing and flexible SoCs products, are expected to see a combined growth of over 15 percent CAGR with significant market share gains in the forecast period.

Murtuza Ali, senior analyst at Counterpoint, says: “Nvidia and Mobileye are defending their leadership, but Qualcomm and Chinese SoC vendors are expanding fastest as OEMs push affordable L2+ features into the high-volume mass market.

“By 2035, the market will be more fragmented, but total vehicles with high-compute needs will be around 3-4 times larger than current levels. SoC vendors that can strike a balance between AI performance, power efficiency, and cost competitiveness will reap success.”

OEMs are expected to evaluate multi-source strategies to optimize costs across L2 and L2+ for the mass market and high-compute SoC for premium autonomous vehicle derivatives.

The growing autonomous market has significant upside for vendors that secure early access and support through scalable SoCs with flexible L2 to L4 roadmaps, providing integrated safe and validated hardware-software stacks which can help drive up the value of content-per-vehicle.