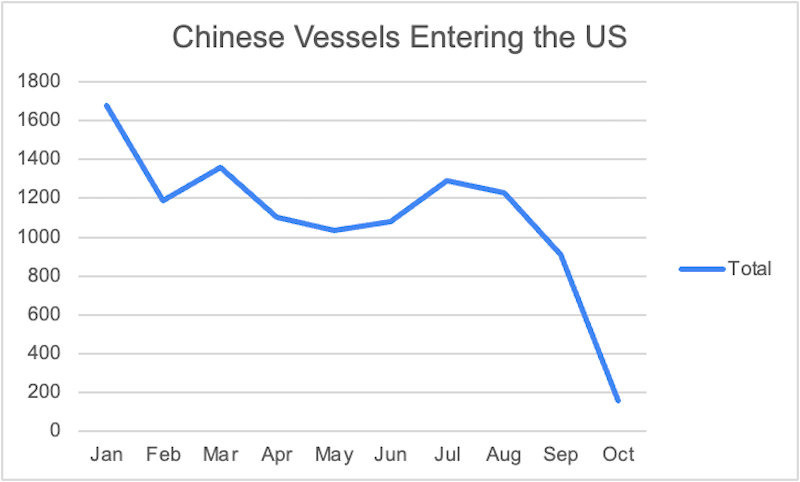

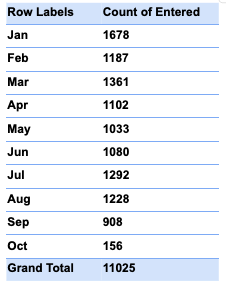

Chinese ships entering US ports have fallen by more than 90 percent since January, according to new data from maritime analytics firm Pole Star Global. The collapse underscores how quickly trade between the world’s two largest economies is deteriorating amid rising tariffs and new port fees.

Pole Star says the number of Chinese vessels entering the United States dropped from 1,678 in January to just 156 so far in October (as of October 14th), following the introduction of reciprocal port fees and the renewed threat of tariffs from the Trump administration.

Saleem Khan, chief data and analytics officer at Pole Star Global, says: “We are seeing Chinese vessels that are being screened by our customers nearing zero.

“This is a concerning drop from the number we saw in January 2025, where 1,678 Chinese vessels entered the US and were screened by our customers.”

The decline coincides with President Donald Trump’s warning that he is prepared to impose an additional 100 percent tariff on Chinese goods, which would raise the total tariff rate to around 130 percent.

Speaking earlier this month, Trump framed the escalation as part of his plan to “protect American workers” and pressure Beijing into “fair trade” – a move that economists say could send shockwaves through global supply chains.

According to CNN, the proposal would double the current tariffs applied to roughly $360 billion worth of Chinese imports, potentially adding hundreds of billions in costs for US companies that rely on goods from China.

At the same time, the maritime sector is facing new financial barriers. As reported by AP News and the law firm HFW, both the US and China have begun enforcing special port fees on each other’s vessels.

Chinese ships entering US ports are now charged new fees based on gross tonnage, while Beijing has introduced its own tariffs of 400 yuan per ton, scheduled to rise to 1,120 yuan by 2028.

Analysts estimate that the cumulative impact could reach $20-23 billion annually if current trade volumes were to resume – though the Pole Star data suggest those volumes are collapsing instead.

The immediate effect is logistical disruption. Khan says maritime traffic patterns are already changing as shipping companies divert vessels to other regions.

“As you can see with Pole Star data, the new port-fees have already started to change behavior in the shipping market,” says Khan.

“In the short term we should expect route changes, void sailings, and noticeable upward pressure on freight rates as carriers implement surcharges or GRIs (General Rate Increases) to pass the cost to shippers.”

The impact extends beyond the shipping lanes. China remains the dominant supplier of consumer electronics, automotive components, and industrial machinery to the United States.

A prolonged freeze in maritime trade could trigger shortages, inflationary pressure, and production delays across multiple sectors.

Economists warn that even before any new tariffs take effect, the anticipation alone is depressing trade flows as importers rush to hedge or shift supply chains.

Al Jazeera noted in its coverage that the renewed tariff threat reflects a political strategy as much as an economic one – playing to domestic manufacturing constituencies ahead of next year’s election.

Meanwhile, The Guardian quoted China’s Commerce Ministry as calling the US actions “wilful and harmful”, warning of “necessary countermeasures” if Washington proceeds with the 100 percent tariff plan.

The combined policy changes – tariffs, port fees, and retaliatory measures – have brought trade between the two nations to a near standstill on the water.

Pole Star’s data, based on vessel-tracking and screening activity used by governments and insurers, provides an early, real-time indicator of that slowdown before it shows up in official trade statistics.

The trend could mark the beginning of a more permanent shift in global commerce. The shipping data tells a story that political rhetoric often obscures. Trade routes can change faster than policy. Once ships stop coming, restarting them is not easy.

If the tariffs are implemented and port fees remain in place, the world’s busiest trade corridor could see its lowest activity in decades – signalling not just a trade dispute, but the start of a structural decoupling between the US and China that could redefine global logistics for years to come.