SoftBank and Symbotic establish new ‘warehouse-as-a-service’ joint venture

SoftBank, the telecommunications group which has wideranging interests in robotics, and Symbotic, a developer of AI-powered automation technology for the supply chain, have established a new joint venture to address the more than $500 billion annual warehouse-as-a-service market opportunity.

The newly created company is called GreenBox Systems LLC.

Concurrently, Symbotic also announced an approximately $7.5 billion new customer contract with GreenBox, who will be the exclusive provider of Symbotic systems in the warehouse-as-a-service market, and will make supply chain services available to customers.

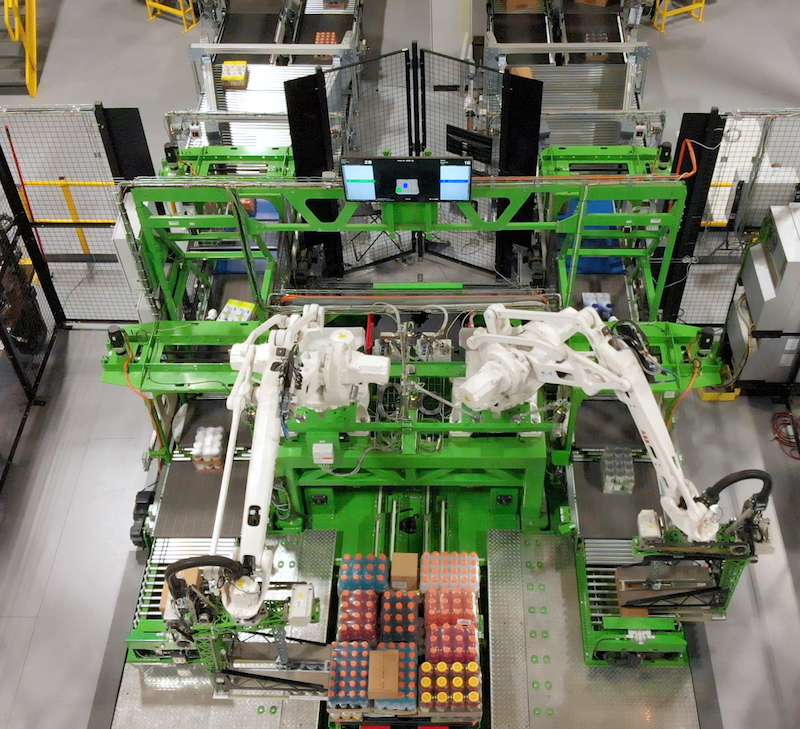

GreenBox will automate supply chain networks globally by operating and making accessible Symbotic’s advanced AI and automation technology for the warehouse.

Symbotic’s AI-powered robotics and software technology will be the cornerstone of GreenBox, installed in single and multi-tenant facilities.

The efficiency, SKU agility, scalability, and density of the Symbotic system allows GreenBox to effectively manage single and multi-tenant facilities across the supply chain and thus fundamentally reshape the economics of automated supply chain services.

Enabled by these technologies, GreenBox customers will be able to reduce inventory and costs while boosting SKU count and agility, all without associated capital expenditures and operational complexity.

Rick Cohen, Symbotic’s chairman and CEO, says: “We are pleased to partner with SoftBank in this venture that accelerates our shared vision to transform the supply chain.

“GreenBox enables Symbotic to bring the benefits of our technology to a broader customer universe, expanding our market opportunity.”

Vikas J. Parekh, managing partner at SoftBank Investment Advisers, says: “GreenBox taps into the powerful potential of AI and other enabling technologies in supply chains, while also making the benefits of automation accessible to more businesses through an ‘as-a-service’ offering.

“In partnership with Symbotic, GreenBox will equip customers with more intelligent, streamlined, and scalable warehousing solutions while eliminating the burden of major capital expenditures.”

GreenBox will order Symbotic’s systems over a six-year period commencing in fiscal year 2024, to be implemented across its warehouse network in larger-scale deployments than Symbotic’s current installed base systems.

Symbotic expects in excess of $500 million in annual recurring software, parts and services revenue from GreenBox once all systems are operational. Symbotic systems typically become fully operational within 24 months of project design approval.

GreenBox’s board of managers will comprise three managers, one nominee from each of Symbotic and SoftBank, and one independent manager. GreenBox’s management team will be independent from Symbotic and SoftBank.

Transaction and Implementation Details

SoftBank and Symbotic own 65 per cent and 35 per cent of GreenBox, respectively, with the joint venture established today. GreenBox will initially be funded with $100 million of capital contributed pro rata by Symbotic and SoftBank to fund operating expenses and initial system purchases.

After Symbotic’s initial $35 million pro rata capital contribution, the contract is expected to be accretive to Symbotic’s annual free cash flow (net of capital contributions).

Symbotic has issued warrants to SoftBank representing up to 2.0 per cent of Symbotic’s fully diluted shares outstanding, which will vest in 0.25 per cent increments upon payment of each $937.5 million to Symbotic for installation of Symbotic systems under the GreenBox contract.

The warrants have a 6-year term and strike price representing Symbotic’s 45 trading day volume weighted average price (VWAP) as of July 21, 2023, of $41.9719 per share.

Separately, SoftBank has purchased approximately 17.8 million shares from Symbotic chairman and CEO, Rick Cohen, at Symbotic’s 45 calendar day VWAP as of May 26, 2023, of $28.05 per share. This sale is 100 per cent secondary shares and will not result in any dilution to Symbotic shareholders.

Goldman Sachs served as exclusive financial advisor and Sullivan & Cromwell as legal advisor to Symbotic.