Warehouse Automation Trends: The State of the Material Handling Automation Market in 2023

Article contributed by Vecna Robotics

Latest warehouse automation trends reveal that the market has been on a tear in recent years, driven by the need to augment operations with flexible automation to weather the next supply chain shock and address critical labor shortages.

To analyze the current state of the material handling automation market, Vecna Robotics partnered with CITE Research to survey over 1,000 supply chain professionals across industries including automotive, third-party logistics (3PL), consumer goods, manufacturing, e-commerce and retail to uncover the key trends, challenges, and opportunities in the market.

Before we dive into the details, here is a quick snapshot of the state of the market right now:

- Warehouses are facing a significant labor shortage – The majority of the market is 10-25 percent understaffed, with material handlers and forklift drivers to move pallets representing the largest labor gaps at 34 percent and 31 percent reporting difficulties in filling these positions, respectively.

- Automation is here to help – Most supply chain professionals view automation as a positive for workers, with 70 percent highlighting improved retention and over half recognizing it as a means to upskill employees and create new job opportunities.

- Autonomous pallet moving has just started to scale – Automation remains largely untapped, with 76 percent of companies having never deployed an Automated Guided Vehicle (AGV) and 70 percent never implementing an Autonomous Mobile Robot (AMR). Nevertheless, larger facilities are embracing automation, with 50 percent of those exceeding one million square feet having introduced AMRs. E-commerce leads the adoption rate at 39 percent with automotive closely behind at 38 percent.

- Case picking is everywhere – The majority of respondents (78 percent) are already using case picking in their operations, with a whopping 90 percent using it in the consumer goods industry, and yet this is still almost completely manually performed today.

By 2025, the global warehouse automation market is projected to expand to $69 billion. The following data will help us understand the drivers, barriers and financial considerations of adopting automation.

In addition, the data informs how to achieve automation at scale to offset increasing product demand and global supply chain disruptions while keeping existing workers happy.

To deploy or not to deploy: That is the question

As a multitude of problems cripple the material handling industry, companies are turning to automation to help, with 85 percent of respondents planning to deploy some form of automation in the next 12 months.

Drivers for automation adoption

Unsurprisingly, the primary drivers for this adoption are the labor shortage (25 percent) and supply chain disruption (22 percent).

Smaller facilities are particularly impacted by the labor shortage, while larger facilities are driven to automation due to supply chain disruption. Among industries, retail and e-commerce are most affected by the labor shortage and supply chain disruptions.

Barriers to automation

While it’s no secret that automation is gaining steam, with 4 in 10 reporting a strong return on investment (ROI) from previous deployments, there still remain a number of obstacles to adopting automation. Let’s dig into these.

In today’s volatile economy, cost concerns are at the top of the list of obstacles to implementing automation solutions, with budget (41 percent) and cost/ROI (40 percent) being the most significant.

Cost/ROI was also the main obstacle to adopting automation efforts previously, with 54 percent of supply chain professionals stating that it has hampered their implementation plans.

Digging into the data, we discovered that all barriers to automation adoption show a negative correlation with facility size, except for cost/ROI. Surprisingly, the larger a company’s revenue, the more budget and cost/ROI become obstacles to adoption, which could reflect the following:

- Long term strategic vs. short term ROI: decision makers at larger firms may be under more pressure to show short-term returns to their business unit vs. smaller companies that have more runway to consider automation as a strategic long-term investment and competitive differentiator.

- Capex vs. Opex models: Dated capex cost models are delaying rapid adoption of automation at scale.

- Prove value: New technologies have to do a better job at proving value (no science projects please!) in environments with more financial discipline and in order to compete with other types of tech investments.

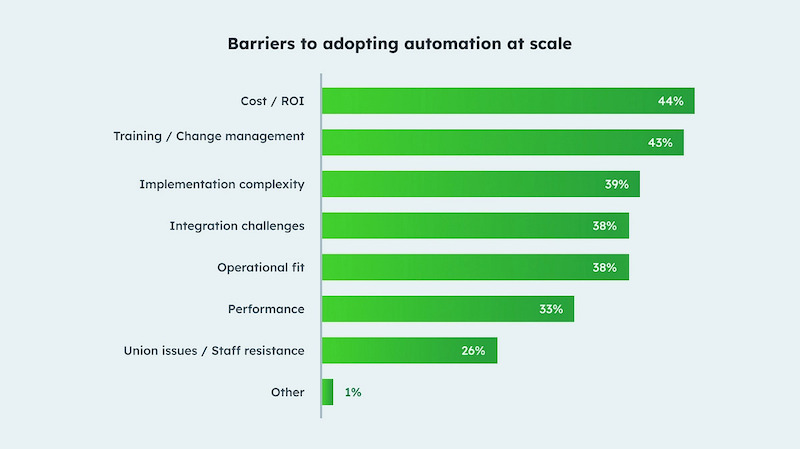

When it comes to adopting automation at scale, the barriers remain spread. Cost/ROI remained the top barrier (44 percent) but was followed closely by training/change management (43 percent).

Implementation complexity (39 percent), integration challenge (38 percent), and operational fit (38 percent) also represented significant barriers to adopting automation at scale.

Interestingly, facilities exceeding one million square feet behaved differently than the average sized facility with their main barriers to adoption being performance, implementation complexity, integration challenges, and training/change management.

Our analysis also reveals that the 3PL industry is the least affected by these obstacles, while the consumer goods sector is the most impacted.

What technologies are facilities looking to adopt in 2023?

Automation isn’t the only technology top of mind for supply chain professionals. When asked to prioritize technologies for 2023, respondents shared the following feedback:

- 5G wireless is currently leading the way in deployment and is projected to have the most widespread adoption in the near term with 41 percent planning to deploy within the next 12 months. The manufacturing sector is poised to be a major adopter of this technology with close to 50 percent looking to deploy within the next 12 months.

- Technology information systems, such as Warehouse Management Systems (WMS) or Enterprise Resource Planning (ERP), were next on the list with 38 percent of warehouses planning to deploy in the next 12 months, with automotive (44 percent) and manufacturing (42 percent) set to be the biggest adopters.

- Battery and charging technologies followed closely with 37 percent of facilities planning to implement them in 2023, with consumer goods far outpacing the other industries in terms of adoption.

- Racking and storage equipment comes in fourth with 35 percent planning to deploy in the next 12 months, with consumer goods set to be the largest adopter (41 percent) and retail expected to be the lowest adopter (15 percent).

- Material Handling Equipment (MHE) robotics for pallet-sized loads is still in its early stages, with 31 percent of facilities surveyed planning to deploy in 2023. There is no real material difference across industries when it comes to pallet-sized robot adoption, with automotive set to be the largest adopter (36 percent) and retail expected to be the lowest adopter (22 percent).

Investing in automation

While MHE robotics is still in the early stages, it’s a promising prospect for the industry, so much so that almost 70 percent have budget earmarked for new material handling automation solutions within the next year. Let’s look at the financial considerations when adopting automation and who is making those decisions.

What are the financial considerations?

When it comes to procuring new technologies and adopting automation in the warehouse, supply chain professionals generally have three options:

- Obtaining new technology and automation solutions as a capital expenditure (CapEx)

- Leasing the technology from a third party (CapEx or Opex depending on the lease)

- Obtaining them as an operating expense (OpEx)

When the cost of automation often exceeds the signing authority of a warehouse manager, funding will come from a CapEx budget controlled by upper management, meaning that the proposal may be one of many competing for limited funds allocated across the company.

However, according to respondents, the CapEx approval process does not appear to be a significant hindrance to adoption with 89 percent feeling their company’s CapEx approval process is supportive of adopting automation.

Leasing is another common method to purchase material handling equipment, but the problem is that model is dated when it comes to automation technology. For example, one can lease automated material handling equipment but, typically, the equipment itself is only a fraction of the overall cost.

Critical services like deployment, maintenance, software updates and support services are not typically included in the lease and, if not accounted for, could bust ROI forecast models.

Robotics as a Service (RaaS) models like those offered by Vecna, material handling robotics solutions are available as an annual operating expense enabling companies to update or increase their robot fleets as their needs evolve.

RaaS models also tend to include all associated services and support, and are contractually bound to performance KPIs and uptime SLAs.

We expect to see this flexible and scalable pricing plan become more common, with 84 percent of respondents saying that it would accelerate adoption. When looking at facility size, we found that the larger the facility or company, the more likely they are to adopt RaaS.

When building a cost model for automation solutions, companies most consider safety costs (48 percent), training costs (47 percent), turnover costs (42 percent), and/or labor availability costs (42 percent) in addition to just wages and benefits.

Breaking this down by facility size and industry, larger facilities are more sensitive to these cost factors. On an industry basis, the consumer goods industry is more sensitive to most cost factors.

Who are the decision-makers?

Various parties are involved in material handling automation investments, with the majority of respondents reporting that all roles from Chief Supply Chain Officer to HR are at least somewhat involved in investing in automation. However, COOs, CSCOs, CTOs and IT are the most involved parties when it comes to investment.

Interestingly, for any material handling automation projects that are being considered, the majority of decisions (35 percent) are made by regional or line executives in charge of multiple facilities, while the next highest is a C-level decision at 25 percent.

When digging a little deeper, we see that:

- Finance, IT, and HR are more involved when facilities are larger

- IT is more involved in the decision-making within the consumer goods and manufacturing industries

- Corporate transformation/digital transformation was very influential when it comes to investing in automation in the consumer goods industry

- HR gets more involved in the decision-making process when the facility size or company’s revenue is larger

Getting to scale

So, how does automation become mainstream? Let’s look at what is affecting automation adoption at scale:

The economic downturn is not significantly impacting adoption. 74 percent of automation projects are not impacted by fear of economic downtown.

In fact, 15 percent are accelerating adoption. However, 26 percent of respondents reported that automation projects have been postponed or delayed indefinitely due to economic headwinds.

Larger companies require a corporate strategic imperative to drive automation projects. Around 50% of companies with $1 billion or more in revenue rely on a corporate strategic imperative to adopt and scale automation.

Increasing product demand and global supply chain disruptions are causing automation adoption at scale. Respondents cited increasing product demand (30 percent) and global supply chain disruptions (26 percent) as the largest factors in adopting automation at scale.

Tightness in access to skilled labor (13 percent) and reshoring of production back to North America (11 percent) are less impactful.

The robots are coming

Given this data, we can see that automation has quickly become a critical strategic priority, and from the boardroom to the warehouse, leaders are looking to get robots and other warehouse technologies on the floor as soon as possible.

Based on the data, following are the top automation deployment trends that we expect to see this year:

High-speed, secure internet is the biggest technology obstacle for automation adoption so we will see the adoption of 5G Wireless technology as a main priority for companies.

Updating and upgrading disparate WMS and ERP systems throughout supply chains and standardized across modern, cloud-based systems will also help alleviate some of the integration challenges currently faced by the industry.

Consumer goods, automotive and 3PL will continue to lead the charge in automation adoption, with retail lagging behind.

Due to the lack of labor in pallet-moving roles, automation will be increasingly sought after to augment the talent shortage, with case picking representing the largest automation potential.

The largest facilities will deploy automation faster.

Read full article here. And for a more in-depth review and discussion about Vecna’s approach to deploying warehouse automation, watch the multi-part From No Not to Robot webinar series posted to Vecna’s Resource page here: https://www.vecnarobotics.com/resource-filtering/?filter-resource-type=webinar