Machine learning in banking and marketing applications for 2021 and beyond

Artificial intelligence (AI) and machine learning in banking make the strongest combination possible. Since these technologies are versatile, there are a lot of ways to use them across industries, and in the fintech sector as well.

There are a lot of concerns and discussions around artificial intelligence and machine learning that last for several decades already. The recent pandemic has greatly accelerated the development of innovation.

Smart robots are already capable of helping shoppers select and deliver goods, as well as performing simple medical tasks such as delivering drugs and instruments. What is more, the main forecast remains unchanged – the share of artificial intelligence in business will grow every year.

In this article, we decided to figure it out how artificial intelligence in banking and marketing is used, and how the bank of the future will look like.

What Are the 4 Types of AI?

Right now, we are observing the rapid evolution of smart machines that was predicted by sci-fi writers of the previous century.

Artificial intelligence and machine learning systems are already powerful enough to assist humans in their personal and business processes, however, according to the AI classification, there is still a lot of space for development.

There are four types of artificial intelligence: reactive machines, limited memory, the theory of mind, and self-awareness.

- Reactive machines are the systems that are able to possess and analyze information here and how. They don’t have a memory from the past, however, they have logic-driven predictive capabilities.

- Limited memory machines have some memory pieces that contain information about the past. For example, self-driving cars are programmed as limited memory machines. They have knowledge about traffic rules, as well as can process real-time information when making the maneuvers.

- The theory of mind machines are still under development. This type of machine is expected to have an understanding that other people have their thoughts, feelings, and emotions. For the first time, the theory of mind machine was described by Aizek Azimov in “I, Robot”. The “Liar!” novel tells the story of the robot who tells people only those things they really want to hear in order not to make them emotionally suffer.

- Self-aware machines are expected to have and most importantly, recognize their own thoughts, needs, feelings, and emotions.

Even despite the fact that only two first types of smart machines are already here, there are a lot of ways artificial intelligence and machine learning in banking, marketing, health care, education, and many other industries.

How Is AI Used in Banking?

According to the research, “AI-driven customer service, real-time fraud prevention, and risk management – it’s the last one that might appeal most to those interested in industry disruption.

Deep learning’s use of patterns to predict future activity appears to have tremendous potential for stockbrokers, investment bankers, and asset managers- to assist them, at least for now.”

Let’s research in more detail how AI in fintech is used now.

- AI-driven customer service. There are a lot of ways to make the customer service truly AI-driven or, it’s better to say, data-driven. For example, with the help of data analysis, the banking institution may find out about the purchasing intentions of the customer and offer a flexible loan. Also, leading banks come up with smart chatbots that help customers to interact with financial companies better. With the help of smart apps, the customers may automatically track their spending, plan their budget, and get accurate saving and investing suggestions.

- Real-time fraud prevention. The most common type of fraud banks face globally is credit card fraud via identity theft. The level of credit card fraud reports increased more than fivefold between 2014 and 2019. And this figure continues to grow. Сredit card, as well as other types of fraud detection with AI and machine learning, is quite promising for banks since these technologies allow analyzing the real-time data and making accurate predictions before the fraudulent attempts happen. There are a lot of ready-made solutions for fraud prevention in banking, like the one developed by SPD Group, and also, it is possible to come up with a personalized protective tool to meet the needs and respond to the risks of a certain bank.

- Risk management. As for risk management, there are also a lot of ways to use artificial intelligence in banking. For example, AI-powered systems may predict the investments and insurance risks, analyze the real intention of the customer when issuing a loan, as well as evaluate the risk of being involved in money laundering and/or terrorism financing.

How Is AI Used in Marketing?

As for the usage of artificial intelligence and machine learning in marketing, there are a lot of opportunities for every industry. We have already briefly described how AI in fintech may help with improving customer service, and here are more applications of this technology.

- Customer retention. AI is able to help with customer retention with the help of personalized offers, discounts, and special services. What’s more, it is also capable of churn predictions. If there are some data-driven and behavior-driven insights that a customer is going to reject the services of the company and/or switch to the competitors, an AI-powered system may catch these signals and the company may come up with a personalized retention strategy.

- Real-time customer interactions. AI-powered chatbots are already smart enough to support customers at each of the sales funnel’s stages. Firstly, this almost completely eliminates the need for a human customer support team, secondly, chatbots are kindly pushing the customer to make a purchase by answering the questions and making accurate suggestions.

- Voice search. Voice search is on the rise, and this technology is fully AI-powered. There are speech recognition functions that help customers to search for the companies faster. Also, there are a lot of AI-powered tools that help companies with voice search optimization to become better visible on search results, for example, Answer The Public.

- Buyer profiling. AI is also useful for customer segmentation, data analysis, and profiling. These actions are needed for personalized marketing strategies development.

Artificial Intelligence in the Banking – Case Studies

Below is how machine learning in banking is practically used by the world’s leading banks.

- JP Morgan Chase developed a contract management system that helps with document analysis and classification.

- Wells Fargo has a smart chatbot that helps customers navigate the website and turn the whole interaction with a bank into easy-going chatting.

- Bank of America. This bank offered its customer the support of a smart financial consultant in the form of a chatbot. Their chatbot may notify customers about overspending, analyze their spending habits, and track anomalies.

- CitiBank is using artificial intelligence in banking as a part of its fraud detection strategy. Thus, the software they utilize help with money laundering issues detection.

What Is the Future of AI in Banking?

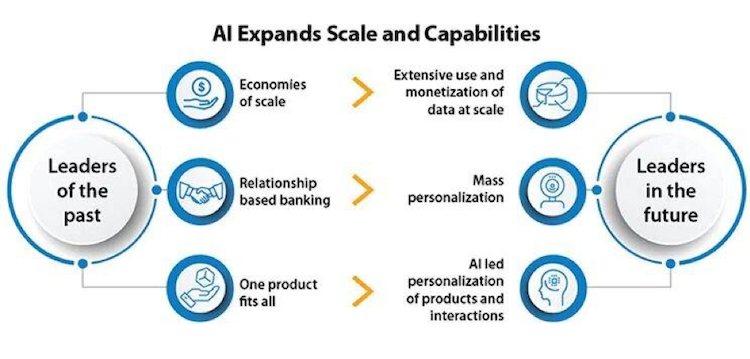

The future of AI in banking is the AI-first bank that will be intelligent, personalized, and omnichannel. Also, in addition to AI-first banks, there will be mobile-first banks that will exist only in mobile applications (without physical branches that are not flexible but are costly) powered by artificial intelligence and machine learning. In a nutshell, the concept of “the bank in the pocket” is almost here.

Conclusion

The use of AI and ML in banking is going to make the financial service delivery really innovative, enjoyable, and safe. What’s more, these are the technologies the banks of the future will be built on. Fraud detection is one of the most pressing issues for financial companies, however, more and more innovative tools are developed and used to detect and prevent any risks and illegal attempts.