Hydrogen vs electric vs petrol: How will cars be powered in the future?

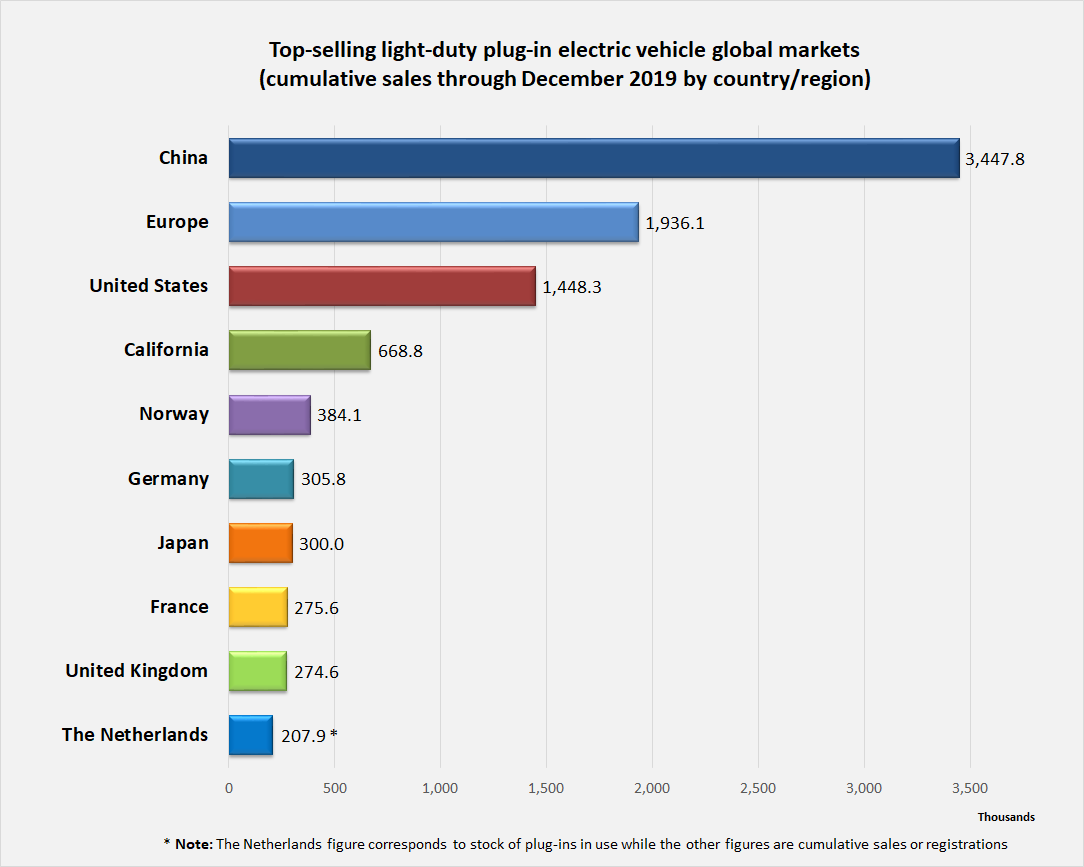

Electric vehicles sales have seen sustained increases in the past few years and significant milestones have been reached in many countries.

According to data published on Wikipedia by independent researcher Mario Roberto Durán Ortiz, cumulative global plug-in electric vehicle sales passed 5 million units in December 2018.

Five million is just a drop in the ocean in terms of the number of all the “light-duty” vehicles – vehicles weighing 4,500 kg or less, which includes cars, vans, and small trucks – on the roads worldwide, which, according to a Guidehouse Insights report, numbers around 1.2 billion in total. Other researchers estimate the figure to be around 2.5 billion.

But 5 million still represents a respectable market, and it is underpinned by milestones such as:

- annual sales of electric vehicles reaching 1 million in China in December 2018;

- the USA achieving its highest monthly electric vehicle sales of 50,000 in December 2018; and

- Germany, by December 2019, passing Norway as Europe’s largest EV market by annual sales volume, with more than 100,000 unit sales.

Norway is an interesting country because its citizens, on average, buy significantly more electric vehicles than any others in the world. For every 1,000 people in Norway, there are 55.9 EVs.

California, another region where citizens are regarded as progressive, lefty, tree-hugging hippy types with an interest in saving the planet while working out on the beach and intermittently surfing the waves, also has a proportionately high number of EVs, at 13.2 EVs per thousand people.

The US, as a whole, has 3.4 EVs per 1,000 people, while China’s figure is 1.6 per thousand.

Running out of petrol cars

The growing adoption of plug-in electric vehicles in the market, coupled with automakers’ willingness to invest big money into developing new designs, establishing production systems and charging infrastructure, has led many people to predict that electric vehicles will take over from petrol cars at some point in the not-too-distant future.

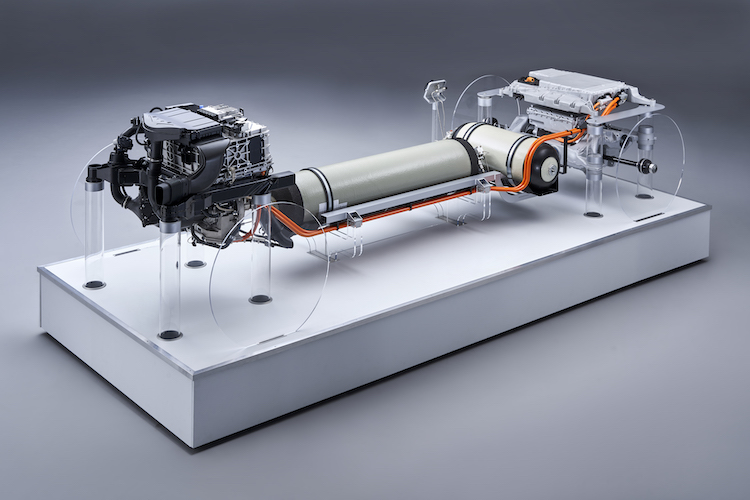

And although hydrogen has been left behind somewhat, it hasn’t disappeared completely. Leading automakers such as Toyota, Honda, Hyundai and BMW are still pouring billions into the technology in the belief hydrogen fuel cells do have a place in the future automotive market.

BMW recently reaffirmed its commitment to hydrogen, even as it builds on the success it has found with its electric models. In fact, the German auto giant seems to be hedging its bets, developing its technologies for petrol, electric and hydrogen simultaneously, as though it’s not quite sure what will happen in the future.

The company’s chairman, Oliver Zipse, said: “We continue to invest consciously in various technologies. This includes hydrogen fuel cell technology. Ultimately, this is the most intelligent and fastest way to effective climate protection.”

He added that the company will be unveiling the new BMW 5 Series Gran Coupé, and both the Sedan and Touring versions will be available in “electrified versions”.

Zipse emphasised that the guiding principle for BMW’s development are the environmental regulations set out by the government.

“We electrified early and systematically,” said Zipse. “This year alone, we will lower the CO2 emissions of our European new vehicle fleet by another 20 percent compared to the previous year – through measures in our conventional vehicles and by ramping up e-mobility.”

He added: “We are very well prepared for the new goals now coming into effect – and that is a real competitive advantage.”

Anything you can do

Germany’s other auto giants, Volkswagen-Audi, and Daimler-Mercedes, have been launching electric cars to some acclaim, but have been mostly reticent about any development work they may have done in hydrogen fuel cell technologies.

Volkswagen appears to be still considering its attitude to hydrogen, preferring to point to others’ projections and findings in the area.

In an article on its website, VW notes: “The Federal Ministry for the Environment… assumes that hydrogen and synthetic fuels, so-called e-fuels, will remain more expensive than an electric drive, as more energy is required for their production.

“The Agora Verkehrswende (traffic transformation) initiative also points out that hydrogen and e-fuels do not offer ecologically sound alternatives without the use of 100 percent renewable energies, and that, given the current and foreseeable electricity mix, the e-car has by far the best energy balance.”

This explains why VW has been much more willing to develop cars powered by batteries rather than hydrogen fuel cells. To underline that decision, VW recently invested €450 million in a battery manufacturing joint venture with Swedish company Northvolt.

However, VW has a huge presence in the large vehicles or trucks market, owning brands such as Scania and MAN. For these types of heavy vehicles, VW suggests hydrogen may hold some promise.

It points to the Fraunhofer Institute’s view that “synthetic fuels and drive technologies such as hydrogen in combination with the fuel cell will indeed play a role” – not so much in the passenger car sector, but rather in long-distance and heavy-duty traffic, as well as in rail, air and sea transport.

But even there, these segments “will only be converted in later phases of the energy turnaround – beyond the year 2030”, concludes VW.

Japan’s ‘hydrogen society’

Toyota, probably the world’s largest automotive manufacturer, appears to have come to the same conclusion – that hydrogen is best suited to large trucks and maritime vessels. But that doesn’t mean that the company has been muted in its backing for hydrogen.

The Japanese automaker has just unveiled a hydrogen fuel cell truck, jointly developed with Hino Motors, and accompanied the launch with an expression of strong support for hydrogen.

In a statement, the company said: “Toyota and Hino have positioned hydrogen as an important energy source for the future and have worked together on developing technologies and spreading and innovating fuel cell vehicles for over 15 years since their joint demonstration trials of the fuel cell bus in 2003.

“Going forward, Toyota and Hino will further strengthen its partnership and accelerate efforts toward the realization of a hydrogen society.”

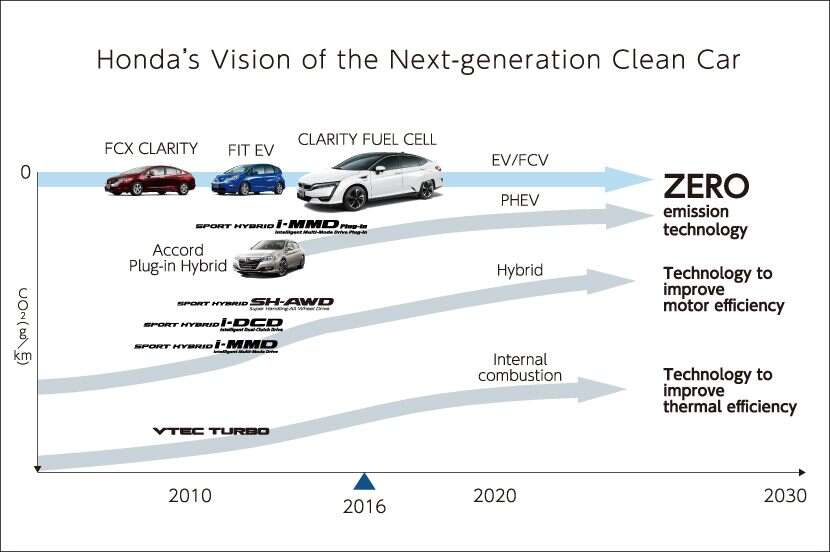

Honda has also bought into the so-called “hydrogen society”. The company is targeting cars for the technology but appears to be suggesting combining the two technologies in the same ecosystem, although it seems to be slightly more enthusiastic about hydrogen fuel cell vehicles, perhaps to make up for its lack of attention from others.

Toshihiro Mibe, senior managing director, Honda Research and Development, says: “Honda believes electric vehicles, plug-in hybrid vehicles, and FCVs powered by hydrogen are effective methods.”

Mibe says Honda supports hydrogen because “it can be found on our planet in abundance, and it can temporarily store energy instead of electricity, making it a very convenient energy source”.

This is a disadvantage of electricity in terms of infrastructure – electricity storage systems are rare to non-existent because no method efficient enough has been developed. To date, the vast majority of charging stations – whether at home or at a public charging station – are connected to the power grid, or what could be described as a “live network”. They will stop working if the grid goes down or if there’s a connection problem.

Honda is developing what it calls a “Smart Hydrogen System” – a hydrogen charging station. But that requires infrastructure investment that no single automotive company can manage. So it probably helps that the Japanese government has also adopted this “hydrogen society” idea.

“The Japanese government is leading the push towards a hydrogen society, beginning with four major cities,” says Mibe.

“The commercial hydrogen station business can only work if there are enough FCVs to use the stations, so other areas need some way to have access to hydrogen. That is why Honda has developed the SHS, a completely-packaged hydrogen station.”

It’s all about money

The key factor is always money. At the moment, the majority of vehicles in the world are petrol-driven, combustion engine vehicles – simply because that is the cheapest system.

The petrol economy has been in existence a long time, all the infrastructure is in place and the vehicle designs and performance levels are all established.

But all that would change almost overnight if either or both the battery electric vehicles or hydrogen fuel cell vehicles became cheaper than petrol cars.

At the moment, battery electric cars fit in better with the industrial infrastructure of the world as it is – they are easier to produce and easier to distribute and charge up and so on.

Hydrogen is a bit more tricky because it’s basically a paradigm shift – a completely new way of doing things, an entirely new platform that doesn’t fit in easily with the current oil-petrol infrastructure.

But Honda, Toyota and others who are backing hydrogen are predicting that the cost of producing and distributing hydrogen will come down to a more competitive level at least.

These costs will probably converge at some point in the next 10 years, but it’s difficult to see how petrol will be beaten at the moment, what with oil prices in negative territory and suppliers actually paying buyers to take it off their hands.

Strange times, but hopefully things will become clearer in the next decade or so. One thing is for sure: people don’t really want vehicles that pollute the atmosphere anymore, and they want the automotive industry to sort it out.