Big feature: Historic opportunities presented by smart cities

Experts from the Arthur D Little consultancy provide a detailed overview of the historic, “trillion-dollar” opportunity presented by the move to smart cities, in this article by Ralf Baron, Morsi Berguiga, Jaap Kalkman, Adnan Merhaba, Ansgar Schlautmann, Karim Taga

The 100 largest cities in the world produce 25 per cent of the planet’s wealth. To succeed, more and more cities are going “smart” in order to meet their biggest challenges and enrich the quality of their citizens’ lives.

This unstoppable trend is driving double-digit growth in a trillion-dollar global market.

What are the opportunities for telecom companies, utilities, financial institutions, transportation companies, software developers, equipment manufacturers and others in the smart-city market?

More and more cities are going “smart” as a response to some of the world’s biggest challenges. The best cities put their citizens at the center of their strategies, enriching the quality of their lives.

This unstoppable trend is driving double-digit growth in a trillion-dollar global market that offers huge opportunities for telecom companies, utilities, financial institutions, transportation companies, software developers, equipment manufacturers and others.

In this article we take a closer look at some of these opportunities for companies.

The challenges facing cities

Cities are the lifeblood of the 21st century. More than half of us live in them, and the 100 largest cities produce 25 per cent of the planet’s wealth.

The uncontrolled and exponential growth of metropolises around the world has led to developments that put mega-cities at risk and turn them into places that, at best, can be difficult to live in and, at worst, could severely limit the world’s future social and economic viability.

Key challenges include the following:

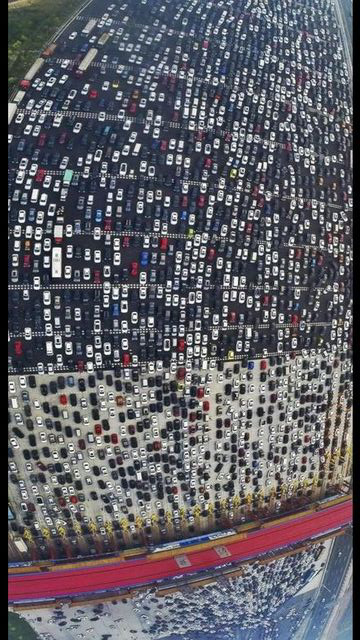

Population density: In 1990 the world had 10 “mega-cities” (those with 10 million inhabitants, equivalent to the population of Greece); today the number stands at 28, and by 2030 the world is projected to have 41. Population growth puts a strain on infrastructure, leading to traffic congestion, delays, inefficiencies and a lack of affordable housing.

Pollution: Eighty percent of the world’s cities with more than 100,000 inhabitants do not meet WHO air-quality guidelines. The release of greenhouse gases not only damages our environment, but also induces illness and causes more than 3 million premature deaths worldwide every year.

Urban health: Studies have found that urban dwellers are subject to higher stress levels, less healthy diets and have a lack of greenery and physical activity. This makes them more vulnerable to obesity, diabetes, depression, arthritis, heart diseases and cancer.

Security issues: Cities are associated with higher crime levels due to the higher concentration of valuable items they contain, as well as the ease of anonymity. Law enforcement has so far been relatively successful at reducing the number of crimes. However, new threats are emerging, such as identity theft through Wi-Fi hotspots or portable contactless card scanners used by thieves on underground railways.

Growing need for connectivity and mobility: Growing cities fuel an increasing demand for continuous connectivity and enhanced mobility, without which cities could grind to a halt. New technologies in sensors and monitoring offer possibilities to manage city operations much more effectively.

What is a smart city?

In order to overcome these challenges, cities will have to become smart, which can be defined as follows:

“A Smart City uses modern technologies and innovative policies to meet the demands of its citizens. Through the provision of more accurate and readily available data it allows communities and government bodies to make informed decisions. Smart city processes must have a positive impact on the local community in terms of efficiencies, innovation and resource allocation.”

How smart city technologies can help

Leading smart cities have policies and strategies that place the individual citizen at the center, improving the quality of life and comfort for users.

Smart city technology and policy innovation can be conveniently grouped in 10 “verticals”, namely:

- energy;

- transport and logistics;

- security;

- public policy and administration;

- medical and health;

- building automation;

- communication services;

- education;

- financial services; and

- tourism and retail.

In many cases, the private sector is already active and offering solutions within or sometimes across verticals. This especially happens in areas where the business case for particular solutions is clear.

However, in other cases, where the business case is less clear, cities have stepped in to create an environment and an infrastructure where private sector companies can profitably participate.

Which cities are front runners?

Many indices have been developed to measure the “smartness” of cities. Examples include IESE Cities in Motion Index (IESE Business School), Innovation Cities Index (2thinknow Global innovation agency), or Smart City Index Master Indicators Survey (Boyd Cohen, Universidad del Desarrollo & Fast Co, ESADE Institute for Public Governance and Management).

All of these Smart City indices (and many others), measure how “ready” or “mature” cities are regarding their status and/or ability to become “smart” in general or with regard to selected vertical industry segments.

To provide a more holistic view, Arthur D. Little has developed a combined index based on existing indices, economic/socio-demographic sources and our expertise from consulting on various smart city projects around the globe.

Below, we highlight 15 selected cities across four maturity stages.

Platform stage: In Arthur D. Little rankings, Nanjing, Barcelona, London, Rio de Janeiro, Seoul, Dubai, Copenhagen and Manchester come out on top in the “Platform” stage. These leading cities follow an integrated approach, enabling service providers to use a common open platform through which services and data can be offered to, and shared with, governmental bodies and businesses, as well as citizens and visitors alike.

Vertical stage: Cities in the “Vertical” stage have launched projects across verticals, including sub-platforms such as mobility- or water- and waste management platforms. The vision to move towards a city-wide platform approach is to a large extent communicated but not yet realized.

Pilot stage: Cities in the “Pilot” phases have launched projects in individual verticals, but a cross-vertical platform approach has not yet been achieved.

Marketing stage: Cities in the “Marketing” phase (such as in Africa and India) have just announced their Smart City visions and strategies.

Our analysis has shown that the leading smart cities share a clear vision, a long-term strategy and strong governance, and a horizontal, open platform to enable the creation of new, cross-vertical business models.

Today’s leading smart cities have not only understood that openness, integration and interoperability will be key ingredients for leading smart cities in the future, but also that revenues will predominantly come from new business models focusing on service enablement and provisioning for its citizens and businesses.

Where are the opportunities for companies?

The total market for smart city vertical applications is huge and attractive. We estimate that the market size in 2015 was close to $1 trillion, and will grow to over $2 trillion by 2020.

Revenue growth is therefore well over 15 per annum, with many verticals growing by over 20 per cent every year.

The four largest verticals in terms of revenues are:

- energy;

- building automation;

- transportation and logistics; and

- financial services.

Together these four sectors make up 70 per cent of the total opportunity.

Below we provide some examples of how telecom operators, utilities and transportation companies can benefit from these growth opportunities.

Telecom operators as a service

Telecommunications operators have started to successfully position themselves within the smart city environment at various levels.

Although not all smart cities have a telco partner – as Stockholm or Vienna have – the underlying infrastructure needs to be in place to offer basic smart city services.

Given the increasing demand for secure and reliable broadband connectivity, telcos will become a key cornerstone for mission-critical smart city applications and infrastructure.

In addition, telcos such as Telefonica and China Comservices (a joint venture between the three Chinese operators) have engaged in a “platform-enabling” play, in which they act as general contractors and extend their services to data aggregation and analysis, operations and even providing their own products and services to smart city stakeholders.

There are three main smart city plays for telcos:

- connectivity;

- infrastructure; and

- platform.

The most obvious proposition that telcos can offer is on the connectivity part is building and operating the networks for the smart city. For example, city Wi-Fi services, fixed and wireless broadband and narrowband networks for the specific vertical use-cases, and so on.

Telcos have the best experience in setting up and maintaining fixed and wireless networks, so this is the most “classical play” for any operator in the smart city context.

However, the overall value generation opportunities are relatively small – around 10-15 per cent value share of the overall smart city ecosystem – and given that telcos usually are not exclusive with regards to networks, the “connectivity play” can be seen as a first step into the smart city market.

An additional service that can be provided by telecom operators includes the planning and management of specific sensor infrastructure. Examples include parking sensors and backhaul, climate and environmental sensors, security camera operations, and so on.

As telecom operators have a very good understanding of network planning according to required bandwidth, latency and criticality, this service offering can be a sustainable differentiator for telecom operators in the infrastructure play.

On the back end, telcos will likely face competition from global ICT players such as IBM, Cisco and Ericsson, resulting in only a small increase in the overall value share of 5-10 per cent.

In the subsequent “platform play”, telcos do not only operate networks and infrastructure, but extend towards smart city IT platforms, enabling data aggregation and analytics for the city to allow for fast and secure operations and immediate triggering of a reaction – alternative routing of public transportation due to congestion, for example.

By entering the platform play, telcos will be able to extend the value share within the eco system beyond 30 per cent and thereby become critical players in the smart city.

Telcos could even extend beyond the “enablement”, bringing own service offerings into the equation.

This could consist of data analytics and monetization solutions, such as providing data to external third parties, as well as subsequent provisioning models.

Although this position requires significant investments in IT systems, the additional value generation is around 10-20 per cent, as data aggregation and analytics opens up the possibility to monetize the information and allow cross-vertical enablement.

In the final stage, a telco could act as the “general contractor” for the city – effectively running and monetizing the overall smart city operations and services.

In this play, telcos would offer own services – either self-developed or sourced – in the name of the city, generating revenues from various different business models.

The city effectively only has to pay for its own benefits, while businesses and citizens would directly pay the telco operator.

The “Smart City as a Service” model effectively can be deployed in cities with limited smart city budgets and can be scaled across various verticals over time.

As the telco is effectively the service provider for the city, the value share within the ecosystem is obviously comparably large – but it will also require significant investments in IT systems, developers and data experts, as well as the likely need to carve out such an organization in order to manage the complexity of such an end-to-end model, including the management of the diverse provisioning models and partnerships required.

Utilities reach beyond traditional business models

Utilities across the world have woken up to the threats and opportunities that arise from “smartization” of day-to-day products and services, ranging from smart appliances to transmission and the distribution grid.

While significant focus revolves around smart grid and smart meters, the most successful utilities have reached beyond their traditional business models to offer wide-ranging and holistic smart services, as convergence from adjacent industries make them vulnerable.

Examples include smart grids, smart meters, vehicle-to-infrastructure connectivity, smart street lighting, and smart home technology. Details are given below.

Smart grids: The smart grid is an electricity network that can intelligently integrate the actions of all users connected to it – generators, consumers and those that do both – in order to efficiently deliver sustainable, economically viable and secure electricity supplies.

The worldwide smart grid market is expected to surpass $400 billion by 2020, with an average compound annual growth rate of over 8 per cent.

Software makers (used to analyzing massive amounts of collected data) are set to benefit the most, hence utilities must partner or reposition themselves to capture this opportunity.

In the Americas, various cities have deployed smart grids, including Austin, Boulder and Ontario.

In the EU, Enel and EdP are leading the smart grid initiative with country-wide implementations. The Dutch Smart Energy Collective has been building city-scale smart grids.

China, South Korea, India and Brazil are planning to spend billions in the deployment of smart grids over the coming years.

Smart meters: A smart meter is a digital meter that records the electric energy consumption in near-real time and communicates the information back to the utility and end-user.

Smart meters allow utilities to adopt differential and innovative tariff schemes and demand-side management initiatives, and drive reductions in operating costs due to the automated process of data collection and integrated data management.

In 2013 the global smart meter market size was estimated at $11 billion and is witnessing rapid growth driven by favorable government initiatives supporting the installation of these devices.

For example, the EU has issued a directive requiring all member states to equip at least 80 per cent of consumers with intelligent metering systems by 2020.

In the US, the Los Angeles Department of Water, Austin Energy, Florida Power & Light and Baltimore Gas & Electric are at the forefront of large smart meter installations.

Vehicle to grid: Large-scale electric vehicle adoption will allow vehicle and grid integration and enable utilities to add energy to the grid during peak demand using reserves stored in connected cars.

At any given time 95 per cent of all cars are parked, and the use of electric vehicles as energy storage could be worth up to $4,000 per year, per car, for utilities.

Utilities can easily draw on their technical competencies in managing networks, knowledge of consumption patterns and relationships with energy customers to position themselves at the center of the e-vehicle ecosystem.

Partnering with automotive and technology companies will be crucial in facing the expected stiff competition.

End users will see advantages come in the form of supplying back to the grid at higher tariff, energy arbitrage by charging vehicles with cheaper energy – for example, at night or with solar – and using the vehicles as a backup solution in case of a blackout.

Nissan has partnered with the Enel Group in a pilot project that will allow grid operators to leverage electric vehicles to manage demand response of the electric power grid. Opel is also testing the usage of its electric vehicles as dynamic buffer storage systems in the power grid.

Smart lighting: Street lighting is a key service provided by public authorities at the local and municipal level.

A smart-lighting system allows remote management and control of individual poles and can be retrofitted to minimize the impact on the streetscape.

Smart lighting systems achieve substantial electricity savings in the range of 50-70 per cent, with an average payback period of 7-10 years due to the higher network efficiencies, as well as LED technology they incorporate.

The system will notify the utilities of which lamps require maintenance and even provide GPS localization.

Further value-added services, such as Wi-Fi, air pollution sensors, remote crowd management, smart parking sensors, and so on, enhance the utility of a smart lighting system.

Philips has installed numerous smart-lighting points in European cities such as Rotterdam, Palancia and Holbaek.

General Electric has completed similar projects with its LightGrid technology in US cities, including San Diego.

Smart home: Several applications are changing the home environment, making it more autonomous as well as allowing users and/or utilities companies to manage energy demand remotely.

End-users enjoy the convenience of a smart home, but for utilities the energy-saving opportunities those devices often provide can also be a threat.

With margins dropping, utilities will need to create value by developing capabilities beyond their traditional business, often through partnerships with companies from other sectors.

By leveraging their relationships with existing customers utilities could provide smart devices and obtain a margin on resale price, as well as gain control of non-vital home appliances to reduce consumption in peak time.

Globally, the smart home market is expected to reach $230 billion by 2020.

The main players are divided into three categories:

- end-to-end;

- platform; and

- device providers.

Utilities can benefit from the implementation of smart devices and networks. For example, through its HomeCare program, British Gas provides customers with optional maintenance and repair of devices.

RWE has partnered with Microsoft and eQ-3 to install central control units that link customers’ appliances.

A Dutch pilot project – PowerMatching City II – involves smart household devices, including electric vehicles, washing machines and heat pumps, that adjust their energy demand depending on the energy availability. For example, a dishwasher would turn itself on when the sun shone brightest on the solar panels. This allows utilities to reduce peak demand.

In order to succeed utilities will have to partner with other companies such as Verbund, Amazon, Philips, LG, Apple and iControl, as well as telecoms operators.

Seamless transportation

Several cities are developing an integrated multimodal solution that aims to introduce a new experience in urban transportation, maximize the usage and efficiency of public transport, reduce private transportation and increase citizen satisfaction.

We are seeing the emergence of integrated mobility platforms launched by public or private transport players or start-ups in different cities with the support and funding of municipalities.

These platforms combine all available types of public and private transport into a single integrated offer/interface, often available through a smartphone app, enabling consumers to plan, book and pay for trips seamlessly.

Examples of integrated mobility platforms include Smile – now rebranded as BeamBeta – in Vienna, the Citymapper start-up in Paris and the integrated mobility platform launched by Dubai.

Billion-dollar opportunities

Smart Cities are the new battleground for convergence across industries.

Companies will need to step outside their comfort zones in order to leverage the billion-dollar opportunities that arise from the ambitions of cities to become smarter and more sustainable, with cross collaboration and creation of effective technology ecosystems being key for success.

For those that are able to step up to the challenge, the rewards are likely to be significant.

Clear vision and long-term strategy

Dubai has a vision to become “the world’s happiest and smartest city by 2017” and set up “Smart Dubai” as a steering and governance body to “empower, deliver and promote an efficient, seamless, safe and impactful city experience for residents and visitors”.

Barcelona has the vision to develop “a city self sufficient, of productive neighborhoods at human speed, inside a hyper-connected metropolis, of high-speed and zero emissions”. In order to realize its vision, Barcelona established a clear governance structure – from the strategic level down to individual projects.

In Nanjing, government entities are driving the majority of initiatives and form partnerships with a limited number of technology specialists. Smart City Nanjing is addressing the use-cases for its citizens through a central communication app between citizens, government and businesses.

Horizontal and open platform

China Comservice provides the city platform for smart city services in Nanjing, which has 8 million inhabitants; 24 million daily messages between government institutions, such as speeding tickets, businesses, including insurance and banking, and citizens are already processed via the platform.

Rio de Janeiro formulated a holistic smart city framework as a basis for its city-wide platform and operating center involving IBM and Oracle. This has already enabled the city to benefit from increased efficiency and reduced costs in various areas.

Barcelona’s smart city program spans a holistically defined platform and ecosystem framework, divided into 10 vertical and horizontal areas, integrating all smart city programs with the objective to break down silos.

City of Vienna smart mobility

The city of Vienna has one of the oldest and longest tram networks in the world. It was established in 1865 and today comprises about 220 km of tracks.

Today, Vienna has the sixth-largest tram network in the world, carrying more than 300 million passengers every year, the fifth-largest underground in the EU, with about 80 km of tracks and 430 million annual passengers, and about 180 million bus passengers per year.

Part of Wiener Stadtwerke (the city corporation), Wiener Linien (Vienna Lines) runs the largest part of the public transit network in the city of Vienna and has around 940 million customers per year.

In 2011 Wiener Stadtwerke developed its smart city concept for the City of Vienna. This consists of five dimensions:

- smart mobility;

- smart energy;

- smart living;

- smart city services; and

- smart business.

The cornerstone of the smart mobility pillar was a modal shift to environmental modes of transport away from private car ownership. One of the key measures was to enable multimodal mobility using digital technologies.

In 2012 Wiener Linien started a project together with the Austrian railway company OEBB and other partners to design and deliver the future of mobility. The project name was “Smile – Simply Mobile”.

Central to the project was the development of a prototype integrated mobility platform with a smartphone app, seen as key for developing future mobility.

Existing mobility platforms such as Octopus in Hong Kong had several disadvantages, which Smile successfully overcame for the first time:

Modes of Transport: Public transport types such as tram, underground and bus are the backbone of inner-city transportation; however, private modes are equally important. Car rental, taxis, car- and bike-sharing, among others, were therefore also integrated into the platform.

Functionality: Smile created a mobility platform that not only informs the traveler about all available means of transport, but also lets the customer book, pay for and use them.

In addition, intermodal journeys are offered. Personalization is key as travelers have a range of drivers when planning a journey, such as speed, convenience, being green or price.

Media: Whereas available mobility platforms / solution providers focused on (offline) payment cards or comparable devices, SMILE was fully online, with no additional paper or devices needed.

After the success of the prototype the platform was further developed under the names “BeamBeta” and now “WienMobil”.

Dubai integrated mobility platform

When it comes to urban mobility, Dubai lags behind other cities as it has one of the highest private car usage ratios globally.

Private motor use has reached 602 vehicles per 1,000 citizens and public transport only represents a 14 per cent share of city transport – in comparison with Hong Kong (55 per cent) or London (34 per cent).

The city decided to invest heavily in its public transport infrastructure to reduce the reliance on private cars and address the growing issues created by the increase in the city population and traffic.

A first step was taken in 2009 with the creation of the Roads and Transport Authority, a single public agency centralizing the supervision, regulation and development of road and transport infrastructure in Dubai.

This was later followed by major investments in public transportation infrastructure, such as metro and tramway lines.

In 2015, the city of Dubai launched a major smart city program – “Smart Dubai” – with the objective of becoming a leader among global smart cities by 2017.

The ambitious program includes multiple initiatives in six vertical segments, with smart mobility being a key one, implemented by each of the major city agencies and supervised centrally by an ad hoc dedicated committee – the Smart Dubai committee.

The most significant initiatives include the launch of a city-wide platform hosting smart services, the launch of major e-government program and a plan to boost ICT maturity of freezones – or “Smart District” certification.

Moreover, the city is hosting the Universal Exposition in 2020 and has been preparing a major transformation program to prepare for the event in connection with the Smart Dubai program.

In order to increase the attractiveness of public transport and offer a new city mobility experience, in 2016 RTA launched an ambitious integrated mobility strategy with the goal of bringing all available transport modes in Dubai onto a single platform: from existing public types – metro, tramway, buses, taxi, and so on – to private modes, such as limousines, private rail lines, e-hail services.

The platform would be accessible through simple app or website interfaces and offer a seamless, end-to-end experience.

For instance, a user can book a trip that includes a metro and taxi ride and easily pay for the entire journey without needing to use cash.

The platform also has the potential to integrate e-hail providers, such as Uber and Lyft, to widen choice.

The first wave of services is expected to be released by early 2017.

This article was contributed by the Arthur D Little consultancy.

About the authors

- Ralf Baron is a Partner in Arthur D. Little’s Frankfurt office. He is the Global Head of the Travel and Transportation Practice.

- Morsi Berguiga is an Associate Director in the Dubai office of Arthur D. Little and expert in smart mobility.

- Jaap Kalkman is a Partner in ADL’s Middle East Office and Global Head of the Energy & Utilities Practice.

- Adnan Merhaba is a Principal in the Dubai office of Arthur D. Little. He is part of the Energy and Utilities Practice and leads the Global Renewable Energy Competence Center.

- Ansgar Schlautmann is Associate Director in the Frankfurt office and Global Head of the Innovative Business Designs Competence Center of Arthur D. Little.

- Karim Taga is a Partner in the Vienna office of Arthur D. Little and Global Head of the

Telecommunications, Information, Media & Electronics (TIME) Practice.