Robotics companies continue to draw significant investor attention as automation spreads across manufacturing, logistics, healthcare, mobility and infrastructure.

After a period of uncertainty in the wider venture market, capital is returning to sectors where engineering depth, technical defensibility and long-term demand are driving renewed confidence.

In response to increasing engagement from readers with financial and investment backgrounds, Robotics & Automation News is expanding its data-driven coverage of the robotics and automation capital landscape.

Over the coming weeks, the site will introduce a new daily R&AN Financial Brief and a weekly funding bulletin, summarising venture rounds, corporate investments and notable transactions across the sector.

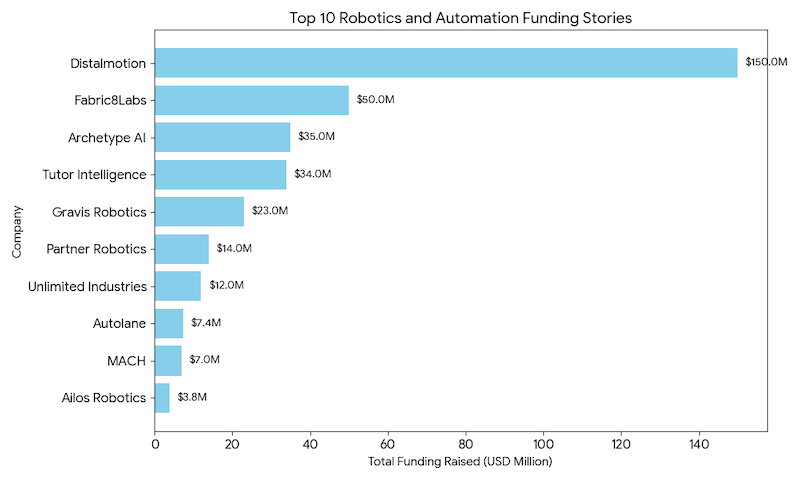

As an introduction, below is a snapshot of 10 recent funding rounds reported on Robotics & Automation News. These examples illustrate the diversity of activity across the industry – from surgical robotics and warehouse automation to advanced manufacturing technologies and physical AI.

Ten recent robotics and automation funding rounds

| Company | Funding amount | Sector / focus | Link to Story |

|---|---|---|---|

| Distalmotion | $150 million | Robotic surgery systems | Link to Story |

| Fabric8Labs | $50 million | Additive manufacturing / metal 3D printing | Link to Story |

| Archetype AI | $35 million | Physical agents / AI robotics | Link to Story |

| Tutor Intelligence | $34 million | Warehouse robotics / AI workers | Link to Story |

| Gravis Robotics | $23 million | Construction robotics / autonomous systems | Link to Story |

| Partner Robotics | $14 million | Social and service robotics | Link to Story |

| Unlimited Industries | $12 million | AI-powered construction technologies | Link to Story |

| Autolane | $7.4 million | Curbside autonomous vehicle OS | Link to Story |

| MACH | $7 million | Off-road autonomy / robotics software | Link to Story |

| AILOS Robotics | €3.5 million (~$3.78M) | High-torque lightweight gearboxes for robots | Link to Story |

As a list

- Distalmotion — $150 million

- Fabric8Labs — $50 million

- Archetype AI — $35 million

- Tutor Intelligence — $34 million

- Gravis Robotics — $23 million

- Partner Robotics — $14 million

- Unlimited Industries — $12 million

- Autolane — $7.4 million

- MACH — $7 million

- Ailos Robotics — €3.5 (approximately $3.78 million)

As a bar chart

Highlights at a glance

Although this set of 10 is not exhaustive, the distribution of funding volumes offers a useful indication of where capital is concentrating today.

Medical and healthcare robotics remain strong, as demonstrated by Distalmotion’s $150 million raise to accelerate adoption of its Dexter surgical platform. Large, late-stage investments in clinical and regulated technologies continue to stand out.

Physical AI – the convergence of large-scale machine learning models with robotics hardware – is also gaining traction. Dyna Robotics’ $120 million round reflects investor interest in foundational technologies that aim to bridge perception, decision-making and physical execution in real-world environments.

Advanced manufacturing platforms, including 3D printing and industrialised hardware systems, continue to see regular investment. Carbon’s $60 million round highlights consistent demand for tools that shorten production cycles and enable more flexible supply chains.

Meanwhile, early- and mid-stage companies working in warehouse automation, construction robotics, and infrastructure inspection are attracting meaningful – though more modest – funding. These include Tutor Intelligence ($34 million), Gravis Robotics ($23 million) and Unlimited Industries ($12 million).

While smaller in absolute terms, these rounds underline sustained interest in automation solutions that address labour shortages and operational bottlenecks across logistics, construction and industrial services.

Even at the lower end of the funding spectrum, companies such as Autolane ($7.4 million) and AILOS Robotics (€3.5 million) demonstrate continued support for specialised technologies, including curbside autonomous vehicle systems and advanced gearbox development for humanoids and collaborative robots.

Why this matters for the broader robotics market

Funding velocity is a leading indicator of both technological momentum and commercial confidence. While the macroeconomic environment remains mixed, the robotics sector continues to attract investment for several reasons:

- Structural labour shortages in manufacturing, logistics, healthcare and construction are driving long-term demand for automation.

- Generational shifts in hardware capabilities – from high-performance actuators to low-cost sensing and increasingly capable onboard AI – are enabling new product categories.

- Improving economics for robotics-as-a-service (RaaS) and subscription-based industrial tools are creating investable business models.

- Interest in ‘physical AI’ is accelerating, particularly where machine-learning systems are paired with reliable mechanical execution.

These conditions support a wide range of investment sizes, from multi-hundred-million-dollar rounds in specialised medical technologies to single-digit raises that help early-stage companies scale prototypes into deployable products.

Introducing the new R&AN financial coverage

To help readers follow these developments more efficiently, Robotics & Automation News will soon launch two new regular features:

- R&AN Financial Brief (Daily): A concise summary of funding rounds, financial statements, capital movements and market developments relevant to the robotics and automation sector.

- R&AN Funding Bulletin (Weekly): A structured review of the most significant transactions, supported by charts, tables and short analytical commentary.

These updates are designed to serve both engineers who want to understand the commercial trajectory of the technologies they develop or deploy, and the growing number of investors and analysts following the automation landscape.

Robotics & Automation News aims to provide clear, factual, and accessible reporting that captures the pace and direction of investment across the sector.

Investors in robotics, automation and AI startups in 2025

Below is a sample list of venture capital firms that have been active in robotics and automation over the past year.

This selection illustrates the range of investors participating in the sector – from large global funds to specialist deep-tech firms – and highlights the diversity of financial organisations backing robotics companies today.

It is not intended to be exhaustive, but rather to provide an initial view of the investor landscape as we prepare more detailed analysis for the forthcoming R&AN funding bulletin.

| Investor | Country | Recent Robotics Investments | Deal Dates | AUM |

|---|---|---|---|---|

| Sequoia Capital | USA | Autonomous systems, AI robotics platforms | 2023–2025 | $56B |

| Lightspeed Venture Partners | USA | Industrial automation, AI infrastructure | 2023–2025 | $35B |

| Andreessen Horowitz (a16z) | USA | AI robotics, humanoids, automation software | 2023–2025 | $45B |

| Founders Fund | USA | Drones, logistics robots | 2023–2025 | $17B |

| Khosla Ventures | USA | Deep-tech robotics, autonomy, materials automation | 2023–2025 | $15B |

| DCM Ventures | USA / Japan / China | Industrial automation, robotics SaaS | 2023–2025 | $4.5B |

| Redalpine | Switzerland | Robotics infrastructure, deep-tech hardware startups | 2023–2025 | $1B+ |

| BMW i Ventures | USA / Germany | Manufacturing automation, supply-chain robotics | 2023–2025 | $800M |

| IQ Capital | UK | Physical AI, robotics control systems | 2023–2025 | $500M |

| Capnamic Ventures | Germany | Industrial automation and logistics robotics | 2023–2025 | $380M |

Funding spectrum

Robotics funding continues to demonstrate resilience and momentum, even as broader market conditions remain uneven. Capital is flowing into a wide spectrum of technologies – from surgical systems and physical AI platforms to logistics automation, construction robotics and next-generation components.

The companies featured above represent only a fraction of the activity taking place each month, but they provide a clear indication of the strategic priorities shaping the sector.

As Robotics & Automation News expands its financial coverage, our goal is to offer readers a clearer, more structured view of where investment is coming from, where it is going and what it signals about the future of automation.

The upcoming R&AN Financial Brief and R&AN Funding Bulletin will build on this foundation by delivering timely, data-driven updates to help engineers, investors and industry leaders navigate the fast-evolving robotics landscape.