Wayve, a specialist in embodied AI for autonomous driving, could be in line to raise as much as $2 billion in its next funding round, according to some observers.

The company recently announced it has signed a letter of intent with Nvidia to evaluate a $500 million strategic investment in Wayve’s next funding round.

This investment builds on Nvidia’s participation in Wayve’s Series C funding round and fuels the company’s continued growth. It also reflects the companies’ shared vision to bring safe, scalable, and production-ready autonomous driving technology to market.

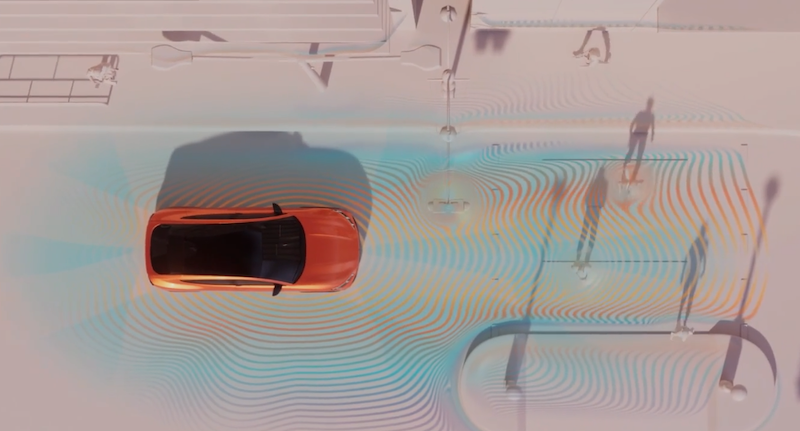

Wayve’s foundation model approach, combined with Nvidia’s automotive-grade accelerated computing platforms, equips automakers with the advanced AI and hardware needed to deliver next-generation mobility solutions on a global scale.

Wayve and Nvidia have collaborated since 2018, with each generation of Wayve’s robot platforms accelerated by Nvidia technology. The upcoming Wayve Gen 3 platform will be built on Nvidia Drive AGX Thor.

Nvidia Drive AGX Thor is accelerated by Nvidia Blackwell GPU architecture and runs the safety-certified Nvidia DriveOS, leveraging the Nvidia Halos comprehensive safety system.

The Wayve Gen 3 platform will push the frontier of embodied AI, advancing the Wayve AI Driver toward eyes-off (Level 3) and driverless (Level 4) capabilities across urban and highway domains.

Alex Kendall, co-founder and CEO of Wayve, says: “Continued support from a global technology leader like Nvidia underscores confidence in our AV2.0 approach to building embodied AI and its potential to transform the future of mobility.”

Observer statement

Ashish Patel, a managing director in Houlihan Lokey’s Capital Solutions Group, says he believes Wayve could raise as much as $2 billion in its next funding round.

Patel says: “We continue to see strong investor demand for AI companies, particularly those in the ‘application layer’ which are critical to unlock the real-world transformative potential of this technology.

“In addition to self-driving cars, across Europe there is interest in technologies that enable rapid software development (Lovable, raised $228 million), more efficient healthcare support (Tandem, $50 million+ raised), defence (Tekever, around $100 million raised), and so on.

“We’re seeing investors lean into companies that can demonstrate meaningful traction, technical prowess, and a global market of customers.

“Companies like Wayve prove out the thesis that globally impactful businesses can be built in Europe, and that the AI-enablement of society is not purely a US-based endeavour.

“Global investors take note of this, and many of the fundraises we see happening across Europe including a mix of US, Middle Eastern & Asian investors, alongside an increasingly well-built European growth equity ecosystem.

“An interesting phenomenon has been the emergence of large US-based corporations with existing AI infrastructure investments deploying capital into Application Layer companies.

“This has multi-fold benefit – the companies gain access to insights, and in some cases early technology releases, which can help to drive a competitive advantage.

“Simultaneously, the Corporate investor is able to further embed their core technology, allowing them to capture more of the value chain.

“We see that financial investors view these kinds of syndicate partners very favourably, treating selective investment by well-informed corporate investors as partial validation of a potential company, often in noisy markets where true technical expertise is required to find breakout businesses.”