China now has more industrial robots than the rest of the world put together, but that headline tells only part of the story. The bigger narrative is the fierce internal competition between global giants and local robot-making startups.

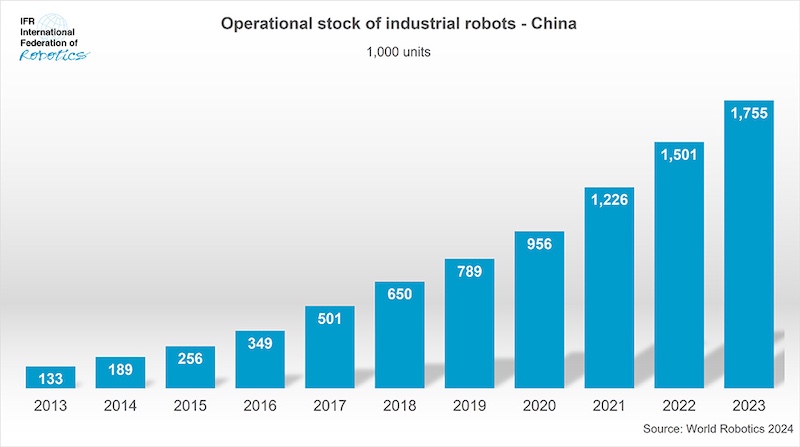

A new report from the International Federation of Robotics delivered a seismic fact: China now operates more industrial robots than the rest of the world combined.

This isn’t just a statistical milestone; it’s the culmination of a decade-long gold rush that has reshaped the global automation industry.

The narrative, however, extends far beyond a simple headline. It’s a story of a fiercely competitive internal market where global titans and ambitious local champions are vying for a piece of an immense financial prize.

To understand the stakes, consider the numbers. In 2023 alone, China installed approximately 290,000 industrial robots. The value of this single year’s influx is immense.

Industrial robotic arms span a wide cost range, from around $10,000 for simpler models to over $100,000 for highly specialized, heavy-payload systems.

Using a conservative average estimate of $50,000 per unit, the 2023 market for new robots in China was worth a staggering $14.5 billion.

This annual multi-billion-dollar arena is the stage upon which a complex battle for technological and market supremacy is being fought, a battle that began in earnest over a decade ago.

Foreign giants cement their presence

For decades, the industrial robotics industry was dominated by a powerful quartet: Japan’s Fanuc and Yaskawa, Switzerland-Sweden’s ABB, and Germany’s Kuka.

As China’s manufacturing sector began its explosive growth, these giants recognized an unprecedented opportunity. They didn’t just want to export to China; they needed to become Chinese.

Over the past 10 to 15 years, they embarked on a massive localization campaign, building state-of-the-art production facilities, extensive R&D centers, and robust sales networks directly on Chinese soil.

- ABB invested $150 million in a sprawling, automated robotics factory in Shanghai, its most advanced globally.

- Fanuc and Yaskawa established massive manufacturing and engineering hubs, tailoring their robots to the specific demands of Chinese factories.

- Kuka expanded its production capacity in Guangdong, becoming a deeply embedded player in the region’s manufacturing ecosystem.

This “in China, for China” strategy was a masterstroke. It allowed them to bypass import tariffs, reduce production costs, and respond with agility to local customer needs.

For years, they enjoyed near-total dominance, with Chinese domestic brands holding a negligible market share. They built an unassailable reputation for superior precision, 24/7 reliability, and advanced software, justifying their premium price tags in critical sectors like automotive manufacturing.

The Kuka acquisition was a turning point

The landscape shifted irrevocably in 2017 with a single, landmark deal: the €4.5 billion acquisition of Kuka by the Chinese home appliance giant, Midea. The move sent shockwaves through the industry.

It wasn’t just a corporate purchase; it was a strategic masterstroke that provided China with a flagship, globally recognized robotics brand and, crucially, its deep-seated intellectual property overnight.

The Kuka acquisition had an immediate and dramatic impact on market share statistics. Overnight, Kuka’s substantial slice of the Chinese market – typically around 10-15 percent – was transferred from the “foreign” column to the “Chinese” column.

This single move single-handedly propelled the reported share of Chinese-owned robotics companies into the double digits.

More importantly, it served as a clarion call. It demonstrated the strategic importance Beijing placed on robotics and ignited a surge of investment and ambition in domestic players.

Companies like Siasun, often seen as a national champion with strong state backing, began focusing on comprehensive, heavy-duty automation solutions.

Meanwhile, Estun Automation took a more agile, market-driven approach, developing a broad portfolio of cost-effective robots aimed at the vast small and medium-sized enterprise market.

Bolstered by government initiatives like “Made in China 2025”, which provided subsidies and purchasing incentives, these local manufacturers began their relentless climb.

A stratified and fiercely competitive market

Today, the Chinese robotic arm market is a stratified and intensely competitive arena. The balance of power is in flux. While foreign giants still command a significant majority of the market’s value, the momentum has decisively shifted.

Industry analyses, including those from the IFR, indicate that Chinese robot makers are now responsible for over a third of all units shipped domestically.

Their shipment growth has consistently dwarfed that of foreign firms, signaling a profound change in the market’s structure. This has created a clear market segmentation:

The high-end fortress

Fanuc, ABB, and Yaskawa continue to thrive by defending the premium segment. Their robots, often 20-50 percent more expensive than Chinese equivalents, remain the default choice for applications where failure is not an option.

Their unparalleled reliability and precision keep them firmly entrenched in the automotive, aerospace, and advanced electronics industries.

The value-driven heartland

This is where Chinese companies like Estun, Siasun, and Efort are winning. They compete aggressively on price, often undercutting foreign brands by 20-30 percent.

Their key advantages are hyper-responsive local service, a willingness to customize, and a deep understanding of the needs of mid-tier manufacturers. They have captured the volume-driven mid-range segment, which forms the bulk of new unit sales.

Future prospects: Coexistence or conquest?

What does the future hold? The trajectory suggests the shipment share of Chinese-branded robots will continue its upward climb, potentially surpassing 50 percent of domestic unit sales in the next few years.

The Chinese manufacturers are innovating rapidly, moving beyond simple imitation to develop competitive collaborative robots and AI-enhanced vision systems.

However, predictions of the total demise of foreign players would not be realistic – they’ve been in the business a long time and are strong enough to compete. The most probable scenario is one of coexistence and continued stratification.

The foreign giants may continue to entrench themselves into the most demanding, high-margin applications where their technological lead is most pronounced. They will continue to leverage their global brands and deep R&D pockets.

Meanwhile, Chinese companies will probably solidify their hold on the domestic mass market. The ultimate question is no longer if they can compete at home, but when they will be ready to challenge the global establishment on the world stage.

For now, the most intense robot war is still being waged inside China, and its outcome will ultimately redefine the balance of power in global manufacturing for decades to come.

Main image courtesy of Efort Robotics China