Top Ten Ways AI Will Benefit Your Business

January 31, 2024

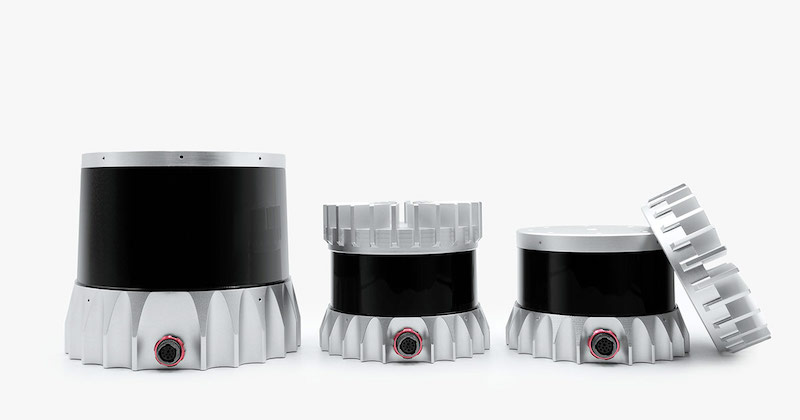

Merger of Velodyne and Ouster creates $550 million lidar giant

February 13, 2023

The Core Concepts of Successful Online Stock Investing

February 3, 2023

5 Reasons Why You Should Invest in Tesla this 2023

February 2, 2023

5 most popular DeFi coins and how to invest in them

January 23, 2023

Why China launched the digital yuan in the first place

January 17, 2023

Why Include Cryptocurrencies in Your Investment Portfolio?

December 5, 2022