Smart-contract platforms like Ethereum have transformed blockchain from simple transactions to programmable finance, powering DeFi, NFTs, and decentralized apps.

Adding assets like ETH to your portfolio offers exposure to this innovation, and for those looking to buy Ethereum, this means direct access to scalability upgrades and real-world adoption.

In 2025’s evolving digital economy, these assets promise growth through scalability upgrades and real-world adoption. But volatility remains high, with 5-10% swings common.

This article outlines key factors to weigh before investing in smart-contract tokens, helping you balance opportunity and risk.

Network Fundamentals and Scalability

Smart-contract assets thrive on network strength. Ethereum’s proof-of-stake shift cut energy use 99%, with layer-2 solutions like Arbitrum pushing 100,000 TPS. Upgrades like Pectra enhance efficiency, supporting $51.9 billion DeFi TVL.

Scalability is crucial. Congestion during peaks raises fees, deterring users. Platforms addressing this, like Ethereum’s rollups, attract developers – 3,000+ active on Cardano alone.

Check adoption metrics. Active addresses, TVL growth, and transaction volume signal health. Ethereum’s 120 million ETH supply and 65% staking participation show maturity.

Utility and Real-World Adoption

Utility drives long-term value. Ethereum powers lending (Aave), stablecoins (USDT), and NFTs, with $3.2 billion XRPL DeFi TVL. Partnerships like Ethiopia’s digital IDs add economic activity.

Real-world use matters. Tokenized assets on blockchain hit $10 billion, with institutions exploring RWAs. This ties price to tangible growth, reducing speculation.

Assess ecosystem. Developer activity (3,000+ on Ethereum) and partnerships forecast adoption. Strong utility cushions volatility.

Risks: Volatility, Regulation, and Competition

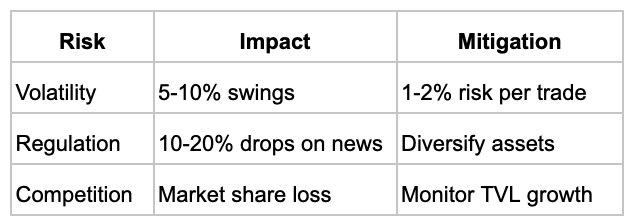

Volatility is inherent. ETH’s 5-10% swings demand discipline – 80% of traders lose chasing highs. Leverage amplifies this; use 3x-5x max.

Regulation looms. SEC scrutiny on staking yields or ETF delays can trigger 10-20% drops. Clarity boosts confidence, as seen in 2024 approvals.

Competition challenges dominance. Solana’s speed or Cardano’s governance draw users. Ethereum’s 60% DeFi share holds, but erosion risks value.

Investor Behavior and Market Sentiment

Sentiment drives short-term moves. Fear & Greed at 26 signals caution, with 60% favoring defensives. On-chain: 70% long-term holders show conviction.

Institutional inflows matter. $13 billion ETF volume reflects confidence, cushioning dips. Retail’s 4.5 million wallets add liquidity but FOMO.

Copy trading helps. Mirror pros with 80% win rates on catalysts, automating buys at support. Choose low-drawdown (under 10%) for safety.

Conclusion

Adding smart-contract assets like ETH offers exposure to DeFi’s $51.9 billion TVL and scalable innovation, with 25% YTD gains signaling potential. But volatility, regulation, and competition demand caution – 80% lose without strategy.

Allocate 5-10%, use 3x leverage, and cap risk at 1-2%. Monitor upgrades and TVL. Copy trading aligns you with pros’ timing. In 2025’s blockchain shift, these assets reward research – balance utility with discipline for resilient growth.