Industrial automation and robotics specialist Dürr has reported a sharp improvement in profitability for the third quarter of 2025, signalling a potential turnaround after a challenging period marked by weak order intake and restructuring.

The German engineering group said EBIT before extraordinary effects rose 40 percent year-on-year to €69 million, delivering a margin of 6.6 percent for the quarter.

Across the first nine months, the margin increased to 4.9 percent, putting the company “on track to perform better in 2025 than in the previous year”.

Sales in the first nine months dipped slightly to €3.05 billion, down 3 percent, but Dürr expects a stronger fourth quarter and confirmed its full-year sales target of €4.2-€4.6 billion.

Order intake remained subdued, falling 29 percent to €2.65 billion, which the company attributed to investment uncertainty caused by tariff disputes and wider macroeconomic pressures.

Dr Jochen Weyrauch, Dürr CEO, says: “We see good prospects for high order intake in the fourth quarter, provided there are no delays in contract awards. From today’s perspective, we are confident.”

Weyrauch highlighted the “solid free cash flow” of €85.0 million in the first nine months: “We are operating in a volatile economic and political environment. In this situation, our ability to generate free cash flow is a key resilience factor.”

Dürr has now completed the streamlining of the group with the sale of its environmental technology business at the end of October.

The divestment is expected to generate €290-€310 million in gross proceeds and reduce net financial debt from €482 million at the end of September to around €250-€300 million by year-end.

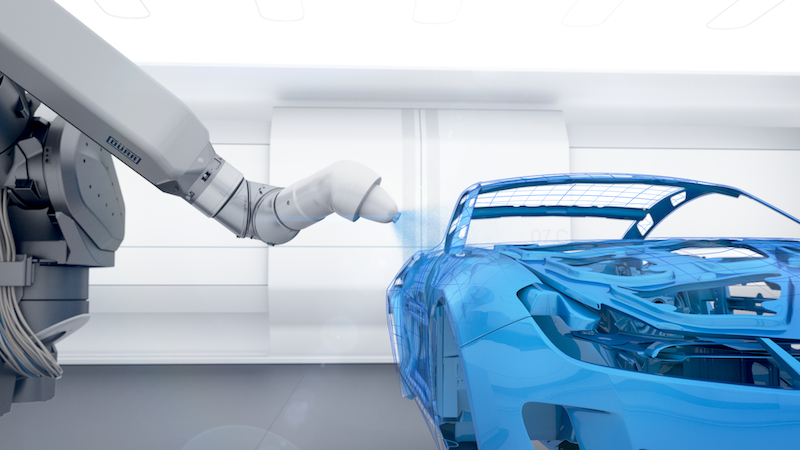

Under its “Sustainable.Automation” strategy, Dürr says it is now fully focused on its three remaining divisions: Industrial Automation, Automotive Paint & Final Assembly, and Woodworking.

Dürr CFO Dietmar Heinrich says the earnings improvement reflects efficiency gains and better margin quality in the order backlog.

“We were able to increase earnings despite the slight decline in sales and the challenging environment,” says Heinrich. “In doing so, we benefited from cost reductions, efficient order execution, and our value-before-volume strategy in sales. The upturn in the service business has also had a positive impact recently.”