Global banking is at a turning point. As payment volumes grow, digital channels expand, and financial crime becomes more sophisticated, traditional transaction monitoring systems are being pushed beyond their limits.

Rule-based engines – once the backbone of fraud detection and compliance – are struggling with false positives, delayed responses, and an inability to adapt quickly to new threats.

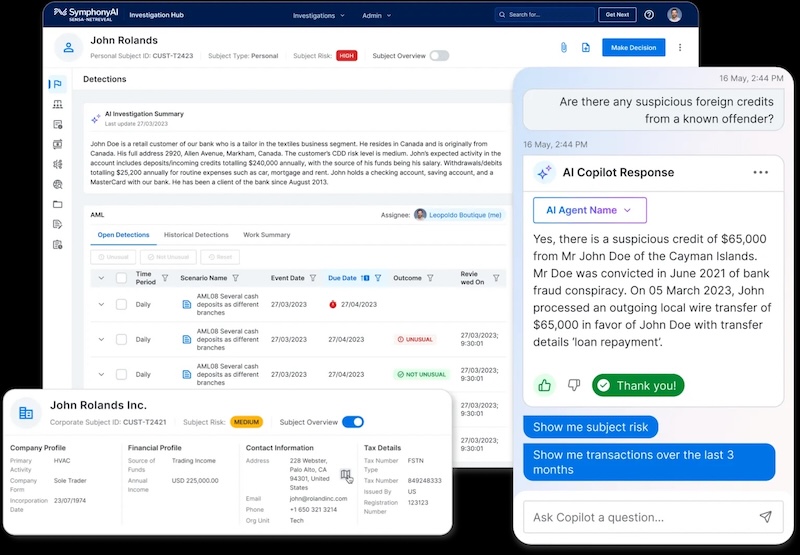

Artificial intelligence (AI) is reshaping this landscape. AI-driven transaction monitoring is no longer a theoretical upgrade; it is fast becoming a foundational capability for banks seeking to manage fraud and risk effectively in a complex, real-time financial ecosystem.

By learning patterns, adapting to change, and operating at scale, AI is redefining how global banks protect customers, meet regulatory expectations, and maintain trust.

Why Traditional Transaction Monitoring Is Falling Short

For decades, banks have relied on static rules to flag suspicious transactions. These systems work by applying predefined thresholds – transaction size, frequency, geography, or counterparties – to identify potential risk. While straightforward, this approach has several structural weaknesses.

The False Positive Problem

Rule-based systems tend to err on the side of caution, generating large volumes of alerts. Compliance teams must manually review many transactions that ultimately prove legitimate. This not only increases operational costs but also slows response times to genuine threats.

Limited Adaptability

Financial crime evolves quickly. Fraudsters constantly test system boundaries, exploit new payment methods, and take advantage of global inconsistencies in regulation. Static rules require frequent manual updates, leaving banks perpetually one step behind.

Fragmented Risk Visibility

Traditional monitoring tools often operate in silos, focusing on individual transactions rather than holistic customer behavior. This makes it difficult to detect subtle, multi-stage schemes such as money laundering networks or account takeover campaigns.

These challenges have driven banks to look for more adaptive, intelligent solutions.

What Makes AI-Driven Transaction Monitoring Different

AI-powered systems approach transaction monitoring from a fundamentally different perspective. Instead of relying solely on fixed rules, they analyze large volumes of data to learn what “normal” behavior looks like – and identify deviations in real time.

Machine Learning and Behavioral Analysis

Machine learning models examine historical transaction data to understand customer behavior patterns. This includes spending habits, transaction timing, geolocation trends, device usage, and peer comparisons. When behavior deviates meaningfully from established norms, the system can flag it for review.

Importantly, these models improve over time. As investigators resolve alerts, the system learns from outcomes, refining its risk assessments and reducing unnecessary flags.

Real-Time Decision-Making

AI-driven monitoring operates at machine speed. Transactions can be assessed as they occur, enabling banks to block, challenge, or escalate suspicious activity before funds leave the system. This is particularly critical for instant payments and cross-border transfers, where delays can mean irreversible losses.

Contextual Risk Scoring

Rather than producing binary “suspicious or not” outcomes, AI systems assign dynamic risk scores based on multiple variables. This allows compliance teams to prioritize the highest-risk cases and allocate resources more effectively.

Strengthening AML and KYC Through AI

Transaction monitoring does not exist in isolation. It is a core pillar of broader anti-money laundering (AML) and know-your-customer (KYC) frameworks. AI enhances these processes by connecting identity, behavior, and transaction data into a unified risk view.

Modern banks increasingly evaluate solutions alongside other compliance technologies, including customer due diligence platforms and onboarding tools. As a result, institutions often look for integrated ecosystems that combine monitoring, screening, and identity verification – frequently benchmarking providers regarded as the best AML KYC software to ensure consistency and scalability across compliance operations.

By aligning transaction monitoring with AI-driven AML and KYC capabilities, banks gain a more accurate understanding of customer risk over the entire lifecycle.

Regulatory Expectations and Industry Alignment

Regulators around the world are not only accepting AI-driven monitoring – they are increasingly expecting it. Supervisory bodies in major financial centers emphasize risk-based approaches, continuous monitoring, and explainability in compliance programs.

Transparency and Explainability

One concern often raised about AI is the “black box” problem. In response, modern transaction monitoring solutions prioritize explainable AI, where risk decisions can be traced back to contributing factors. This transparency is essential for regulatory audits, internal governance, and customer trust.

Alignment With Global Standards

International bodies such as the Financial Action Task Force (FATF) encourage the use of advanced analytics to combat financial crime more effectively. While they do not mandate specific technologies, there is a broad consensus that AI, when properly governed, enhances the effectiveness of AML and fraud programs.

Banks that proactively adopt AI-driven monitoring are often better positioned during regulatory examinations, as they can demonstrate continuous improvement and proactive risk management.

Operational Benefits Beyond Compliance

While compliance is a primary driver, AI-driven transaction monitoring delivers value across the organization.

Reduced Costs and Improved Efficiency

By lowering false positives, AI reduces manual review workloads. Compliance teams can focus on complex investigations rather than routine alerts, improving both morale and productivity.

Enhanced Customer Experience

Fewer unnecessary transaction blocks and account freezes mean less friction for legitimate customers. When interventions are required, they are more targeted and timely, preserving trust while maintaining security.

Strategic Risk Insights

AI systems generate rich analytics that help banks understand emerging risks, customer trends, and operational vulnerabilities. These insights inform broader risk strategies, product design, and market expansion decisions.

Challenges and Responsible Implementation

Despite its advantages, AI-driven transaction monitoring is not a plug-and-play solution. Successful adoption requires careful planning and governance.

AI models are only as good as the data they consume. Banks must invest in clean, well-integrated data sources across channels, regions, and legacy systems.

Unchecked algorithms can inadvertently reinforce bias or unfair treatment. Leading institutions establish oversight frameworks, regular model validation, and cross-functional review to ensure fairness and accountability.

AI augments, rather than replaces, human judgment. Skilled compliance professionals remain critical for complex investigations, regulatory interpretation, and strategic decision-making.

Conclusion

AI-driven transaction monitoring represents a shift from reactive compliance to proactive risk intelligence. As financial crime grows more complex and regulators demand higher standards, banks can no longer rely on outdated tools.

The future points toward adaptive systems that learn continuously, operate in real time, and integrate seamlessly with broader compliance and risk frameworks. Institutions that invest early – not just in technology, but in governance, talent, and data – will be better equipped to protect customers, meet regulatory expectations, and compete in a digital-first global economy.

In this sense, AI is not simply improving transaction monitoring; it is redefining the very foundation of fraud and risk management in modern banking.