Drones, crawlers, quadrupeds, and submersibles for inspecting bridges, pipelines, wind turbines, and more

Modern society relies on infrastructure that is both aging and mission-critical. Bridges, pipelines, refineries, power plants, and offshore wind turbines require constant inspection to ensure safety and reliability.

Yet traditional inspection is risky, expensive, and often disruptive. Workers climb tall stacks, enter confined tanks, or dive into murky waters. Outages are scheduled, scaffolding erected, and safety crews deployed – all before a single defect is recorded.

Enter inspection and maintenance robots. Equipped with advanced sensors, artificial intelligence, and mobility systems, these machines are beginning to handle the dirty and dangerous jobs, collecting high-quality data at a fraction of the risk and cost.

From drones buzzing around turbine blades to submersible robots crawling across subsea pipelines, the market is expanding rapidly.

Analysts estimate the global inspection robots sector is already worth several billion dollars and growing at double-digit rates into the 2030s.

The four modalities of inspection robotics

1. Aerial drones

Unmanned aerial systems (UAS) have become the most visible of the inspection technologies. Companies deploy them to survey wind turbine blades, bridge decks, power lines, and tank farms.

High-resolution optical zoom, LiDAR, and thermal cameras capture defects invisible to the human eye.

The advantages are clear: speed, accessibility, and reduced downtime. A drone can cover a bridge span in hours instead of days, with no need for lane closures or suspended platforms.

Limitations remain – strong winds, payload restrictions, and flight regulations – but autonomy is advancing rapidly, reducing the need for skilled pilots.

2. Ground and crawler robots

In-pipe crawlers and magnetic crawlers provide access to places where humans cannot safely go: boiler interiors, refinery piping, sewers, and culverts.

Many are equipped with non-destructive testing (NDT) tools such as ultrasonic transducers, eddy current sensors, or radiography equipment.

The benefit is close-range inspection without taking assets offline for extended periods. Crawler robots can detect corrosion, pitting, or cracks deep inside infrastructure where visual inspection is impossible.

3. Quadrupeds and climbing robots

This is where robotics has made a particularly striking leap. Quadruped robots – four-legged, animal-like machines – are now being deployed at oil and gas facilities and petrochemical plants.

Swiss company ANYbotics is at the forefront with its ANYmal quadruped, which autonomously roams rigs and refineries.

Equipped with thermal, acoustic, and gas sensors, ANYmal performs routine inspection rounds, listening for leaks, checking gauge readings, and monitoring equipment hotspots.

Its ability to navigate stairs, grated walkways, and tight corridors makes it ideal for hazardous industrial sites where human entry is costly and dangerous.

Alongside quadrupeds, wall-climbing robots using magnets, suction, or vacuum systems can scale ship hulls, storage tanks, and bridge pylons. By carrying NDT payloads, they provide stable, close-contact data collection on vertical or inverted surfaces.

4. Subsea ROVs and AUVs

In offshore environments, remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) are indispensable.

They inspect subsea pipelines, risers, wellheads, and turbine foundations. High-definition video, sonar mapping, and cathodic protection probes provide asset owners with detailed integrity data.

These machines reduce the need for divers in dangerous currents or deep water. Subsea inspection, maintenance, and repair (IMR) has long been a major expense for oil and gas; robotic systems now provide safer and cheaper alternatives, with growing use in offshore wind as well.

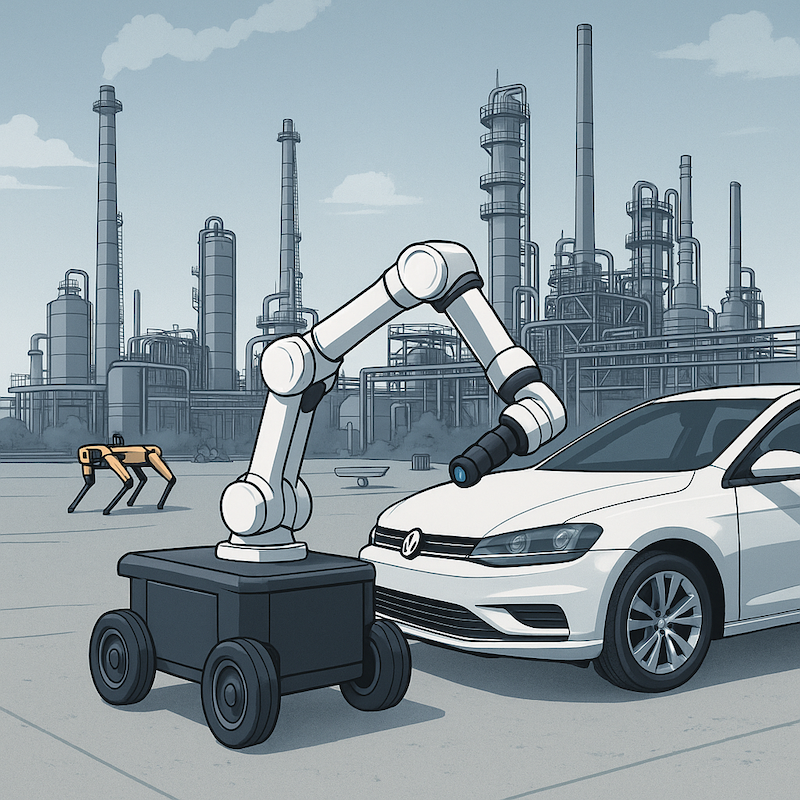

5. Factory inspection robots

While much attention goes to robots that reach dangerous or remote places, inspection inside factories is equally critical. Here the challenge is not access but scale and precision.

On modern production lines, collaborative robots (cobots) fitted with high-resolution cameras, 3D vision, and force-feedback sensors are integrated directly into quality-control stations. They inspect weld seams on vehicles, check electronics assembly, or run durability tests on consumer appliances.

Universal Robots, among others, supplies cobots that perform end-of-line checks with consistency and repeatability, catching defects that human inspectors might miss.

These systems combine the stability of fixed inspection cells with the flexibility of collaborative automation, allowing manufacturers to adapt quickly to new product variants.

The result is fewer defects escaping into the field, higher product reliability, and a smoother link between manufacturing quality control and broader predictive-maintenance strategies.

From data capture to actionable insights

Inspection robots are not valuable only for their ability to reach difficult places. The real transformation lies in data.

Captured imagery and sensor readings are uploaded into analytics platforms, often powered by AI. Algorithms detect cracks, corrosion, or delamination, flag anomalies, and generate defect reports.

Digital twins – virtual models of assets – are updated with inspection data, allowing operators to track degradation over time and predict when interventions are required.

This shift from reactive to predictive maintenance is the key economic driver: better data reduces unplanned outages, extends asset life, and improves safety compliance.

Safety, compliance, and regulations

Robots directly reduce human exposure to the three highest-risk categories in inspection: working at height, confined spaces, and underwater operations.

For aerial drones, regulatory approval – particularly for beyond visual line of sight (BVLOS) flights – is still evolving.

In subsea and petrochemical environments, inspection data must align with non-destructive testing standards and be validated for compliance.

Insurers and regulators are beginning to recognize robotic inspection reports as valid evidence, a step that further accelerates adoption.

Economics and return on investment

The economic argument is straightforward. Consider a refinery tank inspection. Traditionally, scaffolding is erected, workers enter the confined space, and operations are halted for days.

With a crawler or confined-space drone, inspection can be completed in hours with minimal disruption.

Similar gains apply in wind energy, where turbine downtime translates directly to lost megawatt-hours. Drones can scan blades quickly, detect hairline cracks or lightning strikes, and feed data directly into repair scheduling systems.

Robotic inspections are available as capital purchases, leasing models, or “robotics-as-a-service”, lowering barriers to entry for asset owners.

Companies to watch

A number of players are carving out niches across the modalities:

- Skydio – US-based autonomous drones for utility and infrastructure inspection.

- DJI Enterprise – global leader in industrial UAVs, with the Matrice series widely used for bridges and power lines.

- Flyability – ELiOS drones designed for confined spaces like tanks and boilers, using protective cages for collision tolerance.

- Percepto – drone-in-a-box systems enabling continuous autonomous site monitoring.

- Voliro – tilt-rotor drones that can make physical contact for ultrasonic thickness measurements.

- Gecko Robotics – wall-climbing inspection robots performing rapid ultrasonic mapping of corrosion in industrial assets.

- ANYbotics – developer of the ANYmal quadruped, already deployed at oil and gas rigs and petrochemical plants.

- Invert Robotics – suction-based climbers for food, pharma, and energy tank inspections.

- Eddyfi / Inuktun – modular crawler systems combined with advanced NDT technology.

- Oceaneering / Saab Seaeye – long-established providers of subsea ROVs for offshore inspection and maintenance.

- Cyberhawk – inspection-as-a-service firm with strong analytics and reporting platforms.

Case studies

Wind turbine inspections

In the wind sector, drones are now a routine part of maintenance. Operators have cut blade inspection times from days to hours, detecting early-stage erosion or lightning damage before catastrophic failure.

Some companies run quarterly drone surveys, feeding results into digital twin systems to model degradation trends.

Petrochemical plants with ANYmal

At petrochemical facilities, the ANYmal quadruped has been deployed to patrol hazardous areas. It records acoustic profiles of pumps and compressors, monitors for gas leaks, and thermal-scans pressure vessels.

These routine tasks free up human inspectors and reduce exposure to toxic or flammable environments.

Plant operators report not only improved safety but also improved data consistency, as robots perform the same route with high repeatability.

Offshore subsea inspection

ROVs have long been used in oil and gas, but their application in offshore wind is expanding. Autonomous subsea robots now inspect turbine foundations, scour protection, and inter-array cables, reducing the need for divers and expensive vessel time.

Market outlook

Forecasts for inspection robotics vary depending on scope, but the direction is clear: rapid growth.

- Maximize Market Research projects $1.8 billion in 2024 rising to $10.1 billion in 2032, a compound annual growth rate of around 24 percent.

- Global Market Insights estimates $2.8 billion in 2024 with ~14 percent CAGR through 2034.

- ResearchAndMarkets sees $6.7 billion in 2025 expanding to $12.4 billion by 2030.

- Stratview Research forecasts $1.25 billion in 2022 to $7.16 billion in 2029, a CAGR near 28 percent.

- Segment-specific studies echo this trend. Wind turbine inspection drones alone are expected to grow from $336.8 million in 2024 to nearly $557 million by 2030.

- Subsea inspection and maintenance services, of which robotic ROVs are a key component, are forecast to expand from $16.5 billion in 2025 to $28 billion in 2034.

Across all categories, the consistent picture is one of strong double-digit growth as asset owners move toward continuous, robotic, data-driven inspection.

Challenges and gaps

Despite progress, several hurdles remain. Harsh environments test robot endurance; autonomy must improve to reduce operator load; data standards vary widely; and cultural acceptance among inspectors and regulators is still evolving.

Integration into existing maintenance systems is another barrier – data is only valuable when it drives actionable work orders.

Inspection as a background process

Inspection robots are moving the industry from episodic, risky surveys toward continuous, automated monitoring.

Drones, crawlers, quadrupeds, and subsea robots are not replacing human expertise but augmenting it – delivering richer data while keeping people out of harm’s way.

The vision is clear: inspection as a background process, under way constantly, feeding predictive maintenance systems and helping operators make better, safer decisions.

The next decade will likely see robots become a standard fixture across bridges, rigs, refineries, and turbines – quietly reaching the unreachable and making infrastructure more resilient.