The São Tomé and Príncipe Citizenship by Investment program offers investors global mobility and financial optimization through one of Africa’s most accessible second passport options.

Starting from $90,000 through government donation, applicants obtain citizenship providing visa-free access to 60+ countries, attractive tax benefits including no capital gains or inheritance taxes, and processing times as fast as 6 weeks.

Program Requirements and Investment Options

Understanding the program structure and requirements helps investors evaluate whether this African citizenship opportunity aligns with their mobility and business objectives.

Investment Thresholds

The program operates through donations to the National Development Fund supporting renewable energy, housing, and strategic national initiatives:

- Single Applicant: $90,000 minimum donation.

- Family (2-4 members): $95,000 total donation.

- Additional Dependents: $5,000 per person.

- Newborn Inclusion: $500 (after family citizenship obtained).

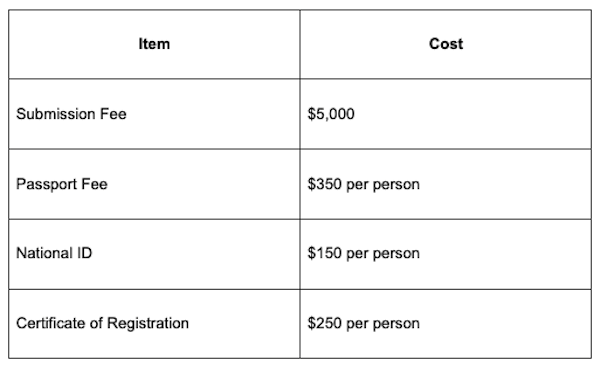

Additional Fees

Eligibility Requirements

Main Applicant:

- Minimum 18 years old.

- Clean criminal record and good legal standing.

- Good health status.

- Pass Due Diligence check.

Family Inclusion:

- Spouse.

- Unmarried children up to 30 years (financially dependent).

- Parents over 55 years (fully supported by applicant).

Application Process and Timeline

The streamlined process emphasizes efficiency while maintaining security standards through proper due diligence procedures.

- Expert Consultation: Assessment of situation and document requirements.

- Application Preparation: Complete document package compilation and submission.

- Due Diligence: Government background check with $5,000 registration fee.

- Preliminary Approval: Approval in Principle issuance.

- Investment Contribution: National Fund donation and fee payments.

- Citizenship Completion: Oath of allegiance and document receipt.

Required Documentation

- Completed citizenship application form.

- Certified passport copies for all applicants.

- Criminal record certificates from all countries of nationality/residence (5 years).

- Proof of current residence.

- Source of funds declaration with supporting financial documents.

- Due diligence report from UCID-recognized entity.

Processing Time: Approximately 6 weeks, significantly faster than comparable programs.

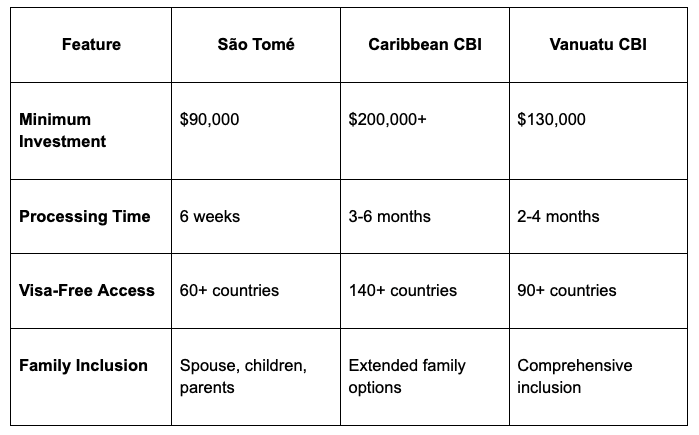

Comparison with Alternative Programs

Evaluating São Tomé against established Caribbean and Pacific citizenship programs highlights its competitive positioning in the investment migration market.

Key Advantage: São Tomé offers the lowest entry threshold with competitive processing speed, though with more limited visa-free access compared to Caribbean alternatives.

Travel Benefits and Visa-Free Access

São Tomé citizenship provides visa-free or visa-on-arrival access to over 60 destinations across multiple continents, facilitating business and leisure travel.

- Africa: 40+ countries including Ethiopia, Egypt, Kenya, Tanzania, Uganda, Mozambique, Zimbabwe, and Zambia.

- Asia: Hong Kong SAR, Macao SAR, Nepal, Sri Lanka enabling business and tourism activities.

- Latin America: Brazil, Bolivia, Ecuador providing South American access.

- Europe: Visa required but high approval rates through Portuguese consulates due to historical ties.

- Notable Exclusions: No Schengen Area or UK access, limiting European business mobility compared to Caribbean programs.

Tax Benefits and Optimization

São Tomé citizenship offers attractive tax advantages for globally mobile investors, particularly those conducting business in Africa or seeking tax optimization strategies.

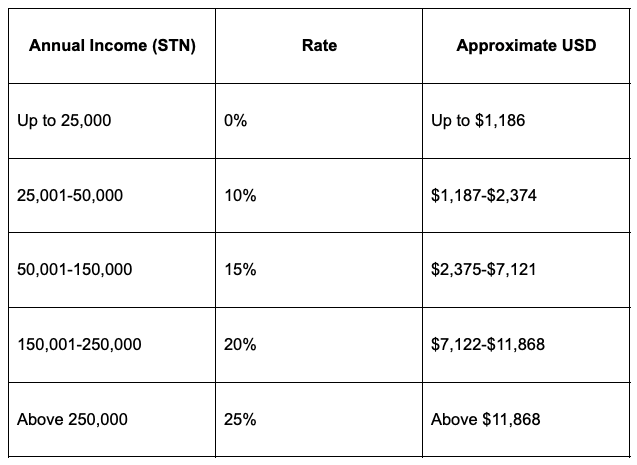

- Personal Income Tax: Progressive rates 0-25% on worldwide income for residents only.

- Corporate Tax: Flat 25% rate.

- Favorable Exemptions: No capital gains, wealth, or inheritance taxes.

- Foreign Income: Tax-free unless residing 183+ days annually.

São Tomé maintains Double Taxation Agreements with Portugal, Angola, and Cape Verde, covering income, corporate tax, and withholding taxes on dividends, interest, and royalties.

Strategic Advantage: No automatic tax obligations from citizenship acquisition—tax residency only triggered by actual relocation.

Target Investor Profiles

Different investor categories benefit from São Tomé citizenship based on specific mobility, business, and tax optimization needs.

- African Investors: High-net-worth individuals seeking fast, low-cost second passport with regional visa-free access and no residency requirements.

- Middle East and Turkey: Investors benefiting from quick processing, family inclusion, and enhanced travel options for business expansion.

- Asian Nationals: Cost-conscious investors seeking affordable citizenship for global mobility and tax planning without mandatory residence.

- Business Professionals: Entrepreneurs conducting African business operations who benefit from regional access and favorable tax treatment.

Program Limitations and Considerations

Key Limitations:

- Limited Visa-Free Access: 60+ countries significantly less than Caribbean programs (140+).

- No Western Access: No Schengen, UK, or US visa-free travel.

- Newer Program: Less established track record compared to Caribbean alternatives.

- Geographic Focus: Benefits primarily African and select Asian/Latin American markets.

According to African Development Bank research, investment migration programs in Africa are growing rapidly, with São Tomé positioned as a cost-effective entry point to the continent.

Professional Implementation

Successful participation requires proper documentation, compliance procedures, and strategic planning to maximize program benefits while ensuring legal compliance.

São Tomé’s program operates through certified agents only, with applications processed via the Dubai office for enhanced efficiency. The public-private partnership model enables faster processing while maintaining security standards.

Due Diligence Standards: Comprehensive background checks ensure program integrity while processing applications efficiently within 6-week timeframes.

Conclusion

São Tomé and Príncipe represents one of Africa’s most accessible and cost-effective citizenship programs, combining fast processing, family inclusion, and attractive tax benefits.

While visa-free access is more limited than Caribbean alternatives, the program offers compelling value for investors prioritizing African business opportunities, tax optimization, and affordable second passport acquisition.

The 6-week processing time, $90,000 minimum investment, and no residency requirements create an attractive proposition for globally mobile investors. However, careful consideration of travel needs and business objectives ensures this program aligns with long-term goals.

For investors seeking fast, affordable access to African markets with favorable tax treatment, São Tomé citizenship provides a strategic solution with professional implementation support ensuring successful outcomes.

Ready to explore citizenship by investment opportunities? Professional guidance from Astons ensures optimal program selection and implementation based on your specific mobility and business goals.