Global Money Transfer: Past, Present and Future

In a world where people are increasingly mobile, the need for efficient and cost effective methods of transferring money internationally is greater than ever.

Global money transfer has come a long way in recent years, with new technologies and services emerging to make the process easier than ever. But what does the future hold for global money transfer?

In this blog post, we will take a look at the past, present and future of global money transfer, and explore some of the key trends that are shaping this industry.

From Barter to Coins

The history of money transfer is a long and fascinating one, dating back thousands of years. Early methods of transferring money were based on barter, with goods and services being exchanged between parties.

This was later replaced by the use of coins and other currency, which made it easier to assign value to items and transfer them between people.

The advent of banking and other financial institutions in the early modern period led to further innovations in money transfer, with the development of things like bills of exchange and letters of credit. These allowed for money to be transferred between different banks and countries, making international trade much easier.

In the late 20th century, the development of new technologies like the internet and mobile phones led to a new wave of money transfer services. These allowed people to send money electronically, without the need for costly bank transfers.

The Bumpy Move to Paper

The past few years have seen a major shift towards paperless money transfer, with more and more people using digital methods to send and receive payments. This trend has been driven by a number of factors, including the increasing ubiquity of mobile devices and the rise of social media.

One of the biggest players in the paperless money transfer space is TransferWise, which allows users to send money abroad without any hidden fees. The company has been hugely successful, and is now valued at over $1 billion.

From Gold to Governments

While the private sector has played a major role in the development of global money transfer, it is ultimately governments that control the flow of money around the world. The future of global money transfer will therefore largely be determined by government policy and regulation.

With Brexit looming large on the horizon, it remains to be seen how this will impact the free flow of money between the UK and Europe.

Payment Processing

The future of global money transfer is likely to be shaped by a number of different factors, including the rise of new technologies, the increasing mobility of people and the changing role of governments.

One thing that is certain is that the industry will continue to evolve and grow, providing ever more efficient and cost effective ways to send money around the world.

With the increased mobility of people, payment processing has become an integral part of every business. Having the ability to take payments online and in-store has become a necessity for businesses of all sizes.

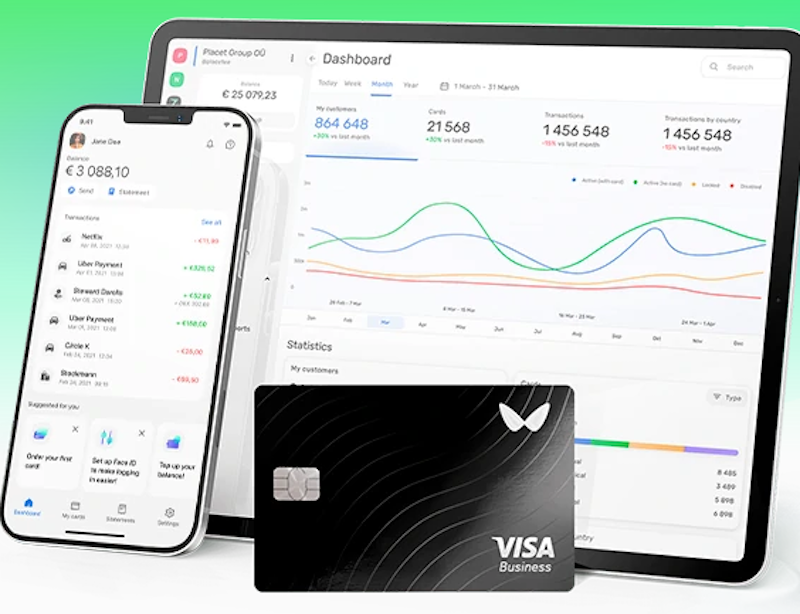

Wallester is a leading provider of payment card solutions and helping businesses to find solutions in the card processing area. Services are designed to be simple and cost effective, with no hidden fees or long-term contracts.

It is a part of a big payment processing picture providing high quality services. If you are thinking that it can help your business, take a look at https://wallester.com/card-payment-platform/payment-processing.

In Credit We Trust

Digital currencies like Bitcoin are becoming increasingly popular, thanks to their speed and security. While they are not yet widely accepted, it is only a matter of time before they become mainstream. Credit products, on the other hand, are already widely used for international money transfer.

So what does the future hold for global money transfer? Digital currencies and credit products will play a major role in shaping this industry in the years to come. With Brexit looming large on the horizon, it remains to be seen how this will impact the free flow of money between countries.

SWIFTer and Easier

In the ever-changing world of global money transfer, one thing remains constant: the need for speed. This was made abundantly clear during the 2008 financial crisis, when the US government intervened to prevent the collapse of several major banks. The future of global money transfer will therefore largely be determined by government policy and regulation.

In the meantime, companies like Wallester are making it easier and faster than ever to send money abroad. Thanks to their innovative technology, users can now transfer money in real-time, without any hidden fees.

The New Frontier: Blockchain

The future of global money transfer looks set to be shaped by two major trends: the rise of digital currencies and the increasing use of blockchain technology.

Digital currencies like Bitcoin are becoming increasingly popular, thanks to their speed and security. While they are not yet widely accepted, it is only a matter of time before they become mainstream.

Blockchain, on the other hand, is already being used by a number of companies for international money transfer. The most popular option is borderless transfer systems, which allows users to hold and convert over 50 different currencies.

So what does the future hold for global money transfer? We think that digital currencies and blockchain will play a major role in shaping this industry in the years to come. Let’s follow the news together.