Nauticus Robotics valued at more than $500 million as it becomes publicly traded company via merger with CleanTech

Nauticus Robotics, a Houston-based developer of cloud-based surface and subsea robots, software, and associated services, and CleanTech Acquisition, a publicly traded special purpose acquisition company, have entered into a definitive business combination agreement that will result in Nauticus becoming a publicly listed company.

Upon closing of the transaction, CleanTech Acquisition (CLAQ) will be renamed Nauticus Robotics and is expected to remain listed on Nasdaq under the new ticker symbol “KITT”. Nauticus is being valued at more than $500 million.

Nauticus develops revolutionary cloud-based autonomy software to enable a smarter and more sustainable ocean industry using its fleet of autonomous robots from the surface to the seabed.

These robots are enabled by the Nauticus Software Suite, a platform of artificial intelligence and machine learning technologies designed to disrupt the legacy methods in the marine industry.

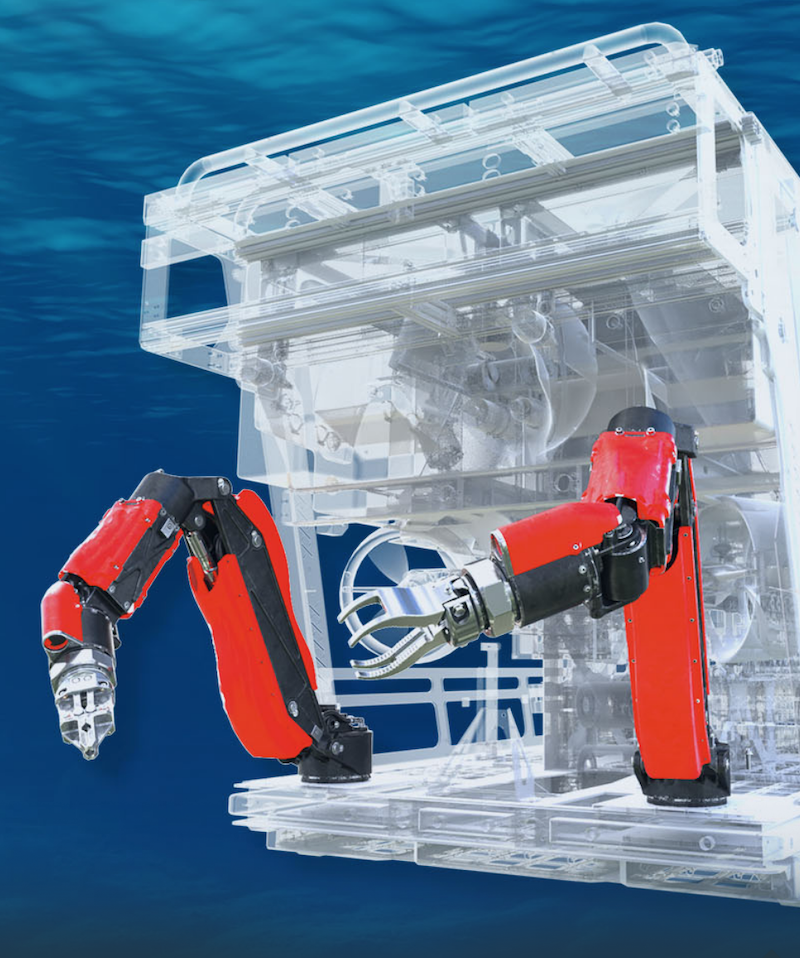

Its first product offering, Aquanaut, is the world’s first tetherless underwater robot capable of robust decision making for both long distance ocean data collection and close-in dexterous manipulation of the subsea environment, supporting government and defense and other commercial industry sectors.

Nauticus’ software, robots, and services provide customers the necessary data collection, analytics, and subsea manipulation capabilities to support and maintain assets, while significantly reducing their operational and carbon footprints to improve offshore health, safety, and environmental exposure.

Nauticus operates in the $2.5 trillion ocean economy where it targets the rapidly expanding multibillion dollar bluetech robotics, data, and services market with a disruptive product offering.

Some incumbent solutions utilize large vessels that can have severe drawbacks, including operating costs that can reach as high as $100,000 per day with large fuel emissions of up to 70 metric tons of CO2 per day and largely utilize antiquated, maintenance-heavy, hydraulic machines with little to no advanced technologies.

In contrast, Nauticus’ expected service pricing would save customers over 50 percent compared to traditional methods while eliminating nearly the entire greenhouse gas emissions with a significant reduction in required onsite personnel needs.

The company’s estimated revenues in 2021 are approximately $8.2 million, with strong visibility to achieve robust growth in subsequent years, including currently contracted orders that would more than double revenue in 2022.

Nauticus’ robotic systems and services will be delivered to commercial and government-facing customers primarily through a Robotics as a Service (RaaS) business model but could also include strategic partnerships for unit sales. The strong unit economics of the RaaS model target long-term corporate EBITDA margins of approximately 60 percent.

Nauticus founder, chairman and CEO Nicolaus Radford and the current management team will continue to lead the combined company.

Radford says: “The passion and conviction of our team at Nauticus has fueled the creation of a truly disruptive and innovative company in the ocean space, and we are eager to take the next step in our growth trajectory as a public company.

“A substantial core of our team has been together, first starting at NASA and now at Nauticus for 15 to 20 years and I am inspired by their relentless pursuit toward this dream. Their talent and efforts are second to none and I could not be prouder of what we have and will accomplish.

“The ocean will be the epicenter in our fight against climate change and the offshore ocean services industry has signaled the beginning of a major technology revolution to combat it.

“Toward that end, we have brought to market a suite of products and services that can make a significant impact on our customers’ cost profile, carbon footprint, and safety by reducing the reliance on costly and carbon intensive surface assets that traditionally service the many sectors of this industry.”

Eli Spiro, CEO of CleanTech Acquisition, says: “CLAQ was created to find a great business that has a positive impact on the world’s carbon footprint. We set a high bar for ourselves and could not be more impressed with Nic and the entire Nauticus team.

“We believe Nauticus’ RaaS model has the potential for strong returns while operating in a market in dire need of disruption. The high caliber of partners and investors Nauticus has attracted, including blue-chip customers in the offshore industry, is impressive and we believe this validates their technology and solution.

“On a personal note, it has been a tremendous pleasure to get to know and work with Nic – he’s a true leader and has been an inspiration to all of us at CleanTech throughout this transaction.”

Transaction overview

The pro forma equity valuation (assuming no redemptions) of the combined company is expected to be approximately $561 million.

Estimated cash proceeds to the combined company from the transaction are expected to consist of CLAQ’s approximately $174.2 million of cash in trust (assuming no redemptions) and approximately $73 million from a fully committed Private Investment in Public Equity (“PIPE Investment”) in equity and convertible notes anchored by existing investors.

Proceeds from the fully committed PIPE Investment fully cover the minimum cash requirement for the transaction, reducing potential transaction uncertainty.

Upon the closing of the transaction, and assuming none of CLAQ’s public stockholders elect to redeem their shares of common stock and no additional shares of common stock are issued upon the closing of the transaction, it is anticipated that CLAQ’s public stockholders (other than the PIPE Investment investors) would retain an ownership interest of approximately 33 percent in the combined company, the PIPE investment investors will own approximately 6 percent of the combined company, the co-sponsors, officers, directors and other holders of CLAQ founder shares will retain an ownership interest of approximately 8 percent of the combined company, and the Nauticus stockholders will own approximately 53 percent of the combined company.

These values exclude $75 million of earn-out shares that would be paid in common stock if applicable requirements are met.

The board of directors of each of CLAQ and Nauticus approved the transaction, which is expected to close in the first half of 2022.

The transaction will require the approval of the stockholders of CLAQ and is subject to other customary closing conditions including the receipt of certain regulatory approvals. The transaction will also require the approval of the stockholders of Nauticus.

Stockholders holding the requisite vote of Nauticus have executed a support agreement and have agreed to vote in favor of the merger and related transactions by unanimous written consent or at a meeting of stockholders when called by Nauticus.