China’s biggest chipmaker to double investment in capital goods to $7 billion

China’s largest chipmaker Semiconductor Manufacturing International is to double its investment in capital goods to $6.7 billion, according to a report on the Nikkei Asian Review website.

The company is somewhat flush with cash as a result of net profit skyrocketing by 644 percent in the second quarter. Part of the increase is due to Chinese telecommunications giant Huawei stockpiling chips.

Huawei is trying to prepare for any potential shortage in its supply chain caused by the ban imposed on its activities in the US and Europe.

SMIC says Huawei is not its only client, though one of the largest, and it will not be violating any international rules that may come into force limiting trading with Huawei.

Liang Meng-Song, co-CEO of SMIC, says: “We still have other clients lined up to produce chips with us, so we believe the impacts could be mitigated.

“We will try to find different and diversifying customers to help us continue pushing forward the latest chip production technologies.”

China has become the world’s largest buyer of semiconductor manufacturing equipment, according to data collated by industry organization SEMI.

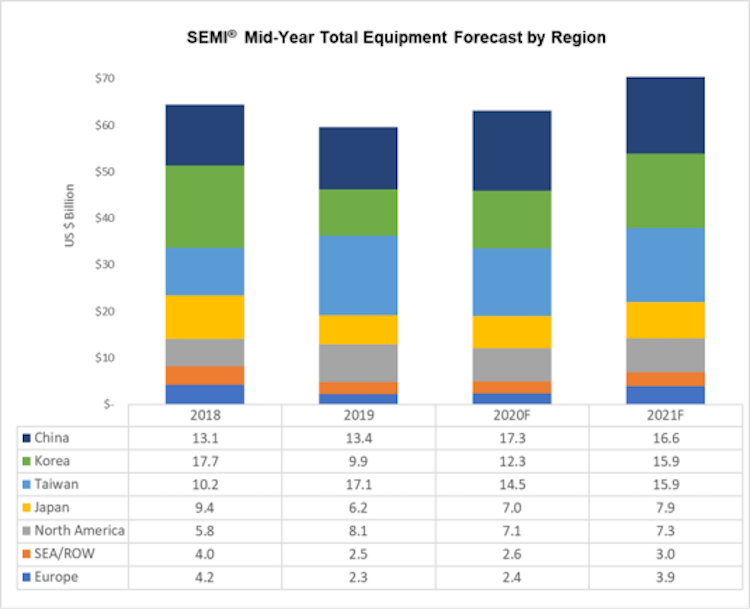

Global sales of semiconductor manufacturing equipment by original equipment manufacturers are projected to increase six percent to $63.2 billion in 2020 compared to $59.6 billion in 2019 before logging record high revenue of $70 billion in 2021 on the strength of double-digit growth, according to SEMI.

“Growth across a number of semiconductor segments is expected to power the expansion,” says SEMI.

The wafer fab equipment segment – which includes wafer processing, fab facilities, and mask/reticle equipment – is expected to rise five percent in 2020 followed by 13 percent growth in 2021 driven by a memory spending recovery and investments in leading-edge and China.

Foundry and logic spending, accounting for about half of total wafer fab equipment sales, will see single-digit increases in 2020 and 2021.

Both DRAM and NAND spending in 2020 will surpass 2019 levels and are projected to grow over 20 percent, respectively, in 2021.

The assembly and packaging equipment segment is forecast to grow 10 percent to $3.2 billion in 2020 and 8 percent to $3.4 billion in 2021 driven by advanced packaging capacity buildup.

The semiconductor test equipment market is expected to increase 13 percent, reaching $5.7 billion in 2020, and continue the growth momentum in 2021 on the back of 5G demand.

Regionally, China, Taiwan and Korea are expected to lead the pack in spending in 2020.

Robust spending in China in the foundry and memory sectors is expected to vault the region to the top in total semiconductor equipment spending in 2020 and 2021.

Taiwan equipment spending, after seeing 68 percent growth in 2019, is forecast to contract this year but bounce back with 10 percent growth in 2021, with the region maintaining the second spot in equipment investments.

Korea is expected to rank third in semiconductor equipment investments in 2020 by outstripping its 2019 levels, making it the third top spender in 2020.

Korea equipment spending is projected to grow 30 percent in 2021 powered by the memory investment recovery.

Most other regions tracked will also see growth in 2020 or 2021.

The following results, shown in the graph and table below, are in terms of market size in billions of US dollars.

Any downturn in the business activities of Chinese chipmakers like SMIC may have negative consequences for US companies which produce and supply semiconductor manufacturing equipment.

SMIC buys “a large amount” of chipmaking equipment from American companies such as Applied Materials, Lam Research and others. If it continues to work with Huawei after the ban is introduced, it may be subject to sanctions itself.

SEMI reports that North America-based manufacturers of semiconductor equipment posted $2.32 billion in billings worldwide in June 2020.

The billings figure is 1.1 percent lower than the final May 2020 level of $2.34 billion, and is 14.4 percent higher than the June 2019 billings level of $2.03 billion.

Meanwhile, the US government has introduced a range of measures to support American producers of semiconductor manufacturing equipment.

These measures were encapsulated within the CHIPS for America Act – CHIPS is short for Creating Helpful Incentives to Produce Semiconductors.

The Act pledges more than $20 billion for a host of programs aimed at supporting American companies, including grants, and have been welcome by SEMI.

Ajit Manocha, SEMI president and CEO, says: “SEMI is very pleased the House and Senate included in the NDAA provisions to support semiconductor manufacturing and research in the United States.

“The US has not kept pace with the growth of semiconductor manufacturing abroad. The US share of global semiconductor manufacturing capacity has been cut in half to just 12 percent over the past 20 years and is forecast to fall to 10 percent by 2023.

“We applaud the sponsors for their support, leadership and hard work to win House and Senate approval to increase federal government support for the industry.

“However, this is just the start of what needs to be done to reverse this 20-year decline.

“The CHIPS for America Act’s investment tax credit for new and expanded semiconductor manufacturing facilities is essential to provide a robust, transparent and reliable federal incentive that will be the foundation of renewed growth of US fabs.”