Nvidia reportedly in talks to buy ARM

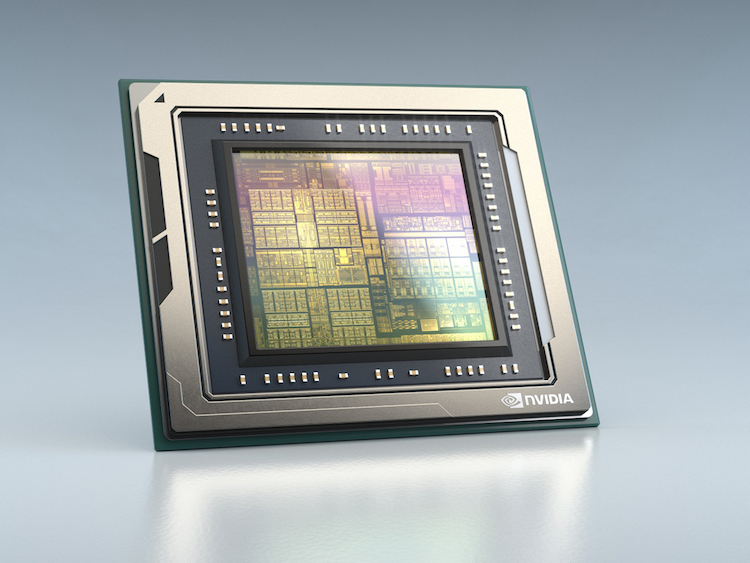

Nvidia, one of the largest chipmakers in the world with a leading position in the robotics and autonomous cars market, is in talks to buy ARM, according to a report on the Bloomberg website.

ARM is a chip designer which was bought in 2016 for $32 billion by SoftBank Group, as reported by the Financial Times.

SoftBank Group is a giant Japanese telecommunications company and is the parent of SoftBank Robotics.

Bloomberg cites “people familiar with the matter” to report that “the two parties aim to reach a deal in the next few weeks”.

Speculation suggests that Nvidia will have to pay to around $55 billion to acquire ARM, but amid the economic turmoil created by the coronavirus crisis, it’s difficult to have confidence in anything.

However, Nvidia is being positive about its long-term growth and may pay anything between $50 billion and $70 billion for ARM despite the uncertain economic environment.

Nvidia is currently the 10th largest chipmaker in the world or thereabouts, with Samsung and Intel making up number one and two respectively.

Its main strength is graphics processing units, which used to be sought after by the computer games industry, but have in recent years been in demand by bitcoin mining startups as well as established, global automotive companies developing autonomous mobility systems.

Nvidia’s recent headline-grabbing moves include an agreement on a wide-ranging partnership with Mercedes-Benz to develop a “smartphone on wheels”, in the words of Ola Källenius, chairman of Daimler and Mercedes-Benz.

The two companies say they will develop a highly computerised, data centre-connected and updatable car much of the technology for which is yet to be developed.

Another piece of the jigsaw is its partnership with Continental, famous for tyres and other auto parts. In a similar deal to the one it has with Bosch and others, Nvidia agreed a partnership with Continental to develop a supercomputer to use for vehicle artificial intelligence.

Nvidia appears to be well placed to gain from the global trend towards electric and autonomous mobility – referred to by some automakers as “CASE”, short for connected, autonomous, shared and electric.

The computing and data infrastructure required for this growing electric and autonomous ecosystem – which will include cars, trucks, e-scooters and so on – will be vast on a scale never seen before.

And while Nvidia is strong in GPUs, which can process data at superfast rates, what will also be required for this emerging ecosystem are central processing units and certainly some types of specialised artificial intelligence chips.

ARM’s chip designs are used by most of the top chipmakers. ARM does not manufacture chips of its own, just designs them.

Its strengths are in CPUs which are used in desktop and laptop computers as well as servers in data centres. It has also held a massive share of the smartphone market, largely as a result of its supply of designs to Apple.

However, Apple is moving away from using third-party chips such as Intel and others, and is developing AI chips of its own. Its Mac laptop and desktop computer range is likely to feature only Apple chips by the end of the year.

If the acquisition goes ahead, Nvidia will be acquiring a company which would be able help map out the future for connected and autonomous vehicles and much else in an increasingly computerised world.