Teradyne doubles down on mobile robots with AutoGuide acquisition

By Ash Sharma, research director, robotics, Interact Analysis

Teradyne this week announced that it would be acquiring mobile robot vendor AutoGuide Mobile Robots for $165 million.

This announcement comes 18 months after it acquired autonomous mobile robot vendor Mobile Industrial Robots (MiR) for $148 million, illustrating its ambitions in the sector.

AutoGuide had revenues of just $4 million in 2018. However, the combined mobile robot business would place Teradyne as a top 15 vendor.

The move to acquire AutoGuide is somewhat complementary to MiR, though may cause some potential overlap and may also lack synergies.

However, the tendency for Teradyne to continue to operate its acquisitions as separate and independent business units, whilst leveraging any cross-company competencies and cost savings should mitigate this.

Doubling down or splitting a pair?

Whilst on the face of it, it appears that Teradyne is doubling down on its bet on MiR, in reality the company is instead capitalizing on a very different part of the mobile robot sector that is also experiencing strong growth.

Here are some of the main differences:

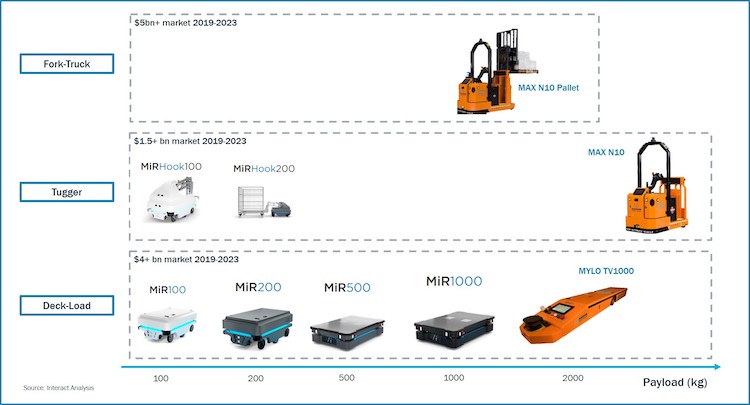

Platforms: AutoGuide’s main product is a SLAM-based tugger that can also be configured as a pallet truck. It also offers a conveyor AGV with configurable tops.

It is one of the few companies that offers both magnetic-tape based AGVs and SLAM-based AMRs.

On the other hand, MiR focuses purely on AMR-technology for deck-load conveyors and tuggers.

The difference in appearance between the two respective products lines is huge; MiR’s modern and clean design is a stark contrast to AutoGuide’s rugged and industrial vehicles.

Applications: Whilst MiR focuses largely on smaller payloads of 100 kg, 200 kg, 500 kg and more recently 1,000 kg, AutoGuide offers solutions more suitable for automating the movement of thousands of kilos in manufacturing environments.

It focuses on pallet-level moves as well as transporting rolling stock. Its pallet truck could potentially see some overlap with MiR’s pallet movers.

Sales Channels: MiR does not install mobile robots directly, instead it has successfully established a very large distributor and integrator network.

It has an extensive network in Europe, the US and also China. MiR offers a “plug and play” approach in which its robots are easily integrated and deployed.

AutoGuide on the other hand works more directly with end customers. Rather than relying on distributors, it has its own integration capabilities as a well as a sister company – Heartland Integration – to work directly with customers.

AutoGuide’s AGVs and AMRs need closer integration into customers’ facilities, though its modular approach allows for rapid deployment.

Whilst MiR has sizeable sales in the US, Europe and China, all of AutoGuide’s customers to date are in North America and it has no presence outside of the region.

The expansion of AutoGuide’s sales network and geographic footprint is likely where Teradyne sees biggest potential for growing the business.

Scale: AutoGuide’s revenues were a modest $4 million in 2018 – inferring a 40x multiple on its purchase price (nearly as high as what 6 River managed to achieve).

Teradyne expects it to double its revenues in 2019 and presumably continue on a growth trajectory which seems very reasonable.

MiR on the other hand generated more than $20 million in revenue in 2018 and grew more than 50 percent in the first half of 2019.

MiR doubled its revenues in 2018 and we expect the acquisition of AutoGuide – which will sit in Teradyne’s Industrial Automation division, alongside MiR and Universal Robots – to add to Teradyne’s growth engine.

Final thoughts

The acquisition of AutoGuide for $148 million looks costly, but could prove a prudent, long-term gamble by Teradyne.

Whilst AutoGuide’s sales have been modest to date and yet to breach the $10 million mark, it is currently on a high-growth trajectory and the market segments it addresses are forecast to grow strongly.

For example, the robotic tugger market is predicted to double in size in the next four years. Automated fork trucks are forecast to achieve even stronger growth.

We expect that this market segment will be worth more than $5 billion in 2023 which presents a huge opportunity for AutoGuide.

The global reach of Teradyne should allow AutoGuide’s sales growth to significantly accelerate, particularly outside of North America, and at the same time Teradyne’s much larger supply chain will allow for faster cost reduction of AutoGuide’s AGVs and AMRs.

AutoGuide’s products fit quite neatly alongside MiR’s, as well as the customer segments it addresses and the acquisition on the face of it looks rather complementary.

It seems reasonable that AutoGuide could reach sales of around $20 million in 2020 and that Teradyne’s overall mobile robot business breaches $50 million.

About the author: Ash Sharma is research director for commercial drone and robotics research, amongst other topics, at Interact Analysis. Sharma has spent more than 15 years in technology research on several sectors, including industrial automation and smart manufacturing, smart home, solar power and energy storage, drones and robotics, medical technology and building automation.