The human factor: GE Digital automation boss hints at new directions for Predix

Exclusive interview with Matt Wells, of GE Digital. By Abdul Montaqim

GE Digital is a subsidiary of General Electric, the quintessential American multinational corporate conglomerate with operations in more countries than the United Nations.

But far from being just one of its parent company’s dozen or so subsidiaries, GE Digital is something of a shooting star, outperforming many other subsidiaries to the point where it is informing, if not transforming, the entire culture and ethos of the company.

Nowadays, General Electric likes to be known as a “the world’s digital industrial company”, except they capitalise the words to emphasise the importance of the virtual realm.

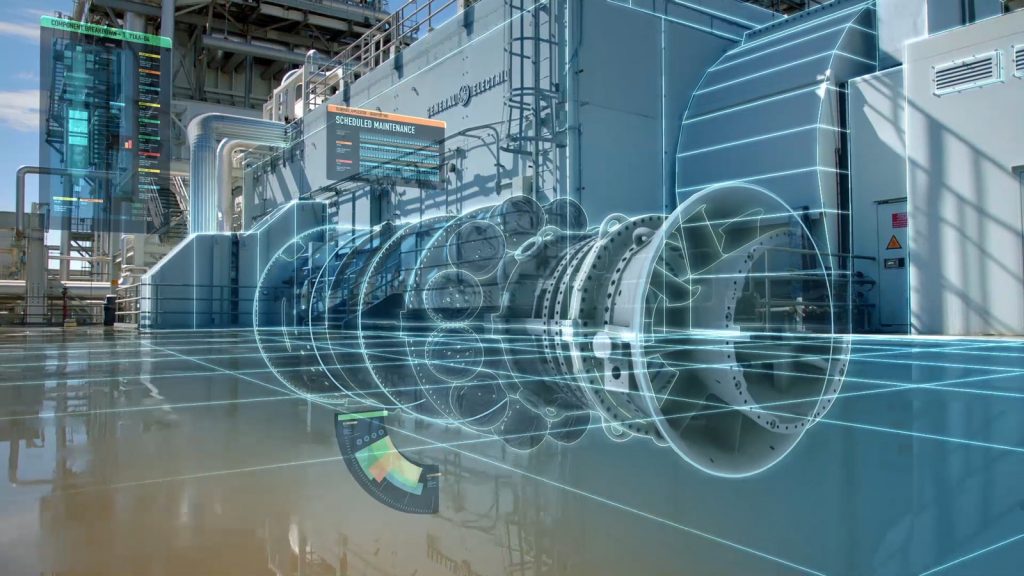

GE was probably the first company to launch an integrated digital platform, or software that enables industrial companies to connect their machines to the cloud and monitor the data they produce – and clearly brand it as such, giving it a name – Predix – and some personality.

Predix, as the name suggests, is principally used to enable predictive maintenance, although it can be used for many other things.

Standing out is not an easy thing to do for any software in any segment, not least one that rose out of the industrial sector.

The differentiation calculus

At the time of launch two years ago, GE claimed Predix was the world’s first cloud service built for industrial data and analytics.

It was a relatively new concept but it’s caught on so fast that virtually all industrial companies large and small are now scrambling to launch and build similar solutions of their own and reposition themselves as digital businesses, just like GE.

Essentially, Predix is software that can connect your computers to the sensors attached to your machines and present the data they are collecting in whatever form you like; and if you’re a developer, you can customise Predix to your requirements.

Often promoted with attractive pictures of power-generating wind turbines, Predix looks open and powerful.

The main benefits of having access to the type of data Predix can acquire through the sensors seem to be:

- it can reveal which machines and processes can be switched off because they are not needed, thereby saving money on energy costs;

- it can notify you of machines that may need maintenance at some point soon before they break down and cause all sorts of unpredictable problems; and

- it can give you enough data to make efficiency gains throughout your operations, no matter how large or geographically widespread.

The man who knows not much

That’s as far as I understand, but I’m no expert. Really all I know is that all these industrial companies which used to spend their time building big things – from power stations, through roads and other infrastructure, to factory machines and components – now all want to “digitalise” and be like the Apple or Google for the industrial sector.

They even have app stores now.

In simple terms, and to use perhaps an inappropriate parallel, industrial cloud platforms such as Predix could be seen as being operating systems, or browsers, or indeed a development platform – like Xcode or Visual Studio – with an associated app store, or any of the things you’ve heard Microsoft, Apple, Google and the others compete about.

And GE Digital has apparently gained an advantage over its would-be competitors, such as Siemens, possibly because of what they call in marketing “first-mover advantage”.

But it’s not alone any more – there are literally hundreds of companies now offering similar industrial cloud services, and among them is Siemens, which is one of the few companies with enough scale and power to pose a serious challenge to GE Digital’s apparent dominance.

Although that’s just the way I see it, and I’m no expert.

The oracle of GE

Matt Wells is senior product general manager at GE Digital. He has more than 20 years’ experience in the sector and is responsible for leading GE’s automation software business.

GE is too big to even contemplate, and GE Digital is growing to a point where it too may need to be sub-divided into more distinct business units.

I met with Wells at this year’s Hannover Messe, held in Germany, a couple of weeks ago, and asked him to explain everything.

“GE is going through a massive transformation,” says Wells. “I don’t think GE’s getting away from its traditional base of manufacturing heavy equipment.

“But I think the key learning that we have as a business, as a leader in the segment, is that much of the advances to be achieved in machine performance aren’t in the machine and hardware itself, it’s how you run and operate the machine, and to achieve those benefits, you need software and portal to accomplish that.

“So that’s why GE is turning itself into what we call a ‘digital industrial company’, because it’s not just software – it’s software in combination with hardware – and we’re creating synergies and benefits from putting the two together.”

Way too much information and money

Any company wants to make money, but there’s something almost incongruous about an old industrial company like GE, established in 1892 – 125 years ago, getting down to brass tacks with the geeky coders of 2017.

It’s like going to a nightclub with your grandad or something. While he might be happy emulating Ol’ Dirty Bastard, maybe you wouldn’t be so pleased – unless you’re a grandad yourself of course, in which case, forget I said that.

But the sheer amount of money involved in your grandad doing a turn as the infamous Wu Tang Clan member – to continue the metaphor I really shouldn’t have conjured up – may be enough to compensate for any excruciating embarrassment that you might have felt at the time.

In other words, GE Digital is huge: it made $4 billion in fiscal year 2016, an amount which places the company very near, or even in, the list of the top 10 software companies in the world – and it’s only a business unit, whereas the others are all dedicated software companies.

The other nine biggest software companies in the world, based on findings published on Wikipedia, are shown in the table below, alongside how many billions of dollars in sales they reported in their most recent annual reports.

- Microsoft :: $86.6 billion

- Oracle :: $37.2

- SAP :: $23.2

- VMware :: $6.7

- Fiserv :: $5.3

- Adobe Systems :: $5

- Salesforce.com :: $6.7

- Symantec :: $5.4

- Amadeus IT Holdings :: $4.3

This time next year, this list should almost certainly include GE Digital in the top 5 if the company’s own forecasts of reaching $7 billion this year and $15 billion annual revenue by 2020 prove accurate.

Florints and the machine learning algorithms

I find the software business difficult to understand. I’m familiar with some industrial software – like Predix and Siemens MindSphere – and can appreciate how useful or powerful they probably are. I also know how to use many media-related applications to an expert level.

But I have absolutely no clue whatsoever about how software is developed, and can only just about manage to follow what’s being said in an interview about the subject.

One thing I have learned, however, is that machine learning is a branch of artificial intelligence, and that AI is now about to accelerate the development, and increase the power, of the industrial internet of things. Or something.

But luckily for me, Wells probably realises my algorithmic ineptitude and talks about machines instead – for a while at least.

“We do a lot of different things in software,” says Wells. “But one critical example for us is this idea of machine vulnerabilities.

“So if GE builds an aircraft engine, or builds a gas turbine, or builds a locomotive, we wanted – and our customers wanted – to have the longest life possible as well as having the cheapest cost of ownership. I think every customer wants to achieve that with whatever they buy. You buy yourself a car, you want that. Customers buy a gas turbine, they want that.

“What we realised is that we’ve maximised a lot of the gains, like the materials we use, how you build the actual machine itself, and that where a lot of the growth and efficiency comes from is monitoring how that machine performs and then being able to predict when it may or may not disable.

“And if we do predict which machines are going to fail, you can do a routine maintenance operation versus a very expensive operation on a catastrophic failure.

“But the only way you can do that is to leverage very complex analytics, like statistical methods, machine learning, and all different kinds of analytics capabilities and bringing it all together and using that to generate those outcomes.”

That’s just for starters

Much of the explanation Wells gave suggested that GE Digital’s software was initially developed for its own operations and then later offered to customers, and that is what he confirms.

“We started off really doing that software for ourselves because we build and sell all this equipment,” says Wells. “But along the way, we started building applications that can be used by our customers who are not part of GE.

“When we do the software ourselves, we are typically offering it as part of a service contract. Not only does it allow us to provide a better cost model for that service contract, it also ultimately allows us to have more effective delivery for that service contract.

“When we sell the software to external customers who are using non-GE assets, then of course we’re successful as a software vendor and they’re still achieving the same outcomes. And that works well for us too, because a lot of what we sell that goes into a plant can offer the same capability to the rest of the equipment that goes into a plant.”

I’ve heard it said in places that GE software is not always compatible with non-GE machines and equipment, and to be fair to Wells, he tacitly accepts that that may be the case in some instances.

“It’s an evolution,” he says. “We’re continuing to refine and expand the platform, but we support UPC-UA, which is an open standard.

“The way Predix works is that we have an edge connector that natively connects to Predix, and through that edge connector, you can use standard protocols such as UPC-UA, and we support Modbus, which are all standards-based protocols.

“We also support things like MQTT, so if someone wants to have their own data push into Predix, we facilitate that as well.”

Software will take over the world

There’s an argument made by some people – or at least me – that it’s possible that a few decades ago, large industrial or manufacturing companies made so much money in the purely financial world of stocks and shares, property, derivates, credit-default swaps and whatnot, that the products their companies’ fortunes were built on became almost a sideline.

So, a company may have started out making cars and made a lot of money through selling those cars. That money was then invested wisely in the financial markets, and the company made a lot more money on the financial markets than it did making cars. In this situation, it is understandable that shareholders would be happy that their dividends were higher than they used to be, but are the company’s cars as good as they used to be?

Some people call such situations “financialisation”.

The parallel that may be inferred in the current situation, in which industrial companies which used to make big machines are all now becoming software companies because that’s where the money is, could be called “software-isation” – if you’re happy to mangle the English language.

That said, whereas financial markets had little or no direct connection to industry and manufacturing, software is directly integrated into the industrial process.

But an argument could be made that if industrial companies make too much money in simply developing software, their building of machines may be inexorably, perhaps inadvertently, downgraded.

This could lead to a situation where companies like GE don’t make machines any more – just supply the software to run them.

It’s, like, software taking over the world, basically. What do you think of that?

“Software will take over the world,” says Wells. “But that’s a very philosophical question about GE itself, and sounds like a question for someone else.

“But I don’t believe GE will ever move away from building machines and equipment because I think that’s what at the heart of what being a digital industrial company is.

“It’s what makes us different from other software companies who just do software, because when you actually build the hardware and you build the analytics on top of the hardware, you have the inherent domain knowledge in the business itself about how to do that and do that properly.

“We don’t come in as pure software consultants. We come in with the expertise that we offer our customers, expertise that we’ve actually tested on our own machines and equipment. And that is what being a digital industrial company is about, and we’ll never get away from building heavy equipment.

“I do think, though, that software will become a fact of everyday life in everything, in physical assets… We even use our assets on cows, for example – we can tell when they’re going to get sick. So software will become an integral part of everything but we will always be building heavy assets in conjunction with that.”

System of a down

It’s inevitable that software will take over the world, if it hasn’t already, as it’s simply a representation of human thinking, and everything you see in our highly engineered, technological world is the product of human thought.

It’s just that in the past all those thoughts were bound up in the neo-cortex of industry experts and given the label “knowledge”. Now, because of software, that industry knowledge can be made available, often in realtime, to anyone through a computer screen.

In the past, an experienced industry professional may have almost intuitively known when a machine or system is about to break down, and possessed in his or her mind much of the information that made him or her a valuable asset to the company. Now, that value can be distilled in software algorithms, particularly as machine learning becomes more prevalent.

And from a business point of view, this will pay huge dividends.

A senior executive at Microsoft, also present at Hannover Messe, says that industrial companies like GE are likely to earn 40 per cent of their revenues from digital services, so it’s not an unfair question to ask industrials whether they will switch to becoming software-only companies and forget about making machines because this is just too much hard work.

General Electric’s most recent annual report said the company had earned $124 billion in revenue, so GE Digital’s $4 billion is currently a small piece of the company pie.

But what about the pie that’s out there where GE Digital is competing with other businesses for market share?

“It’s a very nascent space,” says Wells. “It’s really quite new. GE certainly was a leader in developing this space in its entirety. I think we were one of the first, if not the first, companies to actually have the role of chief digital officer, which is just an example. Every business unit at GE has a chief digital officer.

“In the competitive market, a lot of people will talk the talk, but very few are endeavouring, like us, to actually build the platforms to support it, and I think that’s what differentiates us.”

Will Predix allow humans?

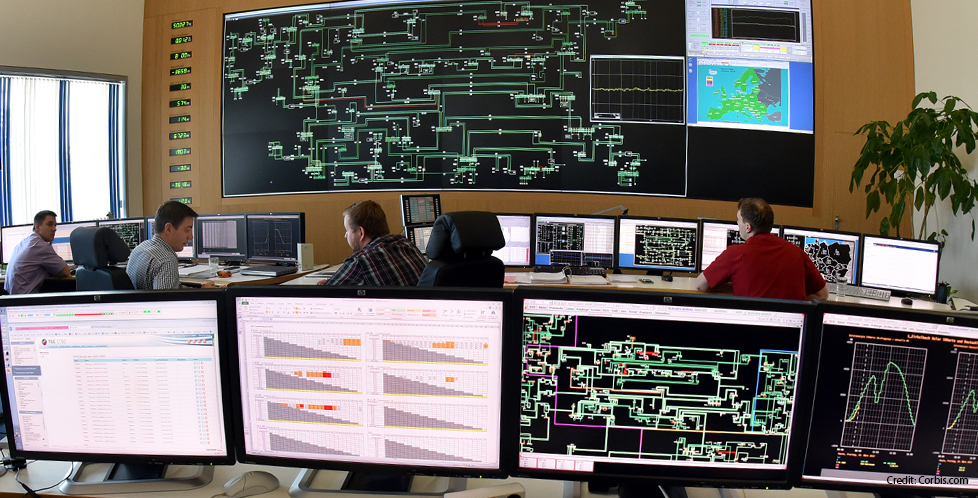

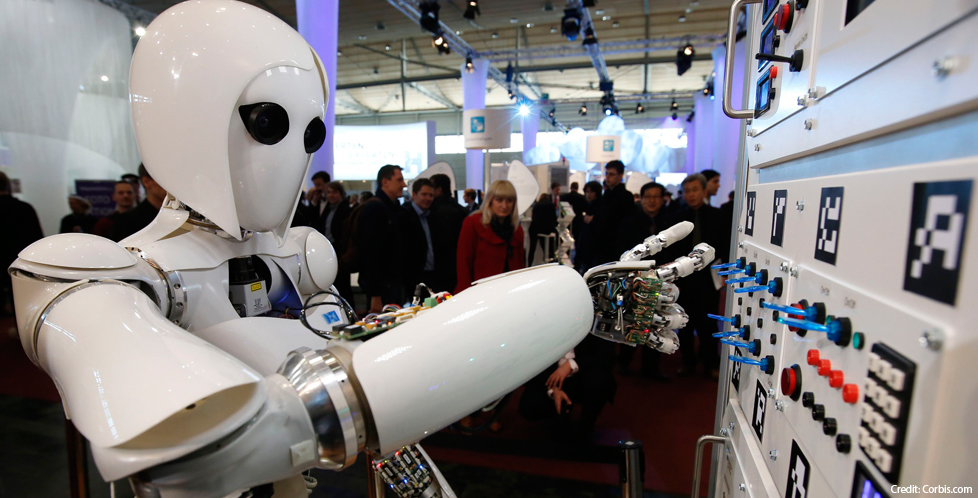

So, Predix and similar software collect data which is then analysed by humans, who then make decisions about, for example, which machines need to be switched off or fixed. But what if Predix could make those decisions by itself and switch off unused machines or even send out a robot to fix stuff?

That’s probably not the sort of question that can be answered now, but it’s certainly something machine learning and AI potentially offers. And by the time that potential is realised, this article would have been written by a robot and probably read by one too.

But before we get to that nightmare dystopia, business has to carry on as usual, and Wells outlines GE’s traditional areas of interest.

“Within GE, we have heavy focus in power, both in generation as well as transmission; we’re big into aircraft engines and all the componentry around that; we’re big into healthcare; we’re big into renewables – solar, wind – we have a large energy connection business, which does a lot of things in the electrical space.

“Within GE Digital, we play in the operation of those heavy assets in the field, and in the manufacturing of those heavy assets.

“So when you make such a wide breadth of things, you get into large, heavy industry, you also get into some discrete manufacturing, and in healthcare. So we play in a wide variety of spaces.

“On our shop floor, you might see us working with an elevator company, we’re working with aircraft, and even from a manufacturing perspective, we work with a large number of process companies as well.”

The robotic course

Although I tried to steer Wells towards admitting that robots loaded with increasingly powerful artificial intelligence are taking over, he kept his answers broad and only indirectly addressed the subject as a “possibility”.

“It is a fast moving space – there’s innovations coming out all the time,” says Wells, by way of indulging some speculative musings. “From a data collection standpoint, sensors are getting smarter all the time. We’ve developed our Predix edge capability to run on sensors that have those smart capabilities.

“Our current business is embedding that smart connectivity to an industrial light bulb, and some of the innovations we can get from there is that we can load new capabilities onto industrial products. So a light bulb is no longer just a light bulb, it’s now a location tracking device. So, sensors are getting overloaded with additional capability as well as the connectivity.

“Then you get into the layer of aggregating that data, and there’s been innovation there, with Hadoop and other big data solutions, and I think the innovations will continue, particularly regarding how that data is categorised.

“So we acquired a company called BitStew to help us do some of that data categorisation because if you want to do effective data analytics you really have to have that categorisation.

“Then I think there’ll be innovations in the type of analytics people are running. So we have a lot of data scientists on staff and we’re building new insights all the time, and they will become more and more reusable so you’ll end up creating an ecosystem of this kind of intelligent capability, and that in itself is a possibility.”

Where’s your data?

The colossal computing infrastructure – made up of hyperscale data centres, epic undersea telecommunications cables and so on – already present in today’s world will still not be enough for the internet of things of the future. There are many forecasts about the IoT and all of them say it will be big, as if it wasn’t already.

Sometimes it’s all that people want to talk about, and that’s not surprising since it’s often been called a historic market opportunity.

Imagine if you knew 30 years ago what the public internet would be like today. Would you think that it was a good opportunity?

And while there’s only 7 billion humans on Earth, analysts at Business Insider estimate there will be 34 billion devices – or “things” – on the IoT by 2020. They also reckon that $6 trillion – that’s six trillion dollars – will be spent on IoT solutions over the next five years.

No wonder, then, that this is what all the talk is about in every tech gathering, even Hannover Messe.

But where will all this data that these “things” collect be stored, and retrieved from? If you’re providing digital services, like GE and others are doing, where do you keep your data and your clients’ data?

“We have two options,” says Wells. “We actually have our own hardware, we have our own data centre, and we’re running our stack on ‘bare metal’, if you will.

“We also have partnerships with Microsoft and Amazon where we can run our stack on their systems as well. It depends on what region we’re in and what the customer preference is. That varies.

“What we do, though, the core of what we offer, is the industrialised services for that cloud platform.

“When you talking industrial applications, there’s certain types of data: so, there’s time-series data – what’s coming off the sensors; and there’s certain models we use to link all that data together, and the analytics framework that we have built to actually run those analytics on that dataset in such a way that it’s continuously running in an industrial environment, and then all of the management, support and the unique capabilities we offer customers.

“We bring the data up to the level where it can be analysed and processes optimised as result.”

The human factor

It’s logical to think that as the amount of sensors or devices grow on the IoT, so too will the amount of data they collect. And when the amount of data gets to a point where it’s just too much for humans to process, analyse and act upon, it seems inevitable that machine learning and artificial intelligence systems will be given the job of making decisions that were previously made by humans.

It’s not clear whether or not Wells agrees with this, but offers his perspective.

“You don’t necessarily need big data for machine learning,” says Wells. “When you think about big data, there’s a few ways to look at it.

“In the industrial space, a lot of manufacturers have a ton of data local to their sites. The way we look at it, we want to pre-process some of that data locally because our goal with big data is to get multi-point focus, to get a broad, enterprise view, and then also for larger companies like ourselves, a system or network view.

“So we have customers who are concerned about their particular assets, then you have vendors like ourselves who are concerned about our entire fleet of, say, our turbines in totality. And the more of that data you are able to get, the more likely it is that you are able to say, for example, ‘I’ve see one instance of this on unit 25,012 and now that I’ve seen that, if it happens again I better know what to do, and if it happens a couple of times, then I can start predicting when it will happen a third time’. And that’s having that fleet view, and that’s where big data comes into play – because if you’re only ever looking at a small amount of data in isolation, you miss those things, you don’t get that correlation; when you get into a big giant set of data, you do get those correlations.

“As for machine learning, I think the core of what machine learning does is that it learns normal behaviour. When we use machine learning algorithms, we feed it a certain set of data, but then they watch that data over time and develop a more complex set of normal behaviours; for example, through startups, shutdowns, upsets, steady states – it learns what the technical behaviour of that system is. And then by doing that, it can generate very sensitive detections of when something is not normal.”

It would seem, then, to be a small step for the machine learning algorithm to autonomously deal with whatever abnormality that occurs and bring the situation back to normal without the need for human intervention.

But Wells suggests that’s a long way off, given that the machines are still learning and will continue to learn for quite some time because business is far more complex than just equipment – there’s humans involved.

“One of the things that’s not often talked about from an industrial internet or IoT perspective is the aspect of the human factor,” says Wells. “What we’re trying to do at GE Digital is create all this capability around machines but also integrate the humans who work on those machines and generate that collaboration aspect, so when problems occur, the whole subsequent chain of resolution operates much faster.

“It’s also about integrating the human workers together. So in a traditional system, when a system goes wrong, someone picks up the phone, tries to figure out who to call, and so on.

“Part of the strategy of building all the functionality into the Predix platform is that you can plug each one of these human workers’ roles into the system so they can instantaneously follow the result of what’s happened and connect through that system so you speed up that part of the resolution process, because it’s one thing to visualise and see the data, it’s another level of capability required to actually resolve it and resolve it efficiently.”

It’s obvious where this is going, of course. Once they reach “another level of capability”, as Wells calls it, the machines will, inevitably, take over the world.