Universal Robots ‘maintains top spot’ in collaborative robot market

Universal Robots is maintaining its top spot in the collaborative robot market, according to a report by ABI Research.

However, competitors including Doosan, Techman Robot and Precise Automation are “closing in“, says the study, Industrial Collaborative Robots Competitive Assessment.

There are well over 50 manufacturers of collaborative robots, or cobots, worldwide, but only a handful of these companies have so far deployed cobots on any meaningful level of scale.

Tens of thousands of cobots have been sold as of 2019 and earned $500 million in annual revenue for world markets.

In its assessment, global tech market advisory firm, ABI Research finds Universal Robots to be the clear forerunner, particularly in implementation.

The report analyzed and ranked 12 collaborative robot vendors in the industry:

- ABB;

- Aubo Robotics;

- Automata;

- Doosan Robotics;

- Fanuc;

- Franka Emika;

- Kuka;

- Precise Automation;

- Productive Robotics;

- Techman Robot;

- Universal Robots; and

- Yaskawa Motoman.

ABI says it used its “proven, unbiased innovation and implementation criteria framework” in its study.

For this competitive assessment, innovation criteria included payload, software, Ergonomics and human-machine interaction, experimentation and safety; implementation criteria focused on units and revenue, cost and return on investment, partnerships, value-added services, and the number of employees.

Rian Whitton, senior analyst at ABI Research, says: “Market leaders in cobots generally have well-developed cobot rosters, in many cases backed up by an ecosystem platform that integrates applications, accessories, and end-of-arm-tooling solutions in with the base hardware.”

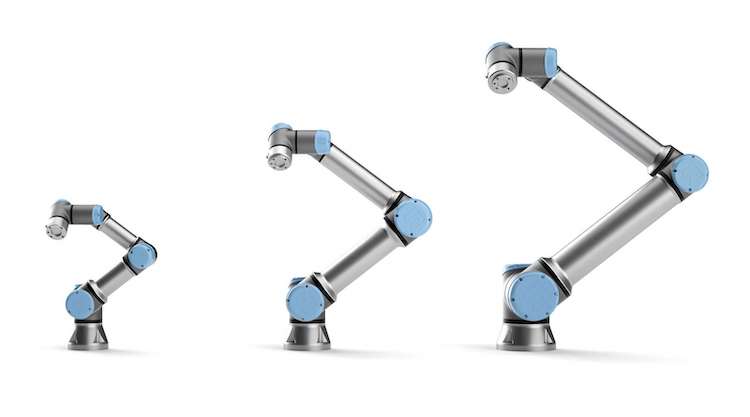

With 37,000 cobots sold so far, UR leads, followed by Taiwanese provider Techman with 10,000, and Korea-based Doosan with over 2,000.

Precise Automation, which uses an advanced direct drive solution to develop faster collaborative robots, was cited as the most innovative of the 12 providers, just edging out Universal Robots, who claimed the overall top spot due to their significant lead in implementation.

There are several companies that are too young to be challenging the dominant parties in the cobot market but are developing new and disruptive technologies that will allow them rise to prominence in the years to come.

Productive Robotics is a case-in-point. The California-based developer has an arm with inbuilt vision, 7 axes for superior flexibility, long reach, and a very affordable price point, but has yet to deploy at scale.

Automata, a British company that develops a “desk-top” cobot costing less than $7,000, is significantly lowering the barriers to entry for smaller actors and is championing the use of open-source middleware like ROS to program cobots for industrial use-cases.

Germany-based Franka Emika and Chinese-American provider Aubo Robotics also represent relatively new entrants to the market who are building on the success of Universal Robots and are beginning to compete with them.

Perhaps surprisingly, while the major industrial robotics providers have developed cobot lines, they have generally been less successful in marketing them or gaining market traction relative to the pure-cobot developers.

In part, this is down to focus. While collaborative robots are valuable, they generally suit deployments and use-cases with smaller shipments and a wider variety of small and large end-users.

For industrial players like ABB, Fanuc, Kuka, and Yaskawa Motoman, their client-base tends to be large industrial players who buy fixed automation solution through bulk orders.

Aside from this, all four of these companies are competing extensively for greater shipment figures in China, where the cobot oppurtunity relative to the market for traditional industrial systems is much less apparent than in Europe or North America.

Whitton says: “Though many of the cobots deployed by these companies are impressive, and they have a lot of software services, the high-cost and lack of easy use among their systems largely defeat the current value proposition of cobots, making them the laggards in this competitive assessment.”

Looking forward, the larger industrial players are likely to improve their relative position, as future growth in cobots rests on scaling up and large deployments.

Whitton says: “Universal Robots, though likely to remain the market leader for the foreseeable future, will be increasingly competing on an even footing with near-peer cobot developers, who are already developing second-generation cobots with significant hardware improvements.

“Meanwhile, some more innovative companies will be able to accelerate adoption through price decreases, improved flexibility, and common platforms to retrofit collaborative capability on industrial robots.”