More than $4 billion invested in robotics companies

Robotics continues to attract more and more attention within the world of venture capital and private finance, with over $4 billion invested in robotics companies in 2018 alone.

But some companies are standing out more than others in innovation that will advance the entire robotics industry. Global tech market advisory firm, ABI Research, has released a report highlighting the 15 key hot tech innovators currently leading in their respective markets through novel technology solutions.

Rian Whitton, senior analyst at ABI Research, says: “Not only are these Hot Tech Innovators propelling the robotics industry forward but also, by looking at their innovations, we can deduce several trends that will have a ripple effect across the board.”

There has been a proliferation of platform-agnostic autonomy solution providers who can make any vehicle autonomous.

They are represented by PerceptIn, Sevensense, and Nuro, who have all leased out their technology stacks and navigation software to original equipment manufacturers and other robotic developers.

These companies are joining a growing array of mobile robotics providers that see themselves less as robot product manufacturers, and more platform-agnostic solution providers that can develop across different markets and through various form factors.

Whitton says: “We see a strong growth application of mobile robotics outside of traditional markets, an example being Singaporean Oneberry’s use of these robots for security.”

One of the great drivers of this development is Amazon, which has acquired some mobile robot providers to automate their mobile supply-chain.

Buying Canvas Technology gives Amazon access to advanced visual simultaneous localization and mapping (vSLAM) technology, while the acquisition of Scout gives the e-commerce giant access to last-mile delivery robotic solutions.

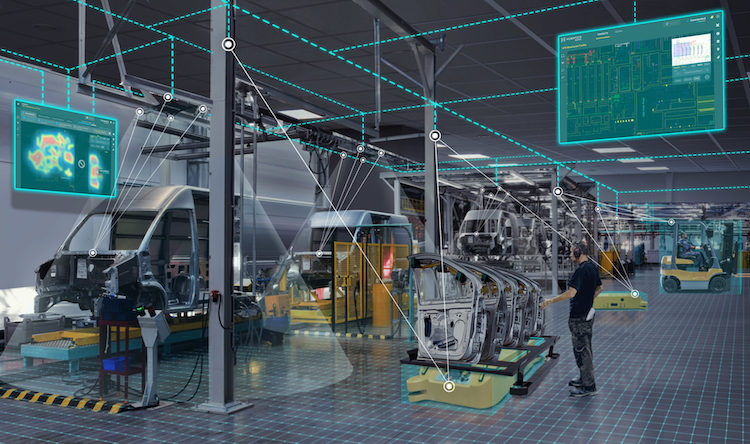

At the same time, material handling innovators like MiR and Otto Motors are delivering more flexible robotic solutions for the manufacturing space.

Previously, the deployment of multiple mobile robots, either indoors or outdoors, required a heavily controlled environment with either costly machine vision solutions or major external infrastructure in the form of fiducial markers or magnetic tape.

Whitton says: “Now, we see the development of advanced location technologies and connectivity to further improve the accuracy, mobility, and coverage of robotics.”

Companies like Boston-based Humatics are creating scalable and effective navigation solutions that will significantly lower the barriers of adoption across industries.

Meanwhile, industrial robotics players are diversifying their portfolios in the face of tightening revenue growth and concerns about overreliance on the mainstay of robotics up to this point – the automotive manufacturing sector.

This change of heart is exemplified by Comau, which has developed a new IoT analytics platform called Ingrid, as well as a passive exoskeleton, educational robots, and a high payload cobot designed for lifting large vehicles.

In the same vein, UbTech, originally known for consumer robot toys, is increasingly expanding its portfolio into education and service robots.

Mechatronic advances are also crucial in making collaborative robotics superior, as evidenced by Precise Automation’s line of safety-assured robots that can run at similar speeds of traditional industrial robots.

Precise’s work stands out in a saturated market with relatively little hardware innovation.

Meanwhile, quadrupedal robotics developer AnyBotics combines a novel robot platform, advanced SLAM, and sophisticated drives to develop dexterous mobile systems that are already being tested for industrial inspection.

Hardware advances continue to propel robots into new directions. For unmanned underwater use-cases, Houston Mechatronics is developing advanced mobile manipulation.

This is mirroring mobile picking solutions in e-commerce fulfillment with companies like IAM Robotics continuing to grow their funds.

Meanwhile, developers are increasingly getting easy access to develop novel mobile solutions, with Ubiquity Robotics and other open-source platform providers helping to accelerate the market.

Whitton says: “Overall, many of the most innovative and impressive companies entering the robotics space are tailored toward mobile robotics.

“With mobile robot manufacturers like MiR, Comau and autonomy solution providers like Sevensense, PerceptIn, and Nuro making the list, it is clear the near-term future of robotics is about scaling up to fleets and automating mobility across industry and commercial spaces.”