General Electric: An industrial giant learning to live in a small world

After years of rebranding itself as a “digital” company, General Electric is returning to being a plain old $100-billion industrial giant that builds aircraft engines and equipment for the energy industry.

According to the New York Times, GE spent “several billion dollars” building its digital business, with former CEO Geoff Immelt telling the Harvard Business Review that the company “put about $4 billion into developing analytics software and machine learning capabilities”.

The idea seemed to have been, and still may be, to provide the equivalent of an operating system for machinery and equipment which are connected to the industrial internet of things, and, in the process, become one of the top 10 software companies in the world.

Within its relatively new division, GE Digital, the company created software which enables machines to connect to computer networks and provide data through sensors integrated into them.

The data would show how the machine was operating, what condition it was in, and whether or not it needed maintenance.

That way, the machine’s operators could schedule downtime and maintenance in an orderly way without disrupting production, which, in the past, may have cost a lot more and caused other, related problems.

GE called the software Predix, and claimed it to be the first industrial internet platform when it was launched in 2015.

Three years on, numerous other industrial giants and smaller, computer-technology-oriented companies have followed suit and built their own industrial internet of things platforms, but none of them appear to want to sell theirs.

GE, meanwhile, is looking to offload Predix and other, unspecified digital assets, perhaps the whole GE Digital business unit.

That would seem to be the conclusion to be drawn from the reports in a number of media, including the Wall Street Journal.

GE had been saying for the past couple of years that Predix and the digital division were generating $4 billion a year in revenue, with $7 billion a year forecast at one time.

But now, the stories include details like the digital division employs 4,000 people and that it’s not living up to expectations.

GE’s new CEO, John Flannery, is reported to have said that the digital division will “keep losing money until 2020, when it would be expected to break even”.

This is according to a report on Channelnomics, which was actually quoting an analyst from MachNation, not Flannery himself directly.

Whether or not Flannery actually said words to that effect, one thing is clear in the new CEO’s actions: his priority seems to be dealing with the huge mountain of debt the company has accumulated.

According to CNN, which was quoting Moody’s, GE has approximately $77 billion in debt, and the company has promised its shareholders to offload $20 billion in assets.

Exactly how much it can raise with the sale of Preix and its digital business is uncertain, but any buyer would probably need to pay somewhere in the region of several billion dollars.

While some analysts have been highly critical of Predix and GE Digital, any relatively small amount – even several hundred million – would probably not be worth it for the iconic conglomerate.

GE has already sold many business units and sold stakes it owned in other companies. These include the sale or merger of the following:

- the sale of the distributed power division to Advent International for $3.25 billion;

- the sale of the industrial solutions business to ABB for $2.6 billion; and

- the merger of the rail manufacturing division with Wabtech in a deal worth $11 billion.

The rail manufacturing division was 111 years old at the time of sale, so GE is not being sentimental about this.

Further, GE’s light bulbs and lighting business is 126 years old – as old as the company itself, but that’s been sold as well for an undisclosed amount.

As CNN points out, one of GE’s co-founders was Thomas Edison.

However, all this is not to say that GE will definitely sell Predix and its digital division. Sentimental it may not be, but interested in money it most certainly is.

Although it looks inevitable, with WSJ reporting that GE has already brought in an investment bank to manage the sale, it may not find a buyer willing to pay enough or may decide the business has potential.

By most accounts, the industrial internet of things is set to grow at a phenomenal rate over the next few years, with Accenture saying it will add more than $14 trillion to the global economy by 2030.

For a company as old as GE, the end of the next decade is not a long time to wait.

Previously, it had imagined making significant revenues from the IIoT, but now, according to the Financial Times, GE will now limit itself to three business areas:

- equipment for the electricity industry;

- renewable energy; and

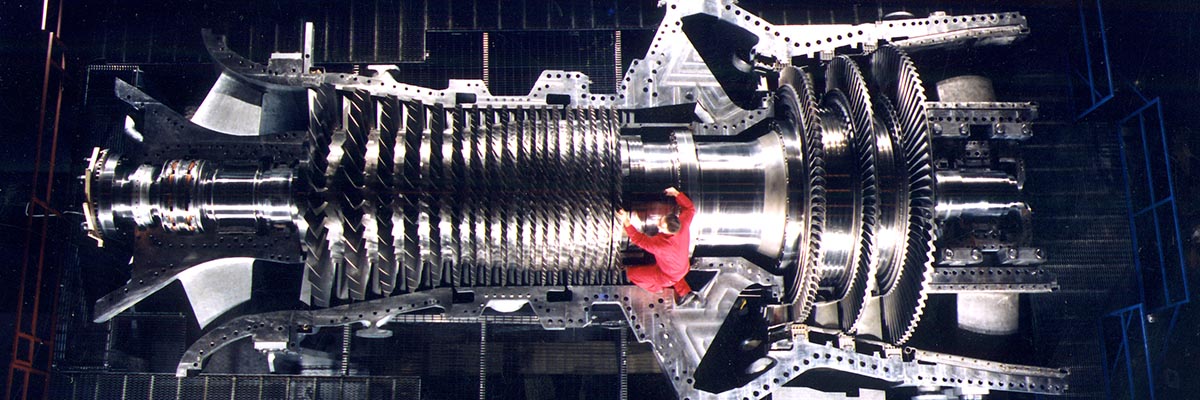

- aero engines and other aircraft parts.

Even if it does sell some of its digital assets, it may develop other areas which are related and perhaps more important.

Also, in the past couple of years, GE has made a number of investments in new technologies and companies, including in 3D printing startup Xometry, and in expanding its own robotics-intensive plants and additive manufacturing facilities.

These investments are relatively small in terms of monetary amounts – several hundred million. But they may provide the basis for a more certain future in some areas of GE’s global operation.

The company is still a giant, with a market capitalization of more than $120 billion. However, its share value has fallen by around 50 percent in the past year, and if it has another one of those years, the future may be a takeover of the whole company.